Fund Selection - June 2014

Each month in PWM, 9 top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

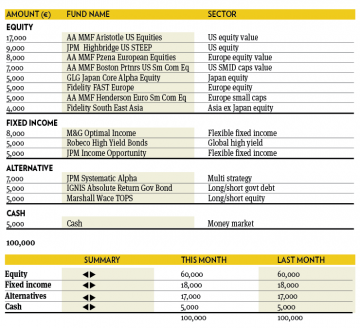

Julien Mechler

Chief investment officer, AA Advisors Based in: Paris, France

“Markets keep offering good potential for investment returns, but require strategic awareness. The volatility created by the mini emerging markets crisis and the tensions in Crimea are reminders of the unknown nature of risks that can affect markets, even when economic fundamentals are improving. We still expect equities to outperform bonds as the world economy accelerates. We consider strong stockpickers with a focus on the quality of the businesses are better placed to exploit equity markets. In fixed income we recommend flexible strategies and high-yield bonds with decent yield differentials that can absorb the shock of higher rates.”

Peter Fitzgerald

Head of Multi-Assets, Aviva Investors Based in: London, UK

“With every increase in prices, the risk to equities increases. Over a reasonable time frame, however, we retain our view that equity investors will be rewarded. It is nevertheless more and more important to ensure you have some offsetting positions to protect in the case of a sell off. Traditionally this role has been fulfilled by fixed income. However with yields at their current levels, this becomes more difficult. Within equities we continue to believe Japan offers the potential for high returns.”

Christian Jost

Executive director and chief investment officer, C-Quadrat Kapitalanlage AG Based in: Vienna, Austria

“International stockmarkets suffered from high volatility during last month, but most markets were able to compensate for most their losses at the end of April. The crisis in Ukraine between pro-Russian separatists and the Ukrainian military stirred up fears of a possible civil war and was a particular concern. Our portfolio reacted to this market environment by increasing the duration on the fixed income exposure through investments in US Treasuries and European sovereign bonds. The risky asset exposure was enlarged through investments in non-cyclical sectors as utilities and consumer staples.”

Management selection team

Eurizon Capital Based in: Milan, Italy

“While the absolute performance of the portfolio is up 0.17 per cent since the beginning of the year, we underperformed our benchmark by 168 bps during the month. Our long positions in equities, high yield and cash were detrimental, since the best performing assets were European government bonds. We also suffered from our position in European equities, due to the poor performance of pretty much all the active managers we hold, who were hit by style and sector rotation. We retain our positive outlook for equities versus bonds and a preference for credit over government issuers.”

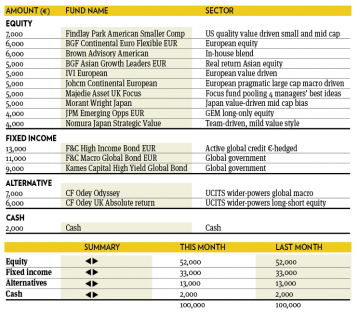

Gary Potter and Rob Burdett

Co-heads of multi-management, F&C Investments Based in: London, UK

“Markets traded in a reasonably tight range in April, with little news to drive sentiment strongly either way. The UK staged a late run to be the outperformer thanks to bid activity in the pharmaceutical area, with the Majedie Asset UK Focus fund compounding these positive moves to become the best performer of the selection. A raft of tech listings at arguably frothy valuations proved the tipping point for a correction in technology stocks, which hit the US market. However Japan remained the laggard of equity markets, though the CF Odey UK Absolute Return fund suffered a rare poor month at the bottom of the table for our selection.”

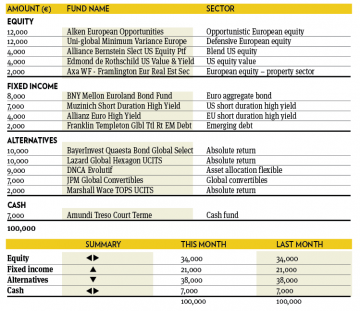

Sebastien Bonnet

Head of Financial Engineering FundQuest, BNP Paribas Group Based in: Paris, France

“Expectations for quantitative easing by the ECB have heated up in recent weeks but the rise of inflation in the eurozone has reduced the chance of any immediate action. Earnings in the US showed a modest positive upturn. There is still room for economic growth improvement both in the US and the eurozone, which should support equity markets. European corporate high yield bonds still bring an attractive carry and should benefit from further easing by the ECB. European property should also benefit from the search for yield.”

James de Bunsen

Multi-asset fund manager, Henderson Global Investors Based in: London

“Within the equity portion we have reduced our already small exposure to mid and small caps by trimming the Findlay Park American and Artemis European Growth funds. We believe attractive valuations are becoming increasingly difficult to find within equities and that smaller companies look particularly vulnerable to any reversal in risk sentiment. We have let cash build up and increased our exposure to UK commercial property, which pays an attractive yield and has capital appreciation potential. We think cash will provide crucial stability in increasingly volatile times, as liquidity is withdrawn from the market and rates begin to rise.”

Bernard Aybran

CIO Multi-management, Invesco Based in: Paris, France

“The main change was in the equity portfolio, where the Nasdaq 100 holding has been redeemed as a part of the index was overheating. As technical damage appeared on this index, the position was closed. The proceeds were partly re-allocated to a broader-oriented US fund manager, and partly kept in cash. The rest of the portfolio was slightly re-positioned towards some more European exposure, a region favoured for both fixed income and equity investments. Going forward, some more geographical diversification can be expected for the equity holdings.”

Peter Branner

Global CIO, SEB Asset Management Based in: Stockholm, Sweden

“During the month we have revisited our due diligence of our absolute return bond fund, managed by Ignis Asset Management. The fund uses a flexible and sophisticated approach to fixed income investments but the starting point is always a strong directional macro view often contrarian to consensus. When combining with other managers they tend to be an attractive contributor as alpha sources are rarely uncorrelated, especially not in turbulent periods. This month, we leave the portfolio unchanged as we think it accurately reflects our conviction.”