Fund selection - May 2017

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

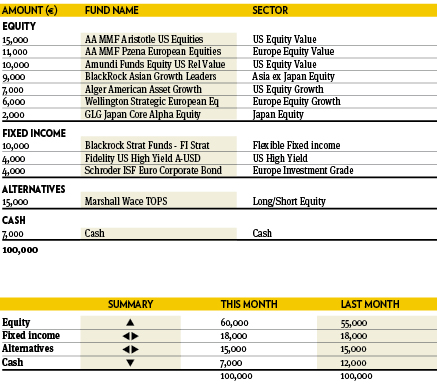

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“The global economy continues experiencing one of longest periods of uninterrupted growth since the end of World War II and the expansion phase of the business cycle is still far from over. In this positive environment, with robust macroeconomic fundamentals, low interest rates and expectations for double-digit earnings growth, we increase exposure to equities in the areas where earnings are accelerating and valuations are attractive, namely Europe and emerging Asia. In Europe we add to deep value-oriented AAMMF Pzena European Equities as value investing will benefit the most from the expected continuation of recovery and growth. In Asia we add to BlackRock Asian Growth Leaders as the flexibility of this strategy will allow to profit from the opportunities offered by this region.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“As the outcome of the French presidential election became less certain, markets reacted by taking a cautionary stance: equities pulled back and government bond yields tightened. Such a response reflects investor nervousness surrounding geopolitical events after pollsters’ failure to accurately predict 2016’s events. Looking through this political uncertainty and instead focusing on the improving fundamental picture, we added to our European equity managers from cash and were subsequently rewarded for this contrarian stance. With European companies reporting their best earnings quarter in a decade we remain comfortable with this overweight equity position.”

Gary Potter and Rob Burdett

Co-heads of multi-management, BMO Global Asset Management. Based in: London, UK

“April saw politics dominate moves in markets yet again, as the result of the first round of the French presidential election produced a strong relief rally from most equity markets. The euro also benefitted from positive sentiment. The announcement of a general election in the UK briefly distracted from geopolitical concerns over North Korea and Syria. Markets were generally positive over the month with European equities leading the way. The BGF Continental European Flexible fund lead the selection, strongly outperforming its base market. Conversely the M&G Macro bond fund lost some ground with currency positioning the driver. We remain cautious in our outlook and vigilant for the trigger for more volatility from asset prices.”

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“The portfolio ended April with a positive performance. Main contributors were Jupiter European Growth, Fidelity European Dynamic Growth and Fidelity FAST Emerging Markets. Main detractors were JPM Highbridge US STEEP, Robeco US Select Opportunities and M&G Global Dividend. For all the detractors, it was the exposure to the US dollar that led to a negative performance, while returns in local currency were positive. Abating political risk in Europe should lead to positive returns for risky assets in the short/medium term, hence we made no changes to the portfolio and prefer equities, flexible strategies and credit to government bonds.”

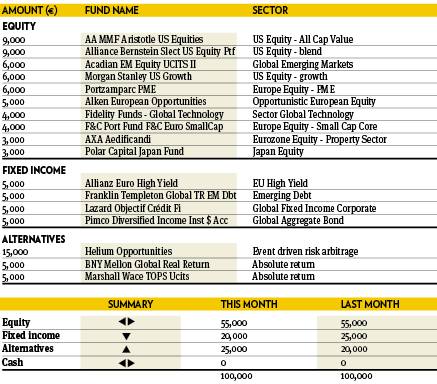

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“After registering the positive performance of our portfolio since the beginning of the year, we have decided to downsize the risk slightly by replacing H2O Multibonds with an alternative investment (BNY Mellon Global Real Return). At the same time, we have diversified the US equity bucket with an introduction of a significant growth bias through Morgan Stanley US Growth.”

Peter Haynes

Investment Director, Kleinwort Hambros. Based in: London, UK

“Politics in Europe and the UK took centre stage during the month with the French presidential election and the ongoing speculation of the terms of Brexit influencing investor sentiment. As it turned out, centrist candidate Emmanuel Macron made it through to the second round and European equity markets took this as good news and rallied strongly for the second month relative to other developed markets. Within the portfolio we have increased the Blackrock European Flexible fund and trimmed Robeco US Premium. Mr Macron’s ultimate victory reduces geopolitical risk, while European economic data remains supportive and valuations do not reflect these positive factors.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“In April, equity exposure has been kept unchanged despite wild swings in relative style and sector relative performances. The changes have been made in the alternative bucket, where one non-directional, low volatility, fund has been increased at the expense of fixed income investments. There, one inflation-protected holding has been fully redeemed to fund a new high yield investment benefitting from the CDS market. The overall duration has been reduced a tad as most interest rates reached their lows and the European high yield investment have been trimmed as spreads are approaching all-time lows.”

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers, Based in: Bristol, UK

“While sentiment has been poor in recent years we have had a mantra of buying the dips in equities and selling the peaks in fixed income. Up until recently, the fixed interest peaks turned out to be false as yields were driven lower. We are sticking to our mantra even having seen a marked increase in investor optimism. It is too early in our opinion to make a contrarian move and sell equities but such optimism can quickly lead to a shorter term set back. Who knows this bull market might end in euphoria. No change to portfolio weights or asset allocation.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“JP Morgan Emerging Markets Small Cap Equity fund is a fundamentally-driven relying on comprehensive research and local knowledge. The fund invests in quality businesses that have sustainably earnings and that the portfolio manager believes will be the large caps of tomorrow. The lead-PM Amit Mehta is heavily involved in the process of idea generation, however the armada of analysts conducting fundamental research on companies to evaluate quality of the business is the main advantage of the fund. The characteristics of smaller sized companies in emerging markets also serve as an indirect hedge versus eventual rate hikes in the US besides being interesting helped by a strong and established global macro trend. We introduce the fund in the equity bucket financed by other equity holdings.”