Fund selection - March 2018

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“In our eyes, the equity market correction is a healthy correction after an extended period of market optimism and we see no reason to assume that it has had an impact on the economic outlook. We still view the macro environment as constructive and that positive fundamentals stay in place. For example, indicators such as business confidence and consumer confidence remain constructive, both in Asia and the US. In the short term, we expect equity markets to be trading in a range, steered by uncertainty around rate hike expectations following the congressional testimony of Fed chairman Jay Powell. In the medium term, equity market behaviour is expected to be more intertwined with the economic cycle. For now, we remain moderately overweight in equities and underweight in bonds.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“February was a challenging month given our pro-risk position and the pullback we saw in equity markets. As hard as it can be to lose money, times like this are helpful: they test our conviction levels. In this case, given the improving strength of company fundamentals, we remain confident being overweight equities and will look to use any further sell-offs to add risk. We did make one change to the portfolio – switching out of Hermes US SMID cap fund for an iShares Core S&P 500 ETF. This reduced our small cap skew within equities while maintaining our allocation to the US.”

Gary Potter and Rob Burdett

Co-heads of multi-manager, BMO Global Asset Management. Based in: London, UK

“February witnessed the first 10 per cent correction in some equity markets for over two years, as bond yields and inflation data seemed to trigger some of the automated trading systems that exist today. However, the short, sharp volatility-driven move reversed to varying degrees, and in fact three of our holdings added value in February including the Old Mutual UK Specialist Equity absolute return fund. The worst performance came from Japan, where the hedged share class of Schroder ISF Japan Opportunities fund recorded a 4.84 per cent drop. As mentioned last month, we were looking for an opportunity to present itself and certainly, the macro back-drop remains encouraging but the impending Italian election could unexpectedly cause mischief. We would perhaps expect to make some portfolio changes before the next report should volatility remain. The value of investments and any income derived from them can go down as well as up as a result of market or currency movements and investors may not get back the original amount invested.”

Silvia Tenconi

Multimanager Investments & Unit Linked, Eurizon Capital SGR. Based in: Milan, Italy

“February was a negative month for the portfolio. The only positive contributors were Vanguard US Opportunities and Eastspring Japan Dynamic Fund. The rise in US interest rates, which in January didn’t bother the market so much, became worrisome as the yield on the T-Bond came close to 3 per cent, leading to a spectacular surge in volatility. By the end of the month, markets bounced back somewhat, but the underlying mood is much sober than before. We didn’t make any changes to the portfolio, as we are still confident the environment is favourable to risky assets.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“We remain positive on equities after February’s technical correction. Economic indicators are still solid and very strong corporate results were observed, particularly in the US, where the earnings season is coming to a close. We keep the global portfolio asset allocation unchanged but we modified the selection slightly. We switch to Henderson Horizon Pan European Smaller Companies in European small cap equities. In European fixed income, much more attractive risk/return profile drives the decision to move high yield investments to investment grade credit area. Finally, within the alternatives investments, we introduce an equity market neutral strategy.”

Paul Hookway

Senior Fund Analyst, Kleinwort Hambros. Based in: London, UK

“Global equity markets ended February slightly lower, at least as viewed through the lens of a sterling-referenced investor, and despite having suffered a swift correction from the highs of mid-January. During the month, we held our asset allocation unchanged, considering the corrections in markets to have been overdone. The macro-economic environment remains healthy; ironically, it was the report of unexpectedly high wage growth in the US that sparked the market declines. While equity valuations remain elevated or indeed expensive by many historical measures, their yields relative to bonds remain attractive. The recent drift higher in bond yields has undoubtedly reasserted volatility in markets but has not in itself spelled total doom for equity investments in 2018. Technical factors have come under greater attention, including weaker market momentum. We note that UK and European markets have broken their positive trends, while the US and global market as a whole remain positive. Similarly, investor sentiment had shown some signs of excessiveness in January giving us reason to be cautious in the very short term and ultimately contributing to the severity of the correction into February, but that positive sentiment softened just as quickly, thus leaving us less concerned for now.”

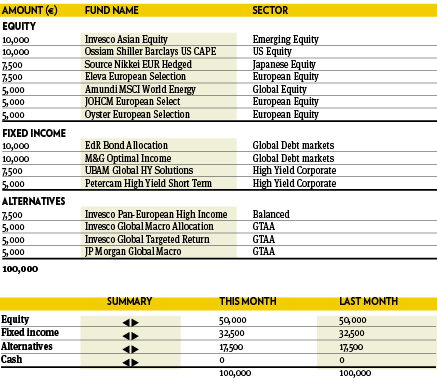

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“The month of February brought the first burst of meaningful volatility in quite a while. A couple of changes have been implemented in the balanced portfolio on the back of this new environment. First, while the overall exposure to stockmarkets has not been changed, US equity has been increased a bit at the expense of their Japanese counterparts which have enjoyed an impressive run. In addition, a long-held euro high yield investment has been redeemed as it looks like spreads might have reach their bottom and the proceeds have been reinvested in a multi-asset, go anywhere, new holding.”

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers, Based in: Bristol, UK

“When I built my first PWM portfolio in July 2016, I said, ‘I have built a well-diversified portfolio which should not need to be altered based on short term macro factors. Only due to manager changes or during times of significant over or undervaluation do I expect to alter the portfolio positioning.’ Almost two years later we have had our first manager exit. We tend to follow managers but with no information on exactly why Philip Rodrigs has left or where he might turn up I have shifted this holding into Lindsell Train Global Equity. In addition I have trimmed Findlay Park American as I do not want to increase exposure to this most expensive of markets.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“Morgan Stanley Global Mortgage Securities Fund offers a global and well diversified exposure to the securitized asset space. The fund, with exposure to both agency and non-agency backed loans, has just about the same rating as the investment grade space but offers higher yield and shorter duration. During the volatile markets so far this year these characteristics have given a clearly better return than ordinary investment grade. The fund has also outperformed its benchmark, a result of its active management with a dynamic sector allocation. We added the fund to the portfolio in August 2017 and will keep it at the current size.”