No small project to take on

Exposure to hedge funds through multi-manager products might be more expensive, but the extra investment stands to pay off.

What is the best route to take in order to achieve a satisfactory investment in hedge funds? It can be easier to avoid some routes, perhaps leaving by default the correct ones.

Having great ingredients is a start, but having a great chef is a finish. Without extending the metaphor too far, it is clear that trying to pick individual hedge fund managers is extremely risky. The returns from individual managers can be more broadly spread than that of traditional asset managers.

And the need to undertake due diligence at a global level and have a deep understanding of quantitative, qualitative and operational risks, is not something that can be readily undertaken by an individual or even a number of individuals who don’t have the specific experience or training to arrive at objective decisions.

Picking individual hedge fund managers could be similar to picking individual ‘dot-com’ stocks. They may boom and they may bust. Not only is this route difficult, but it can be quite expensive. For example, if you wanted to have access to at least 10 or 12 of the major hedge fund sectors and assuming you didn’t want to bet all the money with individual managers, you would probably want to have at least two to three managers in each sector.

As most hedge fund managers won’t accept less than about e1m in their funds, you could be looking at e30–e40m in order to put together a diversified selection of investments. The other and more well-trodden route to achieve the same end is via funds of funds.

Fees justified

The obvious concern about funds of funds is the extra layer of fees. These are clearly only justified if the fund of funds delivers two essential things: One, making money, and two, saving you time.

The fund of funds manager has some similarities to the great chef. They should have the ability to select the best ingredients, i.e. the fund managers but also to have views where they can tilt the portfolio mix according to where greater returns are currently available in the market. A due diligence process should be transparent and it is best to look for a company with a long and public track record which can be understood in depth.

The amount of due diligence required to run a global fund of funds is quite staggering. They need to have teams able to travel all over the world, and have professional expertise both in terms of quantitative analysis, risk measurement and detailed knowledge of some of the quite complex strategies that exist within the hedge fund world.

Above all of this it is important to remember that hedge funds are often small boutiques, so the ability to under-take significant operational due diligence concerning the risks of the business and to investigate the third party providers such as the administrators, custodians, prime brokers is vital.

Keep benefits in mind

It is important to remember why you are considering going into hedge funds in the first place. Hedge funds are simply traditional assets managed in a different style, with the ability to take arbitrage positions, or to sell overvalued stock and buy undervalued stock or simply to go to cash when prudent or to leverage trades when opportune.

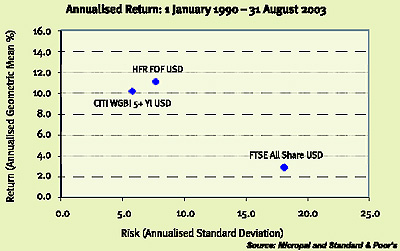

They can, and historically have, managed to perform in a non-correlated way to traditional stocks and bonds. (See graph.)

So the object of the exercise is to include a non-correlated investment that has absolute return characteristics and the potential to reduce the total volatility of your existing portfolio. As we have discussed above, be careful of the route you take and if in doubt, certainly in the early stages, it is probably preferable to go the fund of funds route.

Ian Morley, Dawnay Day Olympia