Fintech on Friday: Cyber security must be central pillar in wealth managers’ digital journeys

Clients may take care to keep their online bank accounts safe, but are much more relaxed when it comes to social media. Wealth managers must ensure not only that their online platforms are secure, but educate their customers how to protect themselves online

In 2017, the penetration rate of social media in the US reached 70 per cent – the largest in the world. During the same year, the number of data breaches in the country reached a record 1,579 incidents. For wealth management marketers, the figures represent a complex challenge – there are certainly wealthy customers to be found online, but ensuring the highest security standards means that reaching them is no easy feat.

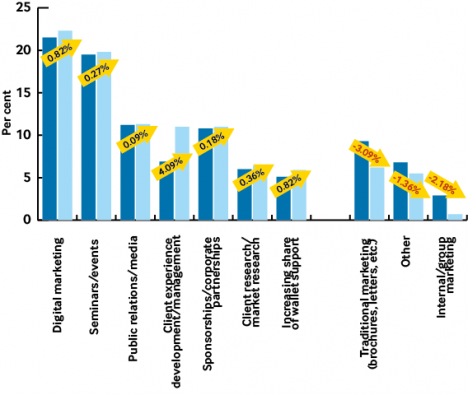

Cultivating a compelling digital identity can help firms to foster engagement with clients and reach new audiences. In our recent CMO Survey, 86 per cent of chief marketing officers cited ‘online experience’ as the top driver of positive client engagement and many are reorienting budgets from traditional to digital media to capture this opportunity [Figure 1].

Figure 1: Wealth management firms' marketing budget allocation

However, high profile hackings – like that on consumer credit reporting agency Equifax Inc, in which data from 145m consumers was exposed – highlights that criminals, scammers and ‘hacktivists’ are not afraid to go after big fish when it comes to cyber attacks. While CMOs recognise the clear opportunity for digital engagement, they also reference the integration of digital tools and technology as one of their most significant challenges.

In part, this nervousness can be attributed to not being able to control the behaviours of those engaging with digital channels – particularly social media.

While clients may take care to protect their bank accounts, they are more laissez-faire when it comes to social media security [Figure 2]. For example, many social media users use their networking accounts to authenticate access to other apps and services – which could hold data such as credit card numbers, purchase histories, street addresses and relationships. This means a hacker who compromises one social network can potentially break into other sites too, stealing sensitive personal information.

Figure 2: App or account types respondents cared most to protect (global perspective)

For employees too, there is also a risk. On social media – where the atmosphere is more relaxed and personal – the tendency to share certain information on both personal and professional social networks is greater. As a recent Forbes article highlighted: “Suddenly, the fact that you publicly tweeted that you went to a leadership conference can be used to craft a targeted phishing email containing a malicious link. While the Nigerian princes of yesteryear might instantly raise eyebrows, if an email is customised to the recipient, the likelihood of the intended response (in this case, a click-through), increases.”

As marketing budgets continue to shift away from traditional strategies and towards digital, ensuring online platforms have the appropriate security procedures is only the beginning. To overcome unease businesses must coach clients and advisers on how to use these platforms.

For clients, this means taking a proactive approach to education about how to be safe online. This is something Barclays have done particularly well through their Digital Eagles campaign, which not only helps users to grow in confidence when using the internet, but also provides information about how to avoid getting scammed and spotting fraudsters.

Joseph Ebin is a manager, Basel Raslan a senior analyst, and Casey Nicholas an analyst at wealth management think-tank Scorpio Partnership