Global asset tracker: Clock ticking for the low volatility era

A sell-off in global stocks in early 2018 may have spooked investors, but respondents to PWM’s third annual asset allocation survey remain optimistic that the global economy remains on course

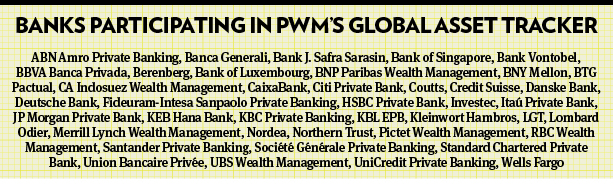

A positive outlook for the economy and markets in 2018 emerged from interviews with chief investment officers, heads of asset allocation and chief investment strategists of 42 private banks, who took part in PWM’s third annual Global Asset Tracker survey (GAT) and mostly were among winners of PWM’s global private banking awards in recent years. Together, they manage more than $10tn in client assets globally.

Further reading

Most played down the risks looming over global markets. “The world economy is undercut by fault lines: record indebtedness and inequality, the shearing away of globalisation and low productivity, but none of these are live risks at the moment,” says Michael O’Sullivan, CIO, International Wealth Management at Credit Suisse.

“Growth is the strongest it has been in 10 years and the same can be said for profit growth in the US and Europe.”

Recessions, historically, have been caused by oil price shocks, too-tight monetary policy, contractions in government spending and financial/credit crises. None of these looks likely to materialise in 2018, says UBS, which enters the year with a broader global equity overweight position.

“We are almost prepared to guarantee no recession in 2018, because there are just no drivers of recession today that would trigger the downturn,” says Paul Donovan, global chief economist at UBS Wealth Management.

A repeat of last year’s healthy current rate of growth is likely this year too, he says. In 2017 it was particularly impressive for its breadth, with every major economy expanding – an occurrence which has happened on only six other occasions in the last 30 years – and generating 3.8 per cent growth in global GDP.

“I would struggle to describe any central banks as tightening too early or too aggressively today and there is no risk of economies overheating, which may determine inflation increases,” says Mr Donovan. “There may be the odd bubble kicking around the world, and bitcoin springs readily to mind, but it is an isolated case.”

The sell-off in global stocks, which painted a sea of red across major indices in early February, ended a long period of extremely low volatility and strong market performance, which brought valuations to high levels.

240.7%

The current equity bull market, which is about nine years old, is the fourth longest and fifth highest in terms of cumulative returns since 1871, with 105 months and 240.7 per cent cumulative performance, as at the end of November 2017, according to Kleinwort Hambros. The 1990s bull market was the longest (153 months and 516.4 per cent cumulative performance). The average bull market lasts five years.

But far from marking the end of the nine-year equity bull market and the start of a protracted downturn driven by recession fears, the market correction is viewed as overdue, given the strength and speed of the market gains last year and in the opening month of 2018, the strongest January performance in 30 years.

Triggered by signs of wage inflation in the US and resulting fears that the Fed would accelerate interest rate increases, it has been certainly exacerbated by algorithmic trading.

“While the rationale for the correction is justified by the risk of inflation, the scale of the correction is not, and is profoundly driven by quantitative trading programmes,” states Didier Duret, CIO, ABN Amro Private Banking.

While the unwinding of positions by investors caught offside by the sudden spike in volatility could continue for weeks, the correction may offer private investors a better entry point into stockmarkets, supported by synchronised economic growth and strong earnings expansion.

“Global economic growth remains strong and there are no signs of a US recession, which usually heralds a wider sell-off,” says Sven Balzer, head of investment strategy at Coutts. “While this correction can be unnerving for investors, we see a robust and corporate environment that should continue to support equities.”

Nevertheless, inflationary pressures in the US have pushed bond yields up, which at long last may start to tempt investors to switch from equities into fixed income.

But this scenario seems far away. In our sample, 70 per cent of private banks enter the year with a tactical overweight position to equities, higher than last year’s 65 per cent, and 90 per cent have a tactical underweight position to fixed income (see Fig 3).

“We do not think inflation will be an issue due to the overwhelming structural headwinds like increased use of technology, globalisation and demographics,” says Katie Nixon, Northern Trust Wealth Management CIO. “But we could see a cyclical uptick as a result of the intense demand impulse from tax cuts and now potentially fiscal stimulus.”

While there are plenty of hurdles ahead, can bull markets just die of old age?

“Markets have changed but our fundamental view has not: synchronised global growth remains intact and we believe global monetary policy will remain generally accommodative, which is a very good environment for global risk assets,” says Ms Nixon.

The tailwind of US tax reform adds upside to earnings estimates and sets the stage for another good year for equities, she says, adding that the bank’s highest conviction call has been to overweight risk assets, global equity and US high yield, for the past several years consistently.

Not done yet

“It is too early to get overly cautious with equity and we think the rally has further to go,” says Jeffrey Sachs, Emea investment strategist at Citi Private Bank.

3.6%

On average, private banks taking part in PWM's GAT survey predict 3.6 per cent growth of global GDP this year, versus 3.4 per cent forecast last year for 2017

The global bank expects its globally diversified portfolio to return 8 per cent this year, fuelled by strong and accelerating global growth, reflected in strong earnings per share growth. Moreover, there is solid dividend yield support. Global dividend yields on average generate 2.5 per cent, particularly attractive compared to investment grade bonds, presenting incentive for investors switching from fixed income into equity.

As central banks tighten monetary policy, the main negative impact will likely be on bond markets. Apart from emerging market debt, Latin American bonds and US high yield, Mr Sachs suggests floating rate notes and senior loans with floating coupons. “The areas where we are most cautious are developed markets sovereign bonds, where valuations are extremely expensive.”

Buying opportunity

While volatility is expected to remain relatively contained by supportive central bank policies and strong economic and earnings growth, the risk of inflation, the end of highly accommodative global monetary policies, potential mismanagement of transition and reforms in China, as well as geopolitical risk have driven almost all banks in our sample (95 per cent) to expect more volatility spikes this year compared to 2017, when it was undeniably very low (see Figs 4, 5 and 6).

Stockmarket weakness may present a buying or reallocation opportunity at lower prices, says Jeff Mortimer, director of Investment Strategy at BNY Mellon Wealth Management.

Historically, after major market dislocations unrelated to weakness in fundamentals, stocks prices typically rise 12 per cent over the following six months and 20 per cent over 12 months, he reports.

“We may continue to see some modest equity market downside, but we are closer to the end of any drawdown than the beginning of a major market correction,” adds Mr Mortimer.

There have been five corrections involving a higher than 10 per cent pullback in global equities since 2010, reports Alexis Calla, global head of investment strategy and advisory at Standard Chartered Bank.

“A healthy correction has always been part of a bull market, and the pullback represents an opportunity for investors to add to their equity exposure,” says Mr Calla. Within equities, the bank prefers Asia ex-Japan and the euro area.

However, as the economic cycle is at a relatively late stage, and it has historically been “very difficult to time the end of an economic or market cycle”, it makes sense for investment allocations strongly tilted towards equities to also have a core allocation to bonds, says Mr Calla. He points to opportunities in emerging market bonds across both US dollar and local currency markets, as well as long/short strategies, which are generally less volatile than long-only.

Private clients are in search of high yield and income, which bonds can no longer provide, notes Jeremie Vuillard, group head of advisory at Kleinwort Hambros. “They are happy to take credit risk but not so much duration risk, to protect themselves from being detrimentally affected from any potential future rise in interest rates, and they also invest in floating rate notes.”

Seeking exposure to equities via derivatives is another trend, resulting from cheap upside participation through call options or capital protected notes, providing equity market exposure with fixed income-type risk.

Solutions providing return uncorrelated to equity markets are also in demand. These include market neutral strategies such as long/short equity funds, alternatives or income investments, such as commercial real estate lenders, infrastructure funds or real estate investment trusts. Structured products, typically providing an annual yield of 7 to 8 per cent, as long as the equity markets do not decrease by more than 30 per cent, are also popular.

“Some of our sophisticated clients are waiting for any potential small spike in volatility to be able to launch this type of solution, which would allow them to lock in better conditions,” says Mr Vuillard.

The outbreak in volatility should make investors aware of both more risk and that we are moving into a changing investment climate, where growth, inflation, yields and volatility will be higher than in 2017, states Credit Suisse’s Mr O’Sullivan.

Within the equity space, the Swiss bank has upgraded financials which benefit from the rise in yields, downgrading more yield sensitive healthcare stocks to neutral. The bank also upgraded emerging markets, based on valuation, growing fund flows, more certain policy outlook and sector drivers such as financials and technology.

Inflation-linked bonds have been added to clients’ portfolios, based on expectations that bond yields may stabilise at higher levels than 2017.

Focus on fundamentals

The sell-off is expected to take froth out of the market, bringing sharper focus on fundamentals and active management. “Extended equity valuations lead investors to be more focused and selective and seek alpha strategies,” says Nannette Hechler-Fayd’erbe, head of investment strategy and research at Credit Suisse. The sophistication needed to navigate a more complex fixed income environment will also be suited to more actively managed investments, she says.

More than three quarters of respondents believe that with the winding back of quantitative easing, which boosted all assets, markets will be more favourable to actively managed products. However, only 40 per cent believe this will translate to a higher proportion of active investment products in portfolios this year (see Figs 7 and 8).

“Even though active managers will outperform benchmarks in 2018, the proportion of ETFs should continue to increase in clients’ portfolios, as most managers missed the performance of their respective benchmarks in 2017,” says Nicholas McCarthy, global CIO, private banking at Itaú. In addition, he adds, asset managers have not lowered fees to meet clients’ demand.

Moreover, market momentum will not discriminate between good and bad companies, offering little chance to active managers to outperform. This will change in case of market correction, he adds.

“We prefer to remain pragmatic rather than dogmatic,” says Lars Kalbreier, CIO at Vontobel Wealth Management. “We believe active management offers outperformance for certain strategies like small cap equities, whereas index funds can be an excellent cost effective alternative for large caps.”

Either way, 70 per cent of respondents, versus 35 per cent last year, expect risk-adjusted returns to decrease this year (see Fig 9), citing higher volatility, a poor bond environment and difficulty to maintain exceptional performance of 2017.