US equities hit record highs as fears over recession fade

Fears of an imminent US recession have abated and recent economic data looks strong, but is the country really in as good a shape as its record-breaking equity markets would suggest?

Stockmarkets in the US are booming. Each of the three main equity benchmarks – the S&P 500, the Dow Jones and the Nasdaq – are sitting at record levels. Indeed, on Thursday August 11, all three were simultaneously at all time highs for the first time since the height of the internet boom back in early 2000.

It all looks very different to the early months of 2016, when worries about China, the oil price and central bank policy saw markets tumbling and commentators talking about the likelihood of the US tipping into recession. So what is the true state of the US economy, and can the equity rally continue?

“We retain an optimistic outlook for the US economy and stockmarket, although we recognise a number of uncertainties exist,” says Wisconsin-based Tom Ognar, who leads the Heritage Growth Team at Wells Fargo Asset Management. He points to the effects of China’s slowing growth rate on both US and global economies as well as fallout from central banks’ monetary policies.

We retain an optimistic outlook for the US economy and stockmarket, although we recognise a number of uncertainties exist

Despite such risks, the resilient US economy has continued to grow at a modest pace. Recent data has shown house prices and demand for new homes increasing, while, having reined in purchases for the first few months of the year, consumers spent more freely in May than in April – good news for the economy because household spending accounts for more than two-thirds of GDP in the US. There have also been signs that manufacturing activity is picking up and M&A activity has continued as companies took advantage of low interest rates.

It has not all been good news however, with US GDP and jobs data underscoring some weaknesses in the economy. “GDP increased at a sluggish annual rate of 1.1 per cent in the first quarter of 2016, down from 1.4 per cent in the fourth quarter of 2015, and May’s disappointing employment data revealed employers added jobs in May at the slowest pace in five years,” highlights Mr Ognar.

Widespread fears of US recession which surfaced earlier this year were “overdone”, says Didier Saint-Georges, a member of the Investment Committee at Carmignac, who expects the slowdown to continue.

“The two drivers of economic growth are investment and consumption,” he explains. “US corporate margins have been coming down for more than a year. It is hard to find a better medium-term advance indicator of investment. A more short-term indicator is the rate of capitalisation and this has been going down as well. When you combine the two it is difficult to figure how the investment cycle is going to pick up and drive economic growth.”

This leaves consumption, where the picture is better with wages starting to pick up and employment looking quite strong. However Mr Saint-Georges worries the economy is looking fragile. He warns any inflation is likely to be in non-discretionary areas, such as in rents or the oil price, and could act as a tax on consumption, while Fed Chair Janet Yellen has “very little leeway” to do anything should the economy weaken.

Yet despite the consensus that the US economy is late in the economic cycle and will continue in slow growth mode, stockmarkets are at record highs. Are equities overpriced?

“US equities may be trading at more expensive multiples than European counterparts, but we think there is still room for the equity market to appreciate,” says Pictet Asset Management’s chief strategist Luca Paolini.

“Valuations in US stocks are nowhere near bubble territory yet, while those in bonds have reached far more excessive levels.” A Fed that is unlikely to raise interest rates before December should also help underpin risky assets, he believes.

“US equities are certainly not undervalued, and there are pockets that are overvalued, but to say the whole market is overvalued is not correct,” says Nick Melhuish, head of global equities at Amundi, Europe’s largest asset manager with €987bn ($1.1tn) in AuM.

The areas which look expensive are those which investors have rushed into in search of safe havens, he explains, for example consumer staples. Better value can be found in energy stocks, claims Mr Melhuish.

“They have bounced back a bit this year along with the oil price, and if you think the oil price is going to normalise somewhere between here and 100 dollars, which I do, the amount spent on exploration will come back to haunt us, probably in 18 months to two years time. That will make the energy companies attractive.”

He also likes healthcare, as well as big tech companies, which have large amounts of free cash flow and are much more diversified than before. “These names are more annuity-like now in that chances of Microsoft disappearing in the next five years because it has made the wrong bet is increasingly unlikely,” he says.

A major difference between investing in the US and in Europe is the gap between the cheapest and most expensive stocks by sector – the spreads are wider in the US than they are in Europe. Europe is relatively cheap, but everything has been “burnt down to the ground”. But in the US, even in sectors which appear expensive, you can still find outliers, says Mr Melhuish. He explains how risk-averse investors have piled into companies with high levels of visibility and low earnings risk, placing a premium on those stocks and leaving others behind, which often tend to play catch-up later on in the cycle as valuation means revert.

The market has been favouring low volatility, yield-focused, defensive stocks, agrees Adam Schor, director of global equity strategies at Janus Capital Group, and instead favours companies that can find ways to grow earnings through innovation, secular industry change and market share gains despite the slow-growth economy. “We are finding these stocks across many sectors but healthcare and technology are especially attractive sectors.”

He highlights the e-commerce trend, rapidly expanding and pressuring traditional mall-based retailers and companies without an effective defence against disintermediation.

Given current interest rates, John Bailer, senior portfolio manager at the Boston Company Asset Management, a subsidiary of BNY Mellon, believes the equity market is undervalued and will be driven higher by more cyclical areas of the economy.

“Currently we are bullish on the financial sector as it is trading at significant discount,” he explains. “We believe the market is overlooking their very strong balance sheets, improving revenue growth opportunities and good cost controls. Also, based on the most recent Federal Reserve test, capital returns through share buybacks and dividends will be positive.”

There are plenty of small regional banks in the US, which makes for an interesting investment universe, believes Boston-based Geoff Dailey, portfolio manager and senior analyst for US equities at BNP Paribas Investment Partners. “You can be very regionally-specific. You can pick banks that serve the New York Area, the North West, California… for example I own a small cap bank that has 18 branches in southern California.”

With banks facing increasing regulatory pressure and compliance demands, they are being forced to add systems and increase headcounts. As such, there are huge benefits to scale. “We are starting to see a ramp-up in deals being made, we are seeing them at higher valuations, and at higher market cap sizes,” says Mr Dailey. “We think that will continue and it makes for an interesting investment theme.”

Boston-based Eddie Perkin, chief equity investment officer at Eaton Vance, believes the market is a little expensive and is surprised stocks have held up so well given the uncertain economic outlook and potentially negative catalysts on the horizon. He highlights the upcoming US presidential election in November.

“It is surprising to me that the market has not focused on what could be two very different scenarios, depending on who gets elected.”

Although the consensus is Hillary Clinton will get elected, anyone doing proper scenario analysis has to consider the possibility that Donald Trump could win. “Because he is such a controversial person and his trade policies would be so protectionist, the market would not like the prospect of a Trump presidency, at least as its first, gut reaction. I don’t think that risk has been priced in yet.”

This risk could creep into the market as the election draws nearer, believes Mr Perkin, or it could be more like the Brexit referendum, where polls and consensus leading up to election day point one way, then there is a surprise on the day itself and the market reacts accordingly. In any case, there is a great deal at stake in this election, he believes. “Both the range of potential outcomes and what it means for potential policy is wider than normal in this election. The uncertainty is high.”

Healthcare is a sector favoured by many fund managers, although this one area could prove to be a political football. Ms Clinton has made reform of this sector one of her key political objectives, and has repeatedly criticised high drug prices.

For Clinton, healthcare reform is clearly not a political soundbite; she really does believe in this

“For Clinton, healthcare reform is clearly not a political soundbite; she really does believe in this,” says Mr Melhuish at Amundi. “She will be looking to lay out clear differences between her and Trump so maybe we will be hearing much more about healthcare.”

But this should not stop people investing in the sector, he warns, rather it is just an additional risk. “The underlying factors are positive enough and the reality is you have to get all of this through Congress anyway.”

Now could be the best moment to look at the biotechnology sector, argues Daniel Koller, lead manager at BB-Biotech, a Swiss-based investment trust, owned by Bellevue Asset Management, and with SFr3.3bn ($3.4bn) in AuM.

Shares in the sector have tumbled since the summer of 2015, and with biotech stocks underperforming general equity markets by around 20 per cent since January 2016, valuations for the biotech blue chips have reached their lows of 2010/11, trading significantly below US and EU large pharmaceutical multiples and below the average S&P multiple.

“We believe the current phase is a breathing space before the next growth curve. The market has now passed on the effects of possible shifts in sales and profit development, reflected for example in the issue of reimbursement in the health systems, and these are evident in the price of shares,” says Mr Koller.

The elections will bring some volatility to the market, highlighting challenges facing US healthcare, he says. Yet he believes the drug industry is starting to become more vocal about its interests and value proposition.

“Contrary to 2008, markets have already been through a correction, a year before the elections,” says Mr Koller. “So the market’s reaction should be minor even if we can expect some volatility depending on the candidate elected and his or her healthcare programme.”

Rumours that Ms Clinton would cut drug prices shocked the market, says Janwillem Acket, chief economist at Julius Baer, but he agrees opportunities outweigh risks in this sector. “The US population isn’t as healthy as it may look – obesity levels are high, there are some bad lifestyles. The US market is the largest healthcare market in the world.”

He highlights the gene sequencing story, now getting out of the laboratory into clinical applications. Several US companies are at the forefront, and have a global outlook. “They have impressive potential,” says Mr Acket, highlighting Illumina and Laboratory Corporation.

Market volatility makes this a time for stockpickers, rather than “coarse” index and sector approaches, which can lead to bad performance. “It is the themes and the companies that you want to look at. Those with good corporate governance, good management and good figures regularly delivered, and sitting within a sector addressing needs, then you are in the right place.”

These quality stocks should also deliver regular dividends, increasingly becoming the yield investors are missing out on in bond markets, adds Mr Acket, although he warns investors should see these payments as an added benefit rather than the sole reason for buying a particular company.

“If you just buy dividends you do the same mistake as you would going into high yield bonds – forgetting that underlying it is something that could be a lousy investment which would risk your capital. Don’t go for the bait of a dividend promise… the search for yield can make people blind and too greedy.”

Despite the growth of passive strategies (see View from Morningstar on p45), in a market such as the US, sitting where it is in the economic cycle, active management is absolutely vital, argues Amundi’s Mr Melhuish, as an exchanged traded fund (ETF) cannot pick up the valuation stories.

“You can buy sector ETFs, or some of the factor ETFs could be relevant. But to pick out those companies on an intra-sector basis, you really need an active manager.”

This is typically the point in the cycle to rely on alpha rather than beta, he believes.

“The cycle is quite mature, making big headline returns between now and whatever ends this cycle is going to be more difficult, so you really need to start peering deeply inside the market. Active managers are much better at doing that than passive strategies,” adds Mr Melhuish.

VIEW FROM MORNINGSTAR

Low-cost passive funds gain market share

Despite the macro bumps of 2016, US equity markets have been rallying, with the S&P 500 index reaching all-time highs in July. However, negative sentiment has seen investors continue to sell US equities at record pace. According to Morningstar data, actively managed US equity funds have seen global outflows of $116bn in the first six months of 2016.

The asset class has enjoyed a seven-year bull market and many commentators are showing doubts it will continue to move higher. Contributing to this trend is the surge in popularity of passive funds. Many individual investors and allocators have opted for a passive approach by investing in index funds and ETFs, which allows them to gain access to the US equity market in a very low-cost manner while profiting from returns that often exceed those of actively managed funds.

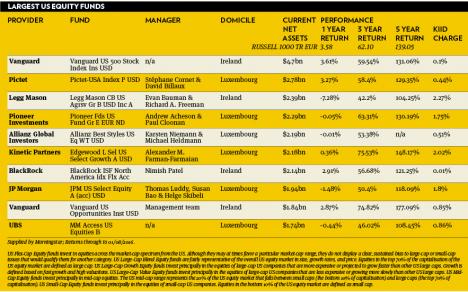

It is of little surprise that the Vanguard US 500 Stock Index fund dominates the Morningstar US Large-Cap Blend Equity Category in asset terms. The fund aims to invest in the S&P 500 Net Return Index constituents and, as such, offers broad access to the US equity market. Over one, three and five-year time frames, the fund has achieved solid returns, placing it in the top quartile of the category.

While we acknowledge active managers have struggled to deliver excess returns, this does not mean the sector is bereft of attractively managed active offerings. The Legg Mason ClearBridge US Aggressive Growth Fund is an established and strong proposition. Adhering to a growth-leaning philosophy, it is managed by two seasoned investors, Evan Bauman and Richard Freeman, who is among the industry’s longest-tenured managers. The investment approach targets relatively-debt free companies growing faster than the S&P 500 and generating healthy cash flows. The fund’s long- and medium-term track record is impressive and it holds a Morningstar Analyst Rating of Silver, which reflects our analysts forward-looking conviction. The offering has attracted large inflows during 2014-15, making it the largest fund in the US Large-Cap Growth Equity Category.

Fatima Khizou, Manager Research Analyst, Morningstar