Asset managers and Apac drive M&A valuations surge

Europe may be struggling with low growth expectations, but merger and acquisition activity in the Asia-Pacific region is on the rise, pushing up valuations and creating a seller’s market, writes Stephen Wall.

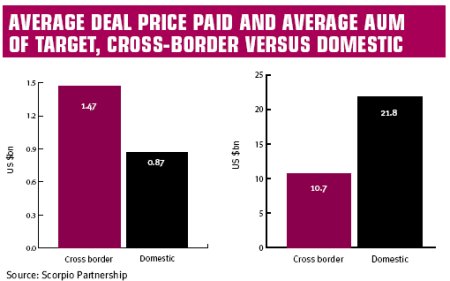

M&A activity in the international wealth management business rocketed towards the end of 2009 as several macro factors and later industry specific drivers combined to draw the market out of its doldrums of 2008 and early 2009. The winners in terms of multiples were the medium net wealth (MNW) to high net wealth (HNW) asset management books, not private banks, and cross-border deals, particularly those with the flavour of Apac (Asia-Pacific). Looking generally across the year, a total of $488bn (€360bn) in private client assets under management shifted to new ownership through deal activity, principally acquisitions. Interestingly, a massive 94 per cent, or $458bn, of this activity was agreed in Q3 and Q4. This period also saw the assets under consideration per deal and the acquisition price shoot up. On average, the price to assets under management (P/AuM) ratio for the deals covered was 4.7 per cent. However, it rose to 5.8 per cent for cross-border deals (against 4.1 per cent for domestic) and a top quartile of 6.9 per cent for Apac deals, with the targets often MNW-to-HNW asset management books. In short, buyers were focusing on the opportunity to capture enhanced premium product distribution channels as a major impulse for deal making. This was not about buy at all costs, but buy clever and be prepared to pay the cost. The result, by wealth segment, was the top deals trending toward the MNW and HNW market segments and firms, as mentioned, with strong asset management capabilities and thus a potential for a recurring income stream. Geographically, this trend shone brightest, to no-one’s surprise, in Apac. Europe, the old market, staggered somewhat under the weight of government pressure and lower growth expectations in wealth generally. The swagger in Apac, from buyers and sellers, and the attraction it brought had the effect of pushing up valuations, in short fast creating a seller’s market rather than a buyer’s. Looking at the rocketing number of deals, core to this rebound were three prime macro drivers which converged to re-energise the market and stimulated deal opportunities – the market rebound, government interventions, including several distressed or forced divestitures of large books, and the critical availability and access to finance to undertake transactions. Stephen Wall is a director at wealth management strategy think-tank Scorpio Partnership.