Fund selection - May 2013

Each month in PWM, 9 top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Graham Duce,

co-head of UK multi- manager funds, Aberdeen Asset Managers

Based in London

“Despite the broadly favourable environment for risk assets, emerging market equities have struggled relative to their developed market peers so far this year. We see this as a longer-term opportunity and have increased our allocation to the region via the JOHCM Emerging Market fund. The fund, managed by James Syme and Paul Wimborne, is a focused portfolio and combines both bottom up stock research and top down market indicators to aid in overall positioning. The fund is suitably positioned to capture any recovery in the region.”

Peter Fitzgerald,

senior portfolio manager, multi-asset multi-manager, Aviva investors

Based in: London, UK

“We made one manager change to the portfolio. We sold our holdings in the Schroder UK Alpha Plus fund following the departure of the lead manager to a competitor. We switched into the Investec fund run by Alistair Mundy, a manager we have used for some time for exposure to UK value stocks. Our policy is generally not to follow managers immediately if they start at a new organisation. We prefer to monitor the transition and make a more informed decision at a later date. We adjusted our asset allocation by reducing Europe in favour of Asia. The risk of Europe following the path of Japan is increasing.”

Christian Jost,

executive director and chief investment officer, C-Quadrat Kapitalanlage AG

Based in: Vienna, Austria

“C-Quadrat Flexible Assets AMI tries to benefit from the diversification of a sizeable multi-asset investment universe. Every component of the investment universe will be subject to individual risk tracing. The fund’s allocation has been geared to a predefined investment risk (with a risk corridor from 2- 6.5 per cent volatility), with a current risk profile of almost 4 per cent volatility and a year to date performance of 0.9 per cent. The risky assets exposure is mainly allocated in European equities. Within the bond sector, the fund’s largest exposure can be found in the European sovereigns eurozone and high yield sector.”

Eurizon management selection team, Eurizon Capital

Based in: Milan, Italy

“In March we did not make any change to our portfolio. It remains overweight equities, overweight European investment grade credit and underweight Euro government bonds. The portfolio outperformed its benchmark in March. The overweight to equities versus government bonds made a positive contribution, while off-benchmark exposure to European investment grade credit and emerging markets equities was detrimental. Our European and US equity funds gave positive results, while global equities hurt performance. The top contributors were Vanguard US Opportunities, Rothschild US Value & Yield and M&G Global Dividend.”

Gary Potter and Rob Burdett,

co-heads of multi-management, F&C Investments

Based in: London, UK

“Momentum stayed with equities, resulting in positive gains in all markets bar Asia which was flat in the month. Japan led the charge with the new Bank of Japan governor stating they will do whatever it can to tackle deflation, while the negotiations over Cyprus and the bank bailout caused Europe to lag the general positive trend. The euro also weakened, compounding these moves. The Morant Wright Japan fund was the best performer of the selection, while the Neptune European Opportunities fund lost ground. We remain positive on market direction, but aware of the influence that events such as those in Cyprus can have in the short term.”

Thierry Creno,

Local Head France, Global Balanced Solutions FundQuest, BNP Paribas Group

Based in: Paris, France

“The equity markets struggled somewhat in March on the back of the Italian political situation and the Cyprus crisis. The MSCI AC World gained +1.8 per cent while the MSCI Emerging fell -1.7 per cent (both in dollars). Despite a significant rise during the first quarter, high quality stocks such as consumer staples and healthcare have led the markets, showing investors remain nervous. Our conservative allocation did pretty well last month, led by our bond funds (45 per cent of the total) that all returned more than 1 per cent. Our selected equity, as well as absolute return managers, have shown some resilience. ”

Lionel De Broux,

manager selection specialist, IPCM, ING Private Management.

Based in: Luxembourg

“Returns provided by underlying investment continue to be strong. We are particularly benefiting from our overweight in hedge funds and allocation products vis-à-vis fixed income. In addition, our recent change in the US allocation has also been supportive as small cap outperformed the S&P 500. The main drag came from our dedicated equity global emerging market fund, but so far we remain confident in the position. We have not implemented any changes in the allocation over the month.”

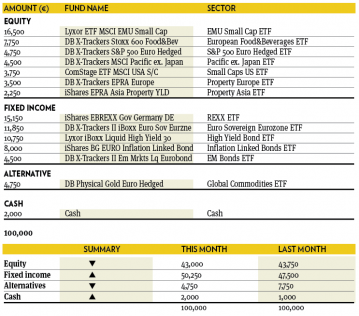

Bernard Aybran,

head of manager selection, Invesco

Based in: Paris, France

“The equity allocation has been somewhat trimmed by redeeming one investment over March, to take some risk off the table on the eurozone and reinvest most of it on corporate fixed income. While the number of holdings remains unchanged, at 14, one extra high yield short-term investment was added. With all major central banks embarked on highly supportive policies, the search for yield keeps on and our balanced portfolio aims to profit from it. Thus, the portfolio remains roughly balanced between one half allocated to pure asset classes and the other half to flexible, broad spectrum fund managers.”

Peter Branner,

global CIO, SEB Asset management

Based in: Stockholm, Sweden

“Volatility in the fixed income space has been low and despite a strong credit trend the opportunities in the asset class are less pronounced. In order to find the few opportunities left in the fixed income market, the skill set required from your fixed income manager is growing. Pimco is a house with the right team in place that covers the whole spectrum of opportunities while acting in a market where size is an advantage. Their unconstraint mandate also allow them to express views in a portfolio without benchmark considerations. We therefore add slightly to our Pimco position and trim our equity allocation.”