Currency volatility central to portfolio performance

Mark Haefele, UBS Wealth Management

The Fed’s potential tapering of quantitative easing is just one reason why it is vital portfolios are hedged against currency risk, while private investors can benefit from fluctuations

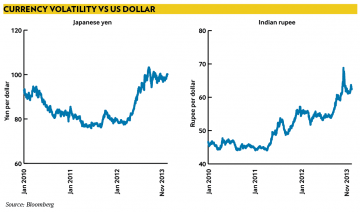

The impact of currency movements on portfolio returns is something investors can no longer afford to ignore, especially in light of the heightened volatility in foreign exchange markets.

“In every investment decision they make, we recommend our clients consider whether the currency element will amplify or offset their expected return,” explains Iain Armitage, head of investments Emea at Citi Private Bank. However, many of them still do not take enough notice of the FX markets, he says.

The performance of the Japanese stockmarket highlights the importance of hedging portfolios against currency risk: year to date the Nikkei has rallied 38 per cent in yen terms but just 20 per cent in euro terms, as the Japanese currency depreciated sharply as an effect of ‘Abenomics’.

Particularly in this low yield environment, a growing number of private investors look at FX as an asset class in itself, which can generate returns.

Clients that are indifferent to whether a return is generated in say British pounds or US dollars, are taking advantage of higher volatility between currencies by investing in products such as deposits, where they sell that indifference to the market, providing the counterparty the right to return their deposit back to them in any of the two currencies and so this gives an enhanced return, explains Mr Armitage.

High volumes

According to the Bank for International Settlements (BIS), the daily turnover in FX markets has increased to $5.4tn (€4tn), from $4tn three years ago

Today there are two main factors that will generate uncertainty and increase volatility in the currency markets, he says: the prospects that, at some point in the next couple of years, the huge amount of liquidity global banks are pumping into the system will slowly be withdrawn from the market and the end of the commodity supercycle, which has greatly benefited emerging markets and their currencies.

Investors should take advantage of temporary movements in currencies. The US Federal Reserve’s decision in September to delay the tapering of its bond buying programme announced in May generated a sudden respite in the appreciation of the dollar, which benefited emerging market currencies. “We see this as a temporary impact and before too long, there will be a return to that path of dollar appreciation,” says Mr Armitage. “This provides an opportunity for investors to take advantage of the short-term pull back.”

Over the longer term Citi, which is overweight equities, and in particular US equities, forecasts the dollar will continue to appreciate, believing the US economy is well positioned to emerge from global recession in a strong way.

“The long end of the interest rate curve, which drives future expectations for the currency, may steepen very quickly and therefore we urge our investors to be well positioned ahead of that occurring,” says Mr Armitage

JP Morgan too is bullish on the dollar over the long term, forecasting the US currency will appreciate against the yen, euro and sterling. “With the US tapering being pushed back, the US economy has more time for growth to broaden and deepen, which is positive both for the US and the global economy,” explains Sara Yates, global head of FX strategy at JP Morgan Private Bank.

Economies linked to the US recovery, such as Mexico or Korea, both big exporters of manufactured goods to the US, will also benefit, and so will their currencies which are expected to appreciate, according to JP Morgan.

The delay in QE tapering makes it attractive to hold selective high yield in currencies for “carry trades” in the near term.

“The currencies we like to hold for short-term carry are the Brazilian real, Indian rupee and the Russian ruble,” says Ms Yates. “However, we remain cautious on many of the high yielding currencies over a longer-term horizon. Many of these economies have homework to do, and unless this is done sufficiently by the time US yields start to move, there is a risk that we see somewhat of a re-run of the summer’s pull back from emerging markets,” she states, forecasting US 10 year yields to rise towards 3/3.5 per cent next year, which will support the dollar.

“We remain particularly concerned over the size of Turkey’s current account deficit and the lack of aggressive action on rate hikes from the central bank” she adds. “We are telling clients to use this interlude to close long Turkish Lira positions.”

Thematic impact

Volatility in currencies, particularly in emerging market (EM) currencies, also has had an impact on recommended equity investment themes.

For example, for a long time UBS has favoured the theme ‘Western winners from EM growth’, believing developed market companies trading on developed market indexes would benefit from their exposure to the consumer growth in emerging countries. But that play was taken off, in light of EM currency volatility, as this was likely to affect the companies’ earnings, explains Mark Haefele, global head of investment at UBS Wealth Management.

However, over the longer term a basket of EM currencies can be seen an asset class producing a higher yield that could offset the depreciation that may or may not happen over the coming years, he says.

Wealthy clients who have a predetermined need to buy another currency often sell currency options to generate a yield on their currency holdings and benefit from any volatility in the asset class, explains Mr Haefele. Selling these options allows them to set their currency conversion rate in the future but earn a yield until that transaction and the conversion happen.

Another position UBS is proposing is being overweight the British pound over the Swiss franc. “Both of these economies can benefit from a resurgence in the eurozone and we think that many have underestimated the relative strength of growth in the UK,” he states.

Gero Jung, chief economist at Mirabaud & Cie Banquiers Privés, explains the bank’s Swiss clients are recommended to hedge their investments in the British pound because “it is a very desynchronised currency relative to fundamentals.

“We continue to be surprised by some market expectations that interest rates will rise much earlier than the bank of England predicts. The actual output data is rather disappointing versus the very positive survey data,” he says.

“The market might anticipate a premature tightening by the bank of England which we do not predict, and this is reflected in the exchange rate, with the British pound appreciating quite significantly recently,” says Mr Jung.

Credit Suisse suggests the theme of the euro weakening against the dollar can be played by euro-based investors buying stocks of European exporters, as their goods become relatively more competitive in countries like China and the US.

“We believe the euro is expensive relative to the dollar and over the next three to four months we expect it to go down from 1.35 today towards the 1.30 level,” says Michael O’Sullivan, CIO UK & Eemea at Credit Suisse.

In a world where currencies are being increasingly driven by policymakers, trying to read their intentions is really vital, says Kiran Kowshik, FX strategist at BNP Paribas Wealth Management. For example, the appreciation by 7-8 per cent of the British pound in the first half of the year was driven by future expectations on the actions of the new central bank governor, who it was believed was preparing to let go of the inflation target, but when those expectations were disappointed the British currency depreciated again in the second half.

“The market tends to front run and price developments as they happen,” says Mr Kowshik. “What’s important is to detect these mini themes and be flexible in your approach. You have to be prepared for more V shaped type of moves in currencies.”

BNP Paribas predicts the dollar will rally next year, principally against currencies of those countries where the central banks run fairly accommodative policy. The yen and the Swiss franc stand out, as both the bank of Japan and the Swiss National Bank will run “fairly easy policy”. By the end of 2014, the dollar/yen and dollar/Swiss franc exchange rates will increase by at least 10 per cent from now, according to BNP Paribas.

Beta versus alpha

Until a couple of years ago, as emerging markets were growing very fast, driven by the Chinese economy expanding at near double digit rates and with the large amount of liquidity pumped into the system, “foreign exchange was a very high beta driven play”, says Mr Kowshik.

Both equities and FX moved in tandem, and investors felt no need to hedge currency risk, even when investing in countries with large current account deficits, such as India. “But today investors have to look for alpha and for idiosyncratic risks across currencies,” he says.

Over the past two years trade balances in many EM economies have been deteriorating, and with the slowing down of China, growth and returns have been rerated lower.

Moreover, while extremely low interest rates in the developed world underpinned massive flows into EM local markets in recent years, the increase in US yields since May has created the reverse effect and the opportunity cost of holding many of these EM currencies has grown, leading to a reassessment of risk. Outflows affected particularly local currency EM debt, which recorded huge inflows last year.

The Fed’s change in paradigm has exposed vulnerabilities of those countries with weaker macro fundamentals and lower cyclical and potential growth prospects. Economies running large current account deficits, which need to attract foreign inflows to finance them, such as Brazil, Turkey, South African, India and Indonesia were particularly affected and their currencies depreciated significantly against the dollar.

“In an environment where global liquidity conditions are tighter, it becomes more challenging for these countries to have access to foreign resources to finance their debt,” explains Marcelo Assalin, lead portfolio manager, EM debt local currency strategies at ING Investment International. “That means there is a high probability that their currencies will depreciate and investors sold in advance of that expectation. This negative environment for EM currencies has certainly encouraged speculative bets against the most vulnerable currencies.”

Over the past two months, since the Fed’s decision to delay tapering of QE, there has been a significant recovery from the most vulnerable currencies, which were also the ones that sold off the most, including the Brazilian real, Indonesian rupiah, Indian rupee and the Turkish lira.

However, going forward, the consensus is that EM currencies in particular those of countries displaying high levels of external imbalances will face stronger headwinds. Investors will prefer to be long more liquid currencies, and will favour countries with current account surplus or countries with current account deficits but with very large stocks of international reserves, which is an important buffer.

“Over the past one to two months, as the markets priced in a delay in Fed tapering, the distinction between bad and good emerging markets has diminished, but as we move into next year, the differentiation will come back to the forefront,” says BNP Paribas’ Mr Kowshik.

Some of the currencies BNP Paribas favours are the Korean won, Taiwanese dollar, Polish zloty and the Mexican peso while it dislikes the Indian rupee, Indonesian rupiah, Turkish lira, Russian ruble and also the Brazilian real.

However, the speed at which the interest rate will rise is critical. “The forthcoming reduction in the pace of bond purchases by the Fed is reasonably well anticipated in the marketplace, and US Treasury yields should rise more gradually going forward,” believes ING’s Mr Assalin. “With the Fed remaining in dovish territory, interest rates should remain stable over the coming months, at 2.5 per cent, and will remain historically low for years to come. Investors will look again for the higher carry provided by EM local currencies debt.”

With the Fed remaining in dovish territory, interest rates should remain stable over the coming months, at 2.5 per cent, and will remain historically low for years to come

ING likes the Mexican peso, the Russian ruble, the Korean won and the Philippines peso and the Brazilian real, the latter because of its high levels of international reserves accumulated there over the past year.

Some currencies, including the real, looked attractive after the latest correction and ING moved the Brazilian currency to an overweight position after the Brazilian Central Bank announced the recent intervention program of auctions of dollar in the market place.

Mr Jung at Mirabaud has a different perspective. “We are more prudent on the Brazilian real, as the economy still has a significant current account deficit, which is around 3 to 4 per cent of GDP. Inflation is more than 6 per cent, higher than the central bank target and the Brazilian Central Bank was probably late in reacting earlier this year,” he says.

A useful diversifier?

Not only can currency investments generate good returns, but their low correlation with equities and bonds means they have valuable diversification benefits, says Sara Yates at JP Morgan.

However, especially in the EM space, this does not hold true, as there is indeed a very strong correlation between foreign exchange and stock and bond markets, argues Gero Jung at Mirabaud. This was highlighted by the “mini-crisis” during of May-September, which had an effect on both bond and equity markets, with the Brazilian and Turkish equity markets declining by 20 and 30 per cent respectively.

“As equity markets are an indicator for expected corporate growth or future earnings and therefore growth, currencies in the more vulnerable countries, such as India and Brazil, with high inflation, relative large account deficits, and dependent on foreign inflows to finance their deficits, depreciated significantly,” he explains.