High yield stands out in troubled times for bonds

Despite volatility over the summer, high yield bond funds continue to attract investors searching for yield in what is a difficult environment for fixed income in general

Uncertainty about when the US Federal Reserve will start to reduce monetary easing is dominating the markets. At a time when any suggestion that the Fed has decided to begin the taper process is likely to trigger a spike in interest rates and spook the market, investors have been revising their fixed income allocations.

Critically, high yield bonds are not particularly sensitive to interest rates, so many are seeking refuge in the sector, particularly bonds with short durations.

In terms of yield, the asset class remains attractive, offering around 5.5 to 6 per cent, approximately twice the return from equity dividends, even after a positive run in 2013. In fact, the IMA sterling high-yield fund sector has now clocked up a 20 per cent average return over three years to mid-October.

One lesson of May and June was that when yields are low, government bonds, high yield and equity markets can all experience a sell-off. It is therefore easy to forget that traditionally high yield has a weak correlation with government bonds and a much stronger one with equity markets.

“Historically high yield bonds and 10-year Treasuries have had a slightly negative correlation, while high yield has a 0.6 per cent correlation to stockmarkets and shares the same drivers,” says Tom Price, portfolio manager of Wells Fargo US Short-Term High Yield Bond fund.

“The economy is generally improving, markets are doing well and rates are heading higher. If the Fed keeps target rates low until the end of 2015, then that will impact longer duration bonds but not shorter duration bonds, so the risk/reward is better at the short end of the market, and there is also better visibility over a three year timeframe,” he says.

The primary risk in high yield is on the credit side, but the current outlook for defaults is encouraging. Companies have been building cash piles, reducing capital expenditure, and improving their debt maturity profiles and borrowing costs by refinancing at lower rates. Bonds with high coupons are particularly attractive as interest rates are low, and such companies are likely to pursue early tenders of their high coupon debt to lock in to lower refinance rates.

“By and large, when you look at balance sheets in Europe the fundamentals are still sound,” says Colm D’Rosario, senior portfolio manager, European high yield, at Pioneer Investments. He explains that although leverage is rising is is at acceptable levels and interest cover is still good.

“Defaults are low and demand for high yield is high and this is what is driving yields lower,” says Mr D’Rosario. “Refinancing risk can be a trigger for default rates in normal circumstances but the high yield and leveraged loan markets are open so it is difficult to see this being a factor for 2014. There has been more than €55bn in new issuance in the high yield bond space and the same for leveraged loans – higher than at any time since 2007 – so there is still the flexibility to refinance debt.”

Better quality

Issuance quality has also improved this year. In 2009, BB-rated bonds accounted for only 7 per cent of total corporate issuance, while single Bs accounted for 7.3 per cent, but year to date BBs account for $170.5bn (€127bn) and Bs for just $117.6bn. However, one of the tough lessons learned in May and June is that investors offload higher quality BB paper in a sell-off because they wanted to be more sure of the prices they can achieve.

“Investment grade investors don’t dip as far down the ratings spectrum as Bs,” says Ben Pakenham, a high yield portfolio manager at Aberdeen Asset Management. “This leads to technical risk as investment grade swamps high yield in size and therefore even a small allocation in their terms translates into a large allocation in our terms. In June we saw this negatively affect the higher rated part of our markets as IG managers became sellers.”

It seems unlikely that these funds will experience another similar massive outflow in the near term. “We think the Great Rotation is less an issue for Europe than for the US,” says Alexandre Caminade, CIO Credit Europe at Allianz Global Investors.

“The European monetary policy should remain accommodative longer than in the US. Despite the pickup of the rate volatility at the end of May and in June, outflows in European high yield have been limited. There is simply too much liquidity in the financial system and also regulatory constraints such as Basel III and Solvency 2, to see any asset class rotation as a major potential risk over the next months.”

One trend in the marketplace is that fund managers are availing themselves of a wider range of instruments to play these markets. “The worlds of multi-strategy credit, strategic bond funds, and absolute return are morphing,” says Fraser Lundie, senior portfolio manager and co-head of Hermes Credit.

“People are beginning to understand that constraints on mandates are not helping managers to mitigate risks.”

Many high yield managers operate within a narrow mandate, for example only short duration, or in Europe or double BB-rated, which restricts a manager’s ability to make optimal security-based decisions. For example, the best deals may not be in the local currency because companies will issue debt wherever it is cheapest, which is determined by currency, the swap rates of the region and any bias, such as for example, if the issuer is a well known brand in its home market.

Mr Lundie points out, for example, that credit views can sometimes be better expressed through a credit default swap (CDS) as the liquidity of CDS is better.

“We have seen unprecedented levels of negative convexity in the market this year, brought about by the percentage of bonds trading above their first call price,” he says.

“CDS is not a finite resource whereas there is only a limited amount of a given bond outstanding. This is important because some of the mechanics of trading bonds do not apply and therefore traders are more readily able to offer liquidity. Furthermore, a CDS has no embedded call option risk, lower jump to default risk – ie rather than buying a bond at say 110, you can enter into a CDS contract at par, and it has no interest rate exposure or duration risk thus shielding investors from the potential capital losses associated with future rises in rates.”

Mr Lundie cites wood-free paper producer Sappi as an example, which has invested in chemical cellulose, creating short-term leveraging of the balance sheet. If a fund manager is only able to invest in, say, European high yield, they would be forced to access Sappi credit risk by buying the 6.625 per cent 2018 Ä bond which trades at 106 price, and is callable in 1.5 years at 103.3 essentially capping any potential upside from the company’s improving fundamentals. However, the Sappi complex also includes a 7.5 per cent 2032 $ bond trading at 78.5 which has no call option embedded in it, a very high running yield and a substantially lower cash price offering more downside protection as well as scope for capital appreciation.

“You can get the company selection decision right, which is not so hard when default rates are significantly below long term averages and likely to stay low next year, but unless you have the focus and flexibility to select the appropriate security within the company’s capital structure the company decision does not result in an optimal risk adjusted return investment,” adds Mr Lundie.

On the defensive

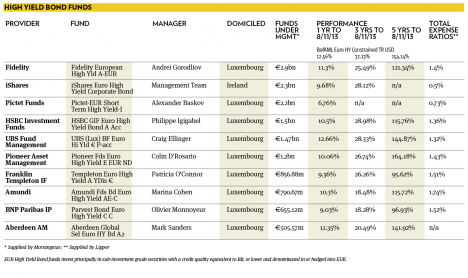

Managers often go beyond European high yield and look at markets as a whole and relatively defensive funds from houses such as HSBC and Wells Fargo have over the last few years been taking advantage of opportunities in high yield that is rated investment grade.

For example the Fidelity European High Yield fund has a 30 per cent off-benchmark position in investment grade, mostly in subordinated Tier 1 bonds from core county banks which should benefit from rising capital levels, structural reform and more conservative banking sector regulations.

Markets over-reacted during the financial crisis and put all banks at the same level

“In the financial crisis all banks were hit hard and subordinated debt has been trading at below 40th par,” says Brian Dunnett, senior fixed income product specialist at HSBC Global Asset Management. “Markets over-reacted and put all banks at the same level – each was treated the same way and they have since come back strongly.”

The fund’s defensive positioning particularly appeals those investing in the sector for the first time, Mr Dunnett says. The fund offers a yield of 4.3 per cent – less than the 5 per cent of the benchmark, but some investors are willing to give up a little yield for reduced volatility.

Other managers like the extra pick-up available in southern Europe. Olivier Monnoyeur, high yield portfolio manager at BNP Paribas, sees pockets of value in Spain, Greece, and Italy, pointing out that the average yield in core nations such as Germany and France is 3.7 per cent while in Spain the average yield is 5.4 per cent. This 170 basis point differential is more than enough to compensate for the risk, he says.

Here to stay

Pierre Bose, head of fixed income Europe at Coutts, says that high yield is a relatively permanent feature of asset allocation, and to obtain diversification smaller clients typically use exchange traded funds (ETFs) such as iShares or SPDR, which are very large and liquid, trade on commonly used exchanges, and use robust frameworks for replication. They prefer bond indices that have issuer caps to prevent domination by a few issuers, such as those from Barclays and Merrill Lynch.

Coutts also likes active managers with strong research teams such as Pimco and US bond specialist Neuberger, led by Ann Benjamin on bond side and Russ Cavode on loan side, which considers the entire instrument range including investment trusts, collateralised vehicles and synthetic vehicles.

One of the most important elements of the asset allocation process is to assess the opportunity set available, Mr Bose says. However, he is cautious about the use of credit default swaps (CDS) as these trades are “not fully funded, but leveraged, making them more price sensitive. If rates rise you can see the reverse is true, and people quickly become negative on credit default swaps, as they are cautious about how much price appreciation they will see,” he says.

“Another lesson of May and June is that a lot of high yield bonds are callable,” adds Mr Bose. “If you know that company XYZ can call your bond at par then it becomes risky if it rises above that price. So the further the whole market trades above the call value, the less willing investors are to hold it. When the market unwinds it will only go lower with everything else, giving investors a limited upside but the same downside as ever.”

A further distinction between funds is that some high yield bond funds dropped financials in 2008-9 after the financial crisis, but others still use the Merrill Lynch benchmark which has 27 per cent exposure to financials.

“Subordinated financials have done well as we are getting more clarity on resolution regimes relating to distressed financials, but there are still questions on what the final definitions will be and there is still the Asset Quality Review to come,” says Pioneer’s Colm D’Rosario.

“High yield pays 5.5-6 per cent, but yields in the financial sub space vary between 4-8 per cent. Although the sector has been volatile, you don’t have the same default risk as elsewhere in high yield corporates. While there are still question marks about the provisioning policies attributable to non-performing loans, we do not expect this to derail the banking sector.”

The Pioneer fund mitigates some of the additional volatility inherent in this space by using active hedging strategies, including Itraxx Crossover and CDS.

VIEW FROM MORNINGSTAR

Steady performance

Euro-denominated high yield debt continues to benefit from the search for yield, although performance has been less spectacular than in 2012.

After a spike in volatility in May and June — when both equity and credit markets became nervous over the Federal Reserve’s tapering announcement — the asset class quickly rebounded. Many fund managers argue that the ongoing improvement in high yield issuers’ balance sheet quality, and the market’s abundant liquidity, continue to bode well for the asset class.

One of the top performers, Aberdeen Global Sel Euro HY, returned 12.25 per cent from October 2012 to October 2013. The team at the helm, led by Brad Crombie, focuses on high-yielding issues from companies whose credit worthiness is deemed to be underestimated by the market. This philosophy leads to a riskier portfolio than that of many of the fund’s peers, but has proved favorable for investors over the years.

HSBC GIF Euro High Yield Bond, returned 10.5 per cent. Manager Philippe Igigabel prefers issuers that he believes are relatively insensitive to the economic environment, either because of their business model or the soundness of their fundamentals.

Petercam L Bonds Higher Yield returned only 5.8 per cent. Unlike most of their competitors, managers Bernard Lalière and Thierry Larose can also invest in emerging-market sovereign debt. Such bets have weighed heavily on returns, as emerging debt suffered from a turn in market sentiment following fears over the Fed’s monetary policy.

ETFs have started to gain traction: both the iShares Euro Hy Corp Bond ETF and the SPDR Barclays Cap EUR High Yield Bond rank in the top half of their category over the past 12 months.

Mara Dobrescu, senior fund analyst, Morningstar France