Opportunities opening up in time of distress

Distressed prices are creating interesting opportunities in private credit, but clients need to be reminded that it takes a while for these investments to bear fruit

The European sovereign debt crisis has opened up new interesting opportunities in the private credit space. As banks seek to deleverage their balance sheets to raise core capital ratios, private fund managers have a chance to step in and buy distressed debt on assets at attractive valuations.

Corporate distressed opportunities are also arising, as those companies with credit facilities approaching maturity are experiencing trouble refinancing. This is especially true for those companies in the small to mid cap space.

“In Europe we are in the same place we were in the US post Lehman,” says Rhian Horgan, international head of alternatives at JP Morgan Private Bank. “In the first quarter of 2009, many assets were sold by forced sellers, as people had liquidity issues rather than issues with the underlying assets. That really gave distressed investors great opportunities in private credit.”

The focus is on managers that have the ability to go in and restructure the companies and put in a proper capital structure that could withstand the continuous volatility in Europe. These debt investors are typically buying in at a much cheaper valuation on these ‘distressed for control’ opportunities, she explains.

The real estate market also continues to have attractive distressed pricing, as a considerable amount of debt is coming up for maturity over the next few years. These maturities are likely to lead to a significant amount of restructuring. In 2012-2014, it is estimated $135bn (€102bn) worth of commercial mortgage backed securities will be maturing in the US, while only $30bn was issued in the whole of 2011.

Compared to private equity, the private credit market is a newer concept. The market has been dominated by bank lending for a very long time, while the concept of private lenders has really only emerged post 2008. “We are seeing more and more opportunities in the private credit space and I would expect it to become a growing part of the portfolio as we continue to see deleveraging,” explains Ms Horgan.

“In the private credit market in Europe and in the US today, you can earn 7 to 8 per cent premium over public credit, by being a lender that is terming out financing. The reality is that companies will pay a premium for certainty.”

While private equity managers aim to generate 20 per cent plus return, typically private credit managers target 15 to 20 per cent returns but today these are targeting 20 per cent plus return too. Private credit managers are able to buy into real estate at prices where they will still be protected, even if real estate fell 50 per cent from sales levels or even if default rates on consumer loans double, says Ms Horgan.

“These returns are very attractive, particularly in a low growth environment, where investors are starved of yield and public equity and credit generate modest returns.”

But capital fund raising is also being impacted by the global debt crisis and risk appetite is down.

| In which of these private equity types do you invest currently? (CLICK TO VIEW) |

“New money is significantly harder to raise, both institutionally and from private clients, in the current environment,” says David Bailin, global head of managed investments for Citi Private Bank. Partly, this is due to the low returns generated by funds in most recent vintage years, to the crisis itself and to clients being more conservative and holding cash, he says. “Our clients tend to build positions over time and collect private equity exposure. But in general right now, capital raising is probably three quarters of the level it was 18 months ago.”

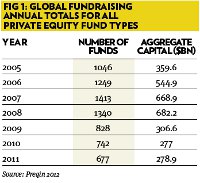

However, the amount of money raised in the years before the 2008 crisis was so large that there is an overabundance of capital on the sidelines. According to information provider Preqin, the amount of capital in all private equity fund types raised globally in the three years between 2009 and 2011 was $1,896bn versus $862.5bn raised in the three years between 2006 to 2008 (see Fig 1).

“It is a bit of clouded picture, but if you look ahead at 2014, the funds that represent this large pool of capital will stop operating in a virtual sense,” says Mr Bailin. “That could be a time when there will be both a large amount of opportunity and prices will be diminishing. For a buyer, this will be a great combo that will take place in several years from now.”

Routes into private equity

There are three main routes which high net worth individuals or families can take to invest in private equity. The first one is direct access, by investing directly into a private equity fund, and becoming a Limited Partner in that fund.

However, as minimums thresholds to get into funds can be as high as $25m, medium to high net worth investors will generally need to go through a fund of funds route, in order to get the appropriate diversification.

Funds of funds managers claim to provide top fund selection skills and access to top-tier managers, which would justify the additional layer of fees.

“We are looking to identify those managers who can present a good investment track record, but also a very clear, consistent strategy to repeat that track record going forward,” says Craig Williamson, partner at SL Capital Partners.

Managers must look after their portfolio in an effective way, react to economic challenges and support the companies they invest in, by for example looking at the debt terms, strengthening the operations or taking action in support of management.

The global financial crisis was a significant test for private equity firms, says Mr Williamson. “When assessing track record, we do very much look at both pre-recession and post recession performance. Pre-recession, it was easier to generate good investment returns, post-recession it is a great deal harder. Tenacity, resources and defensive qualities become more important to protect investors’ money.”

A third way to gain exposure to this asset class is through listed private equities (LPE). According to the latest semi-annual global survey conducted by Scorpio Partnership in collaboration with LPEQ, the industry association of LPE investment companies, liquidity is considered the greater benefit for investing in LPE by 70 per cent of the respondents, up from 55 per cent from the previous survey. Getting exposure to private equity at discounted prices is also seen as a major advantage. Indeed, share price trades at a different price, either as a premium or a discount to the net asset value of the underlying investments.

“At the moment, the discount to net asset value is a 10 year high for the private equity sector in the UK,” explains Alex Fortescue, chief investment partner of private equity fund manager Electra Partners.

That share prices are quite cheap relative to the value of the assets is a reflection of the market believing that systemic risk is high, not specifically within private equity but just the overall market environment, he says.

LPEs also come at a package size which is much more accessible to relatively smaller investors.

Despite some quite high profile blow ups in 2008, the listed private equity sector has generated much higher returns than the market over the long-term. In terms of share price performance, private equity is up 207 per cent over 15 years, versus the FTSE All Share Index of 127 per cent. Over 20 years, it is 763 per cent versus 378 per cent, according to the Association of Investment Companies (see Fig 2).

“In any form of private equity, the returns come through buying businesses, working on them, growing them and then selling them four, five, six years later,” says Mr Fortescue.

“It is not a get-rich-quick kind of asset class, but a long run, superior return game,” he says, adding that Electra aims to generate between 10 and 15 per cent net returns per year and has achieved them over the long run.

“Investors need to have a minimum of a three to five year time horizon when investing in private equity, as that’s the sort of time horizons in which those returns show through strongly,” he says.

According to Scorpio research, LPE is used as a route to private equity by 43 per cent of respondents and 72 per cent of PE users. Sixty per cent of private banks would consider using LPE to reach and manage their PE allocation.

But large banks such as Citi and JP Morgan clearly have their reservations on LPE. “In a perfect world, where clients had the choice and the ability to put aside some liquidity, investing in pure private equity will always be our preference compared to the listed private equity option,” says JP Morgan’s Ms Horgan.

“Securities just don’t trade based on the fundamental underlying private investments, but that’s what we are trying to access, the true private equity.”

The time lag between the quarterly valuation reporting on the net asset value of the underlying investments and the daily share price clearly also has an impact.

Other private banks see very little demand for this asset class in general. “We have very little private equity in clients’ portfolios, even if in the long-term it may be an interesting investment,” explains

Sébastien Gyger, head of portfolio management for private clients at Lombard Odier.

“Private equity does not suit everyone’s risk profile, as not everyone can understand the liquidity implications and long-term cash commitments of these instruments.”

Building a collection

Unlike some of its competitors like JP Morgan, which runs a large operation of funds of private equity funds, Citi believes its ultra-wealthy clients should only invest directly in private equity funds and build a “collection” of diversified investments. “We pick only four to six private equity funds a year, which we think reflect the best opportunities out there; our approach is much more intimate and less distribution oriented,” says David Bailin at Citi Private Bank.

Two trends have emerged recently this year. “We like the concept of co-investment, where our wealthiest clients will co-invest with private equity companies in transactions. We are building a co-investment club or structure to facilitate that,” he says.

Secondly, although there are international opportunities, there is a clear focus on private equity firms having a dominant business in Europe, with considerable resources on the ground.

The aim is to invest in private equity firms that take a very high level of activity in their companies, excellent corporate governance and management, and the ability to do that locally, says Mr Bailin. At Citi, on average, allocation to private equity represents up to a third of the 20 to 33 per cent of total alternative assets in an average portfolio, between 5 and 10 per cent. But clients must have a 10 year time horizon and should not mind the illiquidity associated with it.

Portfolio analysis is particularly important when dealing with private investors, as they not only already own private equity in their investment portfolio but often also in the form of interest in the companies they run.

“You have to look closely and what they own, what businesses they’re in, what risk they have, their time horizons, the capital structure of those businesses, as you advise them on what to buy. This makes a private investor a very different buyer, because an institution is just looking for the return and the exposure the fund provides.”