Fund selection - July 2017

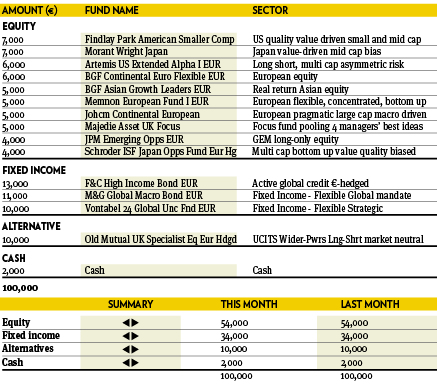

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“Equity and bond markets are being buffeted by central banks, as they begin to chart a slow and gradual course to more normal interest rates. Policymakers appear to view low inflation as temporary and not as setback for less accommodative monetary policies. Both the European Central Bank and the Federal Reserve are turning more hawkish than expected. In the past few weeks, bond yields have risen and equity markets have shown a mixed performance and lack of direction. In this context we leave our portfolio unchanged maintaining our overweight in equities with a regional preference for Europe and emerging markets, as well as our preference in style investing for value versus growth in both Europe and the US.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“June saw European equities give back some of their recent strong performance with other markets treading water. We used this pull-back as an opportunity to invest into EuroStoxx Banks. They remain attractively valued at a price-to-book of 0.84, offer a 4 per cent yield and will benefit from the European cyclical recovery which we believe is occurring. With a 30bps expense ratio and minimal tracking error, the Source ETF seemed optimal. We reduced Hermes Global High Yield to fund this purchase. Despite holding manager Fraser Lundie in high regard, we are becoming increasingly cautious surrounding global yield valuations and hence saw this as an opportune time to lighten up on our position.”

Gary Potter and Rob Burdett

Co-heads of multi-management, BMO Global Asset Management. Based in: London, UK

“Despite generally strong economic figures being announced, mixed messages from central banks on the longevity of their ultra-loose monetary policy caused nervousness in markets, and volatility in currencies on the month. Most equity markets gave up ground with the UK leading the charge down as a disappointing election result for the current incumbent Conservative party weakened their majority and therefore power heading into the two-year Brexit negotiation period. The Majedie UK Focus fund was the worst performer of the selection compounding the woes of its base market, with the euro-hedged Schroder ISF Japan Opportunities fund leading the pack with a strong run. As we enter the second half of the year all eyes will be focused on central banks. We remain vigilant as ever for the ever scarce volatility and ensuing opportunity.”

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“The portfolio ended June with a negative performance. Our exposure to European equity markets, which lost 2.6 per cent in June, detracted the most. Our US dollar exposure detracted as well, but to a lesser extent. Worthy of note was rebound of JPMorgan Highbridge US STEEP, which was the month’s best contributor. The hawkish posture of central banks in June led to some volatility in the markets, hence we are pondering on including some flexible funds which could profit from an upward movement in rates. We made no changes to the portfolio.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“Equity markets suffered a sharp drop in June, retreating from historically high levels. We still believe the allocation is favourably positioned to face the change comfortably, offering a balanced investment profile. In that context, the portfolio remains unchanged.”

Peter Haynes

Investment Director, Kleinwort Hambros. Based in: London, UK

“After falling steadily for most of the year bond yields moved sharply higher in late June in the US, UK and eurozone. Central bank statements suggested that it is not just the US that will move rates higher and begin the long slow process of removing QE. UK and European equity markets gave up some of the gains made in the previous month in response to the spike in government bond yields, but remain in positive territory year to date. It is unclear how bond markets will react to the withdrawal of monetary stimulus going forward so within the portfolio, we have reduced the fixed interest allocation in favour of cash.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“Meaningful movements occurred on many markets during June, whether stocks, bonds or currencies. On the fixed income side, the high yield portfolio has been tweaked some more in favour of US markets at the expense of the eurozone. On the equity side, emerging equity has been increased at the expense of the real estate sector. The latter has been a great performer as of late and the duration that is imbedded into Reits stocks could hurt future returns. The underlying funds behaved as expected, with the benefits of different styles combined in the portfolio.”

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers, Based in: Bristol, UK

“At the end of every party there are a few stragglers that should know better than to continue into the early morning. Bond and equity markets have had quite some party and the signs are that there is not much reason to stay. Low yields, high valuations and weak earnings growth for a decade has sent many off to bed expecting to wake up to opportunity galore. Having said all this I caution anyone that underestimates companies’ ability to reignite profit growth. There could still be one big tune that gets people back on the dance floor yet.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“Lazard Global Listed Infrastructure fund is managed by a five men strong team based in three different locations, New York, Sydney and London. The team is characterised by high integrity, being designers and founders of this strategy that sits in-between equity and fixed income assets. A preferred list of stocks conducted from company specific characteristics such as regulated or contractual price mechanism, monopolistic market structure, low demand volatility and inflation protection, serves as a safe subset to pick stocks from, solely dependent on valuation. The fund will act as a good diversifier among the equity funds in our portfolio and will is financed pro-rata from them.”