Fund selection - May 2018

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“Macroeconomics and business fundamentals remain strong and supportive of risky assets. In general financial conditions have been easing, in line with declining fears over trade wars and inflation. The flattening of the US yield curve has also abated. While European confidence indicators have moderated – except in Germany – the softening continues to be viewed as temporary and we maintain our main scenario unchanged with expectation of above-trend growth for eurozone in 2018. In this context our asset allocation continues to favor equities with a preference for value-oriented strategies. Within fixed income, given the low yield environment, we continue to keep our exposure to absolute return oriented or yield chasing strategies.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“Having added risk in March it was rewarding to witness markets rebound in April. This bounce back was even more remarkable in that it occurred despite the 10 year US treasury yield breaching the mythical 3 per cent level. For me this represents a clear turn in market dynamics. With quantitative easing coming to an end and interest rates set to rise globally, duration is unlikely to provide the safety it has in the past. In fact it is more likely to be a source of risk. That said with little interest rate exposure today, I believe the portfolio is suitably protected from this.”

Gary Potter and Rob Burdett

Co-heads of multi-manager, BMO Global Asset Management. Based in: London, UK

“After a turbulent start to the year markets took on a more positive tone in the month thanks to positive corporate earnings and economic fundamentals. The UK was the best performer, having been at the back of the pack for the first two months of the year, with the Majedie UK focus fund outperforming its base market as the best performer of the selection. On the flipside emerging markets lost a little ground on the month, though the worst performer of the selection was the Hermes Multi Strategy Credit fund which was essentially flat. We have replaced the JPM Emerging Opportunities fund with the TT Emerging Markets Unconstrained fund. From here we continue to see volatility as a theme, and look forward to the opportunities this will present.”

Silvia Tenconi

Multimanager Investments & Unit Linked, Eurizon Capital SGR. Based in: Milan, Italy

“April was a positive month for the portfolio. Due to the increase in market volatility since the beginning of the year, we decided to take some profit on two long standing positions: we sold our US high yield fund and we reduced our emerging markets equity funds. We reinvested in Carmignac Portfolio Securité, a flexible bond fund. Although we are still positive on the global economy, we think valuations are fair and rising interest rates could enhance volatility and impair returns. We are slowly decreasing our exposure to risky assets.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“After the recent market rebound at the end of April, we decided to slightly reduce our equity exposure. Mainly, we have cut outperforming European and Japanese equities to reallocate to the US area where we expect a dollar appreciation in the short term. We also invest in the recovery of the global technology sector through the Fidelity fund. In the fixed income bucket, we have taken our profits on H2O Multibonds fund after its strong outperformance. At the same time, we have diversified our portfolio introducing European government and high yield corporate bonds, as well as an alternative global macro fund.”

Paul Hookway

Senior Fund Analyst, Kleinwort Hambros. Based in: London, UK

“We made no further asset allocation changes this month, though the following changes in implementation were made. In Japan the very strong performance from value stocks meant we take profits from GLG Japan Core Alpha and increasing the weight to Tokio Marine Japanese Equity Focus. In fixed income we switched the holding of Jupiter Dynamic into H2O MultiAggregate where we have higher conviction in current markets. Lastly in alternatives we switched the holding of Janus Henderson UK Absolute return into Old Mutual Global Equity Absolute return; the global focus gives the managers a greater universe to generate alpha.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“During April, the overall balance of the portfolio remained mostly unchanged. One switch has been made for a couple of reason. First, as the Nasdaq index suffered a pullback, a holding has been initiated through an ETF, enabling the portfolio to benefit from strong earnings growth at a discounted valuation. Second, this holding has been funded by selling a long-held European equity actively managed fund. This enables the portfolio to lock in a part the recent European outperformance and also draws the consequences of the current positioning of this holding, that had been in portfolio for several years.”

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers, Based in: Bristol, UK

“It would appear that even the most flea ridden dog has its day. The UK equity market became the most unloved major market in the world. When markets get this unloved there is always the potential for a snap back. We have seen a major move from UK and particularly UK large cap stocks this month with the contrarian and patient team at Majedie made the most of it delivering a return in excess of 9 per cent. It feels like change is in the air and this sort of move in the UK underlines the need to never be dogmatic in your investment approach.”

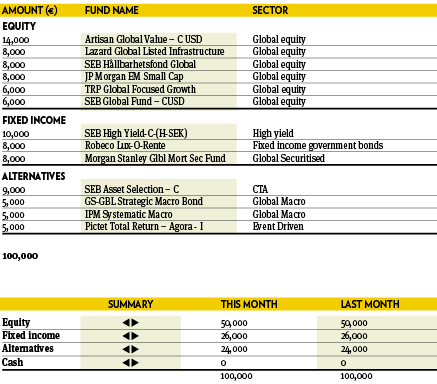

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“The volatile markets during the first four months of this year have proved to be tough on the hedge fund space pushing a broad hedge fund index below zero. The European equity long/short fund Pictet Agora has managed to create steady positive returns in this climate. The manager Elif Actug focuses on potential future events and other triggers which are expected to release significant shareholder value in short periods of time while at the same time maintaining a very low correlation to the equity market. She has proven to have a high ability to identify such opportunities and with her long proven experience we expect that to continue and keep the holding in the portfolio.”