Islamic finance edges towards the mainstream

Angelia Chin, BNPP Investment Partners

Islamic finance is no longer just for Muslims and private investors are increasingly drawn to the diversification benefits and real assets these products target

Although still a niche segment of the global investment market, Islamic finance could soon hit the mainstream, as non-Muslim governments, banks and corporations seek to tap new sources of wealth in the Middle East, Asia and Africa.

In September, having tried and failed three years ago, Goldman Sachs became the first conventional US bank to issue an Islamic bond. The global bank raised $500m (€388m) with its debut sale of five-year sukuk, having garnered orders worth $1.5bn, reflecting heavy demand for new credits by cash-rich Islamic funds.

The Middle Eastern unit of HSBC was the first conventional bank that issued a sukuk for $500m in 2011.

Islamic finance is courted by a swelling number of jurisdictions, keen to boost their position as international financial centres and attract further Islamic business. In June, first among non-Muslim countries, Britain issued sovereign Islamic five-year sukuk bonds for £200 (€254), attracting orders of more than $2bn.

Sukuk are structured to pay a fixed profit rate rather than a coupon and are commonly backed by, or based on real estate or infrastructure. Islamic investment has financed significant parts of London’s infrastructure, including the Shard skyscraper – the tallest building in the European Union – and the Olympic Village.

In Asia, Hong Kong made its debut sovereign sukuk issues in September raising $1bn, while South Africa and Luxembourg joined the sukuk bond rush soon after, becoming respectively the third and fourth non-Muslim countries to sell government debt that adheres to Islamic law.

“Although these sukuk issues are fairly small, they are symptomatic of the fact that Islamic finance is becoming slightly more mainstream than it was before,” says Humphrey Percy, CEO Bank of London and The Middle East.

The global sukuk market is today worth $367bn, according to rating agency Moody’s. Demand for sukuk will rise to $900bn in 2017, predicts Ernst & Young.

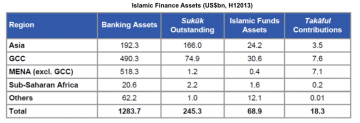

Although the Islamic finance market is developing and expanding, Sharia-compliant assets are estimated to make up only around 1 per cent of the world’s financial assets. Globally, Islamic finance is expected to be worth $2tn by the end 2014, a 150 per cent increase from its value in 2006, according to the consultancy firm. Banking assets represent around 80 per cent of total Islamic assets.

One of the industry challenges is how to expand the still limited, niche range of instruments available to investors, although this is growing.

However, Islamic finance is not just used by Islamic institutions and individuals, but by conventional investors too, claims Mr Percy. Many of the issuers are attractive either from a yield or a diversification perspective, in terms of sector or geography. But Islamic products and services need to be competitive in pricing and performance with those offered by conventional institutions, be they funds, deposits, assets or in financing of companies, he says.

Muslim money

• There are about 12,000 UHNW Muslims globally, with a total wealth of $1.25tn.

• Muslims account for 6 per cent of the world’s UHNW population and 4.5 per cent of total UHNW wealth

Source: Wealth-X

Islamic investment products are based on tangible value and the real economy, encompassing asset-backed investments, which appeal to investors.

“Particularly following the financial crisis, private investors take comfort from the fact that what they are investing in is backed up by hard assets. That is very much a theme for private investors in 2014 and will continue,” states Mr Percy.

Better understanding and awareness of Sharia principles will drive higher use of Islamic products, also by non Muslim investors, states Angelia Chin, CEO Malaysia at BNPP Investment Partners, managing €1.1bn in Sharia-compliant assets, of which Ä1bn in institutional mandates.

Sharia principles, for example, do not allow investments in highly indebted companies, so the focus is on “very healthy, strong companies”.

Returns of the global sukuk asset class have been comparable to most conventional fixed income indices, while the risk return profile is generally more attractive.

“In a rising interest rate environment, a typical short duration strategy, which is natural for the global sukuk asset class, will provide greater resilience and higher return probability,” says Ms Chin.

The large part of the sukuk universe is domestic, marketed locally in local currency, with the Malaysian Ringgit sukuk being the largest domestic sukuk market in the world.

Higher sukuk issuance, especially by investment grade issuers or countries, has increased the size and depth of the investment universe and is the catalyst for further development and issuance of Sharia-compliant instruments in the public and corporate sectors. This will help fully develop the Islamic capital market and enhance liquidity, which will benefit the asset management industry too, by allowing greater risk management and diversification for clients, states Ms Chin.

Because of the demographics and relatively low income per capita in most Islamic countries, excluding Malaysia, raising money in the retail space will continue to be a challenge and “the push” will come from institutions first, she believes.

Maybank in Malaysia reports that more than 40 per cent of the bank’s total Islamic portfolio, including financing, deposits, investment and protection, is held by non-Muslim clients. Within the high net worth space, this percentage more than doubles, to 82 per cent.

Private banking clients, regardless of religious faith and with deeper inclination towards socially responsible investing themes, continue to demonstrate keen interest in this area, says the bank. But it is vital to provide innovative products, competitive to conventional ones in terms of accessibility and profitability.

The overseas mortgage financing facility, based on the principle of Murabahah, catered to finance properties in London was well received. At the bank, the Islamic portfolio among UHNW and HNW clients grew more than 20 per cent across banking, financing, takaful (Islamic insurance) and wealth management, mainly driven by financing. Islamic funds assets offered to private banking clients grew more than 30 per cent last year.

“We see great potential in Islamic finance in this region, driven by Malaysia’s position as an Islamic finance hub as well as the growing number of HNW individuals,” says Eunice Chan, head, high net worth and affluent banking at Maybank. This potential creates an opportunity for the bank to grow in the Islamic space through expansion of its product and service offerings, she adds.

Muslim investors have traditionally invested in physical assets, such as residential or commercial property or businesses – in line with the core Islamic investment principles of ownership and participation – or in their own segregated portfolios, managed by wealth managers globally. Although Islamic fund assets have grown at a reasonable pace over the past five years, they represent just 4 to 5 per cent of Islamic banking assets, with estimates of industry size ranging from $56bn to $74bn.

Growing presence

• The global Muslim population is expected to rise from 1.6bn in 2010 to 2.2bn by 2030, growing at about twice the rate of the non-Muslim world, according to Pew Research

• Muslims will make up 26.4 per cent of the world’s total projected population of 8.3bn in 2030, up from 23.4 per cent of the estimated 2010 world population of 6.9bn

Geographically, the majority of fund assets are held in Gulf Cooperation Council countries and Asia, with Saudi Arabia and Malaysia together holding about 54 per cent of total assets, according to Thomson Reuters.

Islamic finance and funds could appeal to investors, both Muslims and non, from an ethical perspective, explains Adam Ebrahim, CEO of Oasis Group Holdings, where Oasis is a global provider of Islamic and conventional wealth management products, managing assets worth $4.1bn.

Sharia-compliant investments adhere to strict ethical requirements which ensure avoidance of speculative activities, not investing in highly geared/financially risky instruments and avoiding investing in businesses which are detrimental to society, in sectors such as alcohol/tobacco, gambling, defence or biotechnology companies involved in human/animal genetic engineering.

“Increasing investor awareness and education will continue to drive significant demand for ethical and socially responsible investment products, and Sharia-compliant investments can provide investors with a product which satisfies their responsible investing needs while not sacrificing returns,” says Mr Ebrahim.

This philosophy of focusing on tangible, less risky and non-speculative investments ensures downside protection during market weakness thus providing outperformance over the long-term, he adds.

Strong alignment between Sharia and ethical and responsible investing drove Sedco Capital, a Sharia-compliant asset manager based in Saudi Arabia to convert a couple of its funds into ESG (environment, social and governance) compliant funds too. The funds, managed by Stockholm-based IPM, signatory to the UN Principles of Responsible Investing (PRI), are a Rafi US equity fund and a global high dividend fund.

If ethical investors were attracted to these funds this would be a bonus, says Hasan Al Jabri, CEO of Sedco Capital, but “the main issue is really bridging the gap between the Sharia and ethical investment parameters to portray more responsible investing in the future.” The firm is looking to convert other funds in its range into ESG-compliant products, giving priority to manager-signatories of the UN PRI, such as Comgest, sub-adviser of the firm’s European equity fund.

Sedco Capital has evolved from a large private family office, established in the 1970s by Sheikh Salem Bin Mahfouz, the founder of Saudi Arabia’s National Commercial Bank, to become a wealth and asset management firm for party private and institutional clients. It has $3.5bn in assets under management, of which $1.6bn are held in a Luxembourg Sicav, launched 18 months ago.

On its Luxembourg platform, Sedco offers 10 different Sharia-compliant strategies, geared towards sophisticated, larger clients and managed on a sub-advisory basis by external managers, including Credit Suisse and Lazard Asset Management.

“We were able to pick the best managers and populate the funds with meaningful sums of money, which brings down the cost per fund,” says Mr Al Jabri. The ability to build capacity, especially with Sharia-compliant managers, which tend to charge higher fees, is the main differentiating factor with other institutions such as banks, he explains.

Segregated mandates also enable the firm to monitor sub-advisers’ adherence to Sharia rules, while giving the possibility to offer clients bespoke solutions or strategies not available through funds.

Recognising the growing importance of the Muslim community in financial markets, private banks, not just institutional investors, are increasingly interested in Sharia funds. Credit Suisse late last year signed a fund distribution agreement with Sedco Capital, with the firm claiming to have three to four more private banks in the pipeline.

“We have always looked at growth areas and the Muslim community is a big market which is underrepresented from a financial point of view,” says Lars Kalbreier, global head of mutual funds and ETFs at Credit Suisse Private Banking.

“It’s important we can address the needs of our Muslim clients, be they in the Middle East, Asia or other parts of the world. We always strive to provide our clients with a complete offering and Sharia-compliant funds were a pillar that was missing.”

The desire for financial diversification and exposure to different asset classes to achieve a more balanced asset allocation is going to increasingly drive Muslim investors to mutual funds, adds Mr Kalbreier.

Managing funds which are both Sharia and ESG compliant is like “trying to kill two birds with one stone” and the risk is to not satisfy either set of clients, believes Singapore-based Alan Chua, portfolio manager of Templeton Sharia Global Equity Fund at Franklin Templeton, which manages more than $1.9bn in Sharia-compliant assets.

The sub-sets are slightly different and stricter rules imposed by Sharia will have to be applied, with companies removed from investment universe even if ESG compliant.

Although the Sharia fund market is heavily skewed towards equities, this segment is still very much in its infancy compared to sukuk, he explains.

Interest from retail investors is still low, compared to institutions and potential lower performance in the medium term and slightly higher fees could be an issue in the equity space.

In particular, financials are the biggest driver of performance differences between conventional and Sharia funds. Their weight in a typical Sharia benchmark ranges between 0 to 2 per cent, versus 20 to 25 per cent of the MSCI All Country World benchmark.

While during the financial crisis, Sharia funds performed much better than conventional funds, in the past to to three years exposure to financials has significantly contributed to the outperformance of the latter.

As financials globally are still one of the cheapest sectors today, Sharia funds are likely to underperform an unconstrained portfolio in the medium term, over the next three to five years, according to Franklin.

Also, fees of Sharia funds tend to be higher, due to extra layers needed to ensure the products adhere to Sharia principles – including the Sharia board and an independent screener – and small fund sizes. As the investor base grows, the funds will be amortised over a larger number of customers and will be less expensive going forward, he says.

However, for Muslim investors who need to meet their faith-based investing requirements, outperformance against a typical conventional index is not a priority, explains Mr Chua.

“The Muslim population is one of the fastest growing and coming up the curve in terms of rising disposable income. Over time, increased savings and investments will need to be met by Sharia funds,” he says. “We are definitely in this space for the very long haul.”

The biggest impediment to the industry growth is lack of full standardisation of the Sharia guidelines. For example, according to Sharia principles, investments should not be made in highly indebted companies, but the concept of too much debt is open to interpretation. The Dow Jones Islamic Index calculates financial ratios based on the market cap of the stocks, whereas the MSCI or FTSE indices calculate financial ratios based on total assets.

“Islamic financial centres should agree on a single standard by which these ratios are interpreted,” warns Mr Chua.