Alex Borer

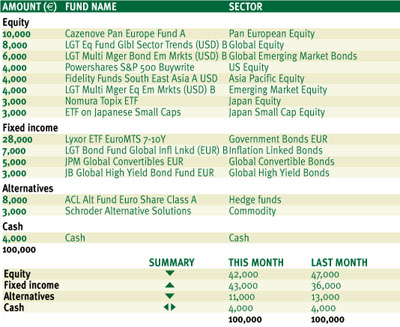

“Financial markets have posted a very strong rally since March. Surprising corporate profits, better macroeconomic indicators and zero interest rates at the short end of the yield curve brought investors back to the risky asset markets. Although our analysis shows that many investors have not fully participated in the recent move, some caution is warranted. We take the opportunity to reduce our exposure to equities, commodities and high yield bonds and invest the proceeds in long-term government bonds. This asset class serves as a hedge in case of a correction and is attractive because of the steepness of the yield curve.”