Big is not always beautiful for finding success in Asia

Leading wealth managers may believe they need to be of a certain size to succeed in Asia, but there is little evidence to back up these claims and smaller players can still thrive

The story of wealth creation in Asia has been one dominated by numbers. Studies proliferate which estimate total wealth in each market, investment performance, market growth rates and wealth creation forecasts.

For many of the region’s wealth managers, this has led to a blinkered chase for what is quantifiable: better investment returns and new client assets. But our latest research suggests private banks need to shift their focus towards building efficiency in the business model and improving their understanding of client needs.

Asia’s preoccupation with numbers was neatly captured recently when two of the region’s wealth management heads independently stated that $20bn (€17.8bn) in assets under management (AuM) is the critical mass required for a private bank in the region. Bahren Shaari, chief executive of Bank of Singapore, commented that wealth managers who did not reach this total would “be forced to consolidate the business”.

Alvin Lee, Maybank’s regional head of wealth management, corroborated the figure while outlining his firm’s plans to secure 6,000 clients within the next three years. He hypothesised “if each of them has, on average between $2m and $5m with us, we will have roughly $20bn AuM. I think this is the right critical mass to work with.”

But just 17 firms in Asia had reached this magic number by the end of 2014. Does this mean that the rest of the region’s wealth managers are doomed for failure?

Not necessarily. In fact, Scorpio Partnership’s Private Banking Benchmark highlights that there is very little evidence that an institution’s size (AuM) is correlated with its ability to operate efficiently (cost: income ratios). Actually, we find that many smaller players are often better at converting AuM into revenue. For example, they may offer specialist solutions that either generate higher or more immediate fees.

Compliance, administration and personnel costs certainly make wealth management an expensive business but the rhetoric of the region’s private banking institutions should reorient away from chasing specific asset targets towards developing more efficiency within their operating model.

Crucially, Asia’s HNWIs are also crying out for a wealth management proposition that focuses less on numbers and more on the qualitative aspects of their wealth. Our latest APAC Wealth Barometer in conjunction with M&G shows that private banks may be heavily involved in supporting a client’s investment product decisions but are absent when it comes to supporting their wealth planning requirements. The result is that investors are not getting the guidance they need to set realistic financial targets.

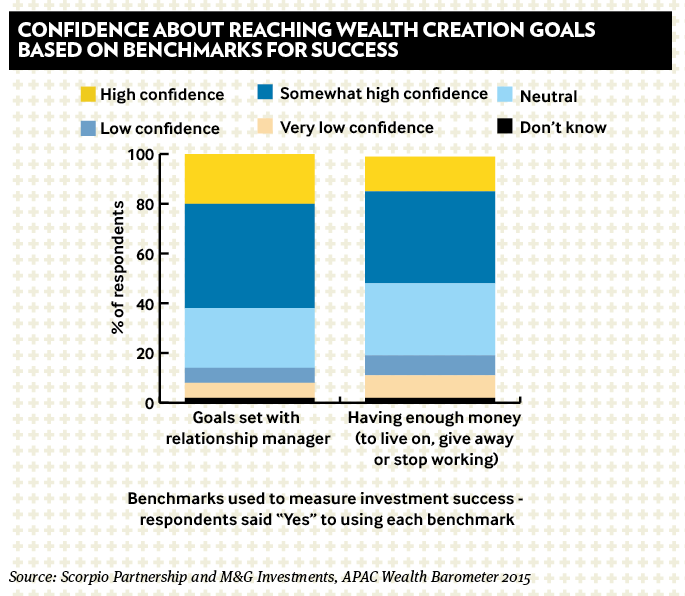

Instead, Asia’s HNWIs are relying heavily on subjective benchmarks to assess their success. When asked about how they judge their investment progress, 58 per cent of the region’s HNWIs cite “having enough money to live on” and a further 45 per cent “having enough money to stop working”. Just a quarter measured their success by the objectives they set with their private banker (see chart).

This is a real shame because those clients who do set goals with their wealth management firms are a lot more optimistic about their ability to hit their wealth creation targets. More than 60 per cent of investors who plan with their relationship manager are confident they will reach goals, compared to just 51 per cent of those who use subjective benchmarks.

The findings suggest that within their institutions and client relationships, Asia’s wealth managers need to start looking behind the numbers. Success in the market will not depend on blindly chasing financial targets but on having a healthy, efficient business models and delivering value to the region’s HNWIs that extends beyond investment returns.

Annie Catchpole is an associate at wealth management think-tank Scorpio Partnership