Asian funds face revenue struggle

‘Hedge funds are getting a reputation for speculating on the value of shares rather than acting as any form of hedge’

Simon Gleave,

KPMG China

Hedge funds are struggling to attract investors and Asia-based funds are suffering more than most. Managers hope that avoiding riskier strategies and a reduction in fees can draw in an increasingly sophisticated client base, writes Henry Smith

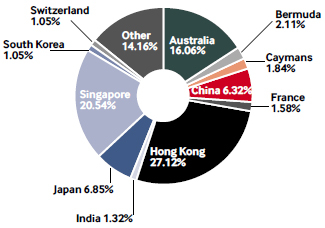

Hedge funds will struggle to persuade people to invest with them in 2009, as reputational risk has become a big issue in the wake of steep performance losses. According to Simon Gleave, partner in charge of financial services at KPMG China, hedge fund investors are concerned that their money is not being managed in the way they expected it to be. “The news that hedge funds lost a reported €20bn by shorting Volkswagen has not helped. They are getting a reputation for speculating on the value of shares rather than acting as any form of hedge. Investors have realised that the risks of losing money are much higher than they thought and so think it is safer to put their money in a bank for the moment,” he says. Asian-based hedge fund managers, due to the small size of their operations, are particularly vulnerable to a contraction in assets under management caused by poor performance and the rising capital redemption requests that have hit the industry. “The majority of these funds have less than $100m in assets under management and when returns are falling by a significant percentage, your watermarks are going to be very hard to achieve”, says Bonn Liu, partner, financial services, KPMG China. “A 2 per cent annual management fee on declining assets under management is not going to be worth much on $50-$100m. The Asian hedge fund industry has not performed as well as the hedge fund industry in Europe or the US. And there is a huge challenge going forward to get back to levels where you are going to earn performance revenue.” Most hedge fund managers in Asia, says KPMG, are running equity long/short strategies focused on the region. Figure 2 from Hedge Fund Research (HFR), shows that Hong Kong, Singapore and Australia account for some 64 per cent of Asia-focused hedge funds based outside the US and UK. Withdrawn assets HFR says that in reaction to nearly $10bn in performance-based losses for the quarter, investors withdrew more than $3.4bn of assets in the third quarter from Asia-focused hedge funds, resulting in a 13 per cent fall in total assets under management from $100bn to $87bn. The total number of hedge funds investing in Asia also fell from 1078 in the second quarter to 1065 at the end of the third quarter. The HFRI Emerging Markets Asia ex Japan Index was down 34.2 per cent for the year to 2 December. Equity hedge (also known as long/short equity) strategies saw the largest outflows in the third quarter, with investors withdrawing $2.9bn. Mr Liu notes that Asian long/short equity is a challenging strategy at the best of times on account of the lack of shorting opportunities in the region compared with the US or Europe. But that situation could change somewhat. China’s securities regulator, the CSRC, is getting ready to implement a pilot programme for a select number of securities companies to engage in margin-trading and short-selling. KPMG's Mr Gleave predicts “a return to basics” with investors seeking to learn a lot more about the strategies they are thinking about subscribing to. “I expect we will see more savvy clients expecting a different type of service. They may look for variations on long-short funds rather than the riskier strategies. The general trend will be towards transparency, simplicity and better risk management which will mean fewer opportunities for higher gains,” he explains. “Markets are still incredibly volatile and so more hedge fund trading strategies may emerge to deal with that volatility but with less leverage, I suspect. All the hedge funds I have spoken to talk about the difficulties of getting clients to come back. All these funds can try and do is manage market volatility and then take advantage of the upswing when it comes. But 2009 will be a muted year with the probable wind-down of a lot of the smaller hedge funds which are not economical to run,” says Mr Gleave. Figure 1: estimated strategy composition of asia-focused hedge fund assets*

*Q3 2008 Source: Hedge Fund Research Figure 2: estimated management firm location of asia-focused hedge funds*

The fund of funds route Mr Liu claims that hedge funds in Asia are more transparent than their counterparts in other parts of the world out of necessity. In order to attract investors, smaller funds have had to be a lot more transparent than the big global players for whom when times are good, their brand name is good enough. Also, many single hedge funds in Asia rely on funds of funds for investors. Many institutional investors investing for the first time in hedge funds choose the funds of funds route, both for cost considerations and because these vehicles promise more transparency in relation to the selection and monitoring of underlying hedge fund managers. Alex Balfour, managing director of Ivy Asset Management in Hong Kong, claims that no institutional investor in Asia has the resources to dedicate to choosing single hedge fund strategies. Ivy, a subsidiary company of BNY Mellon Asset Management, with $13bn of assets under management in funds of hedge funds, opened an office in Hong Kong in February 2008 to target large institutional investors in Australia and Japan with segregated managed accounts. The firm has eight Asia-focused hedge funds on its platform. Mr Balfour says: “In Asia, the flavour is still to some degree multi-strategy because for many of these institutions, hedge funds are relatively new and they don’t want to commit themselves to any particular strategy quickly.” He stresses the importance of educating and managing the return expectations of potential clients. “One very important message we need to get out is that this business is cyclical. Hedge funds will deliver capital protection but they still have periods where trading conditions are tough and this year has been one of those times,” explains Mr Balfour. He adds that clients need to clearly spell out what sort of risks they are willing to expose themselves to in order to achieve a given level of return. Right now as hedge funds are enduring a torrid time, he suggests it is “a good time” for investors to increase risk, while acknowledging that the inherent risks - liquidity, volatility, transparency, corporate governance – make the Asian market “tricky to manage”. But he believes that if and when trading conditions improve in developed Western markets, they will, as is usually the case, improve that much more in Asia. Hedge fund strategies which have been using high levels of leverage will, maintains Mr Balfour, have little future due to the difficulty in acquiring leverage and the increased chance of it being withdrawn suddenly by the prime broker in the current market environment. “As a house, we have never favoured strategies which derive their returns from leverage because there are many strategies which can deliver similar return for risk without employing extra leverage. The problems with the use of high levels of leverage is that it presupposes that left-tail events (negative extreme movements) do not occur and anyone who has been in this business for a while knows that left-tail events do occur and also when you least expect it.” Reduced fees In view of the poor performance posted by hedge funds, he says there is “no doubt” that managers will come under pressure to reduce their fees. “Generally there has been a disconnect between what clients feel they have received last year and what they are actually paying their managers. And I think they are passing on that message loud and clear. Some hedge fund managers will move to a performance fee only while others will stick to a management fee and drop their performance fee.” However, he claims that nobody has called the fees charged by his own firm into question. “It is easy for our clients to assess our cost base and to see what we are doing. We have a more transparent process than the underlying hedge funds,” says Mr Balfour.