Fund Selection - July 2022

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Benjamin Hamidi

Senior portfolio manager, ABN AMRO Investment Solutions. Based in: Paris, France

“Soaring commodity prices, coupled with supply constraints, continue to alter the economic outlook. The tightening policy of central banks has been accompanied by an adjustment of equity multiples through a valuation effect and a risk of economic recession pricing. Earnings expectations have remained fairly robust so far, but the main risk to the markets is now an earnings recession. For now, we are still considering a soft landing scenario for economic activity and earnings. We are sticking to the current allocation and are closely monitoring the risk of earning recession and the uncertainty regarding gas delivery.”

Luca Dal Mas

Senior fund analyst, Aviva Investors. Based in: London, UK

“While still in expansionary territory, US and eurozone economic surveys dropped sharply across both manufacturing and services. Weakness in new orders and deteriorating business confidence in services suggests we could see further weakness in economic data going forward. On the inflation front, we are seeing the first signs of a slowdown in core measures. Investors are now beginning to expect a moderation in the rate hiking path that central banks have announced. Developed equity and bond markets were very weak during the first half of the month, but they partially recovered during the latter part after inflationary signals moderated.”

Jorge Velasco

Director of Investment Strategy, CaixaBank Private Banking. Based in: Madrid, Spain

“The deteriorating growth and inflation scenario forces us to be strategically prudent. In addition to directional prudence, we have added another layer of prudence in relative value bets. In the run-up to the summer and in anticipation of the upcoming release of 2nd quarter results we maintain our strategic cautious positioning, underweighting risk assets and seeking defensive positions in fixed income. We make no changes to the portfolio composition. We remain very cautious in fixed income, credit remains unattractive. In equities, we are maintaining the last positions, although we have less and less conviction in each sector.”

Kelly Prior

Investment Manager in the Multi-manager team, Colombia Threadneedle Investments. Based in: London, UK

“In June, markets continued to endure drawdowns as inflation rose beyond expectations and economic growth faltered. Central bankers remained stoic in their mission to counter inflationary pressures, despite the growing unease of the impact on economic growth of these policies. Corporate earnings expectations have yet to truly reprice despite all this, but the scope for the strong to win out while the weak falter may be closer to reality with no central bankers coming to the rescue as yet. We have slightly leant into the moves in fixed income and a little out of cash. Volatility is here to stay, but this is when investing gets interesting.”

Silvia Tenconi

Multimanager Investments & Unit Linked, Eurizon Capital SGR. Based in: Milan, Italy

“In June, the performance of the portfolio was deeply negative. The only positive contributor was Invesco Asian Equity. Equity and credit markets reached new lows, interest rates spiked around mid-month, creeping back later because recession fears are starting to take hold of the market. There was no place to hide in developed markets but cash. One good piece of news was the reopening of China: the Chinese stockmarket rallied, after months of pain. We initiate a position on the Chinese market, buying Lyxor MSCI China UCITS ETF and selling MFS Global Equity.”

Richard Troue

Fund Manager, Hargreaves Lansdown Fund Managers. Based in: Bristol, UK

“This month I made a modest equity to bond switch, by reducing our investment in Liontrust UK Equity and adding to Artemis Corporate Bond. Yields on sterling corporate bonds are above 4 per cent and this move continues what was started a couple of months ago. For me, making gradual changes to a portfolio as value emerges and the opportunity set changes is a more prudent strategy than trying to make big and aggressive calls. As we move through the second half of the year it will be interesting to see if economic slowdown signals a peak in inflation and rate rises, in which case we might see a peak in bond yields too.”

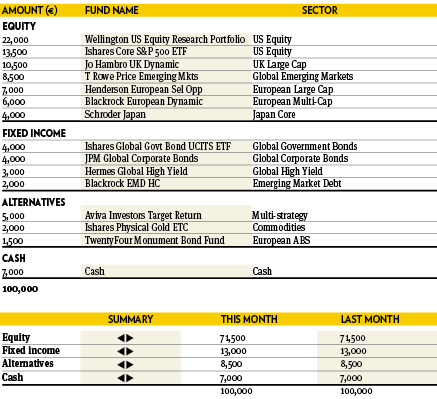

Paul Hookway,

Senior Fund Analyst, Kleinwort Hambros. Based in: London, UK

“The market’s view on inflation changed in early June after the US inflation data was released, highlighting it is now more entrenched than at first thought. This impacted rate expectations which rose to around 4 per cent in the US and sent equity markets tumbling, though they have now declined to around 3.5 per cent. We formed the view that the sell-off in fixed income markets was overdone and they were now offering value; but

we remained wary on increasing credit risk as companies continued to struggle with challenging market conditions. We decided to increase our long duration government bond position, funding from cash and a reduction of the Invesco Stirling Bond fund position, to exploit this opportunity.”

Antti Saari

Chief Investment Strategist, Nordea investments. Based in: Copenhagen, Denmark

“The stockmarket had a rocky month thanks to hotter-than-expected inflation, and the Fed is stepping up the fight to bring inflation back down. Chair Powell is still painting a largely optimistic picture on the economy but has also acknowledged the risk of an upcoming recession. The earnings outlook has been remarkably stable, but growth is slowing and uncertainty increasing. Bond yields have risen to attractive levels, particularly if woes around the global economy continue to grow. Given the uncertain environment we upgrade bonds and downgrade equities to neutral.”

Marco Pabst

Chief Investment Officer London at Union Bancaire Privée (UBP). Based in: London, UK

“June was another difficult month for markets as investors increasingly worried about the risk of a recession in addition to the prevailing high inflationary pressures. This recession risk was reflected in declining commodity prices and in bond yields that appeared to be topping out, at least for the short term. The upcoming second-quarter earnings season will be critical in assessing consumers’ purchasing power and the impact of inflation on disposable incomes and corporate margins. We made no changes to the portfolio, maintaining our defensive stance. Our relative performance was strong, exceeding benchmarks by more than 3 per cent in June.”