Widening the net to make commodities pay

Duncan Goodwin, Martin Currie

Commodity-related funds may have been suffering of late but Martin Currie’s Duncan Goodwin has found success running the Global Resources fund by diversifying across a wide range of sectors and focusing on company strategy and management rather than the index

Despite currently volatile commodity prices, Martin Currie’s Global Resources fund is starting to pick up steam, and its manager Duncan Goodwin is out visiting distributors and banging the drum for the product.

The performance of commodity-related funds has been dire during the last three to five years, returning well below resurgent equity markets and assets are now flowing out from resources-related products as a result.

Martin Currie’s $134m (€104m) fund has however been ahead of the BGF World Mining index over the long-term. It has returned more than 10 per cent over the last six months, ahead of not just the index, but key competitor funds managed by Carmignac and First State.

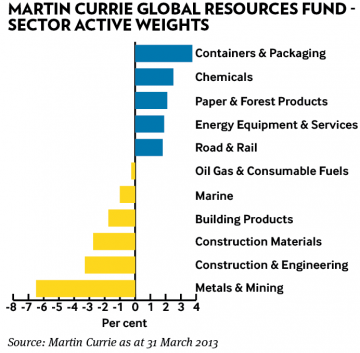

But for Mr Goodwin, recent numbers are just a taste of things to come. One reason for his optimism is that this is a fund much broader than the traditional definition of commodities, investing in 25 per cent of stocks making up the MSCI World Index. These include not just the expected mining and energy shares, but also chemicals, construction, paper & pulp, engineering and shipping companies.

“We are able to invest in those companies which build refineries to purify the natural resources and then those transportation groups which ship the materials around the world,” says Mr Goodwin, whose team typically selects a 30-50 stock portfolio from an 800 company universe.

He believes it is vital for investors to diversify across different sectors and not be wedded to any favourites. “For example, mining was the leading sub-sector from 2005 to 2007, while chemicals was lagging, but now the positions have switched,” says Mr Goodwin, who is looking both for fundamental changes within companies and structural changes within the industry before backing particular stocks.

This approach means the fund can avoid buying into big companies in emerging markets, which through their sheer size dictate their way into index portfolios, yet can be hugely politically influenced. He cites the example of Indonesian miner Bumi, caught in a tug-of-war between holding company boss Nat Rothschild in London and interests in Jakarta, linked to the Indonesian political elite.

“We don’t invest in Bumi, which is plagued by politics associated with various parties,” says Mr Goodwin. “We don’t need to take a view on these companies, as we are not a pure mining fund.”

Rather he will focus on changes in a company’s board, sales strategy or in vital industrial processes, which define a company’s output and business model.

“We are talking about a change of management or strategy, not a play on resource prices,” he says, with a particular emphasis on structural changes, which can often be missed by the broader market.

While fearing a lack of general interest in the resources sector and the threat of increased correlations, 80 per cent of the fund’s exposures are defined by specific stock risks, rather than systematic index risk, claims Mr Goodwin.

He highlights Dutch polyolefin manufacturer LyondellBasell and storage manufacturer North American Steel, which both use gas, from shale gas extraction, rather than oil for their energy needs. Such companies are now paying for gas at the equivalent oil price of $20 per barrel, while rival industrial manufacturers buy oil at $110.

The main sector, which Mr Goodwin’s team will be backing in the near future, is mining, where his fund has been underweight because cashflow has been spent on highly draining, ever-increasing new project costs. He reckons $5bn to $8bn has been spent on projects that are yet to be started – which means a massive hit on company profitability to date.

But the four largest miners in the market – BHP, Xstrata, Anglo American and Rio Tinto – have all seen new CEOs appointed during the last 12 months. “The old managements had the mandate to grow at any cost and satisfy demand from emerging economies,” says Mr Goodwin. “The new managements are increasing rationalisation, focusing on capital efficiency and repaying returns to shareholders.”

This is a trend Martin Currie has already followed in the North American paper & pulp industry, and now expects to take seed within the mining sector. “Paper in North America was over-supplied, with manufacturers going for growth,” recalls Mr Goodwin. “Then we saw a wave of new management coming in with new strengths, which led to a re-rating. We could see similar interesting changes within the mining sector.”