Fund selection - November 2017

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

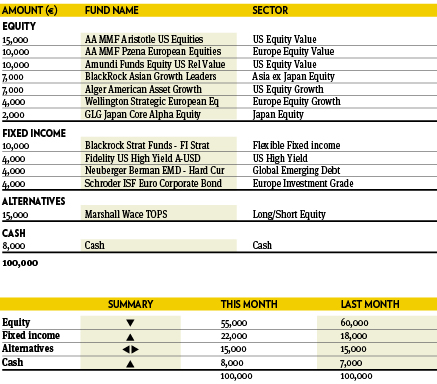

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“Markets have been moving upward almost all year, driven by the economic recovery, low interest rates and double-digit earnings growth. Financial markets have also shown a surprising resilience in 2017, shrugging off a range of political risks, including the new administration in the US, North Korea missile testing and a number of European elections and referendums. In this context we continue to keep a preference for stocks over bonds. Nonetheless we take some profit reducing the overall equity exposure as a sensible precaution for what starts looking a mature equity market. At the same time, while bond markets remain under the threat of rising yields, we introduce a new source of return and diversification by adding emerging markets debt.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“September’s equity rally continued into October rewarding our risk-on portfolio. In particular, we saw very strong performance from our blend of Japanese managers returning over 6 per cent in euro terms for the month. It would seem that market participants are gradually waking up to the fact that Japanese companies are enjoying booming profits, trade on attractive valuations and have a monetary policy back-drop that is highly supportive of risk assets. Combine this with political certainty post Abe’s successful re-election and robust economic growth driven by domestic factors, we remain bullish on this equity market. Happy with the portfolio, we have made no changes.”

Gary Potter and Rob Burdett

Co-heads of multi-manager, BMO Global Asset Management. Based in: London, UK

“Politics dominated headlines in a strong month for markets with corporate and economic results buoying sentiment. Japanese prime minister Shinzo Abe won a landslide election victory, paving the way for a continuation of Abenomics reforms, while clouds formed in Spain following the Catalonian referendum. The expectation of faltering QE stimulus from the ECB, and rising rates in the UK and the US, failed to dampen sentiment. All markets made positive ground with Japan taking the lead, though the BGF Asian Growth Leaders fund was the best performer of the selection. Europe was the poorest performing equity market, with the Hermes Multi Strategy Credit fund trailing all other funds in the selection. We remain cautious going into the final months of the year..”

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“The portfolio ended October with a positive performance. The top contributors were Comgest Emerging Markets Equity and Fidelity FAST Emerging Markets Equity. Pretty much all the equity funds rose, and our US dollar exposure added a bit of performance, thanks to a dovish Mario Draghi and a weaker euro. Strong US GDP data showed that growth is robust and there is some pickup in inflation gauges in Q3. A good earning season confirms the healthy state of the economy. We didn’t make any changes to the portfolio, as we are still confident the environment is favorable to risky assets.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“Global equities achieved their twelfth consecutive monthly growth in October. The factors at play were the favourable global macro-economic environment, positive company earnings results and the recent central banks’ decisions. In that context and given news of progress on the US tax reform we keep our portfolio significantly exposed to equities.”

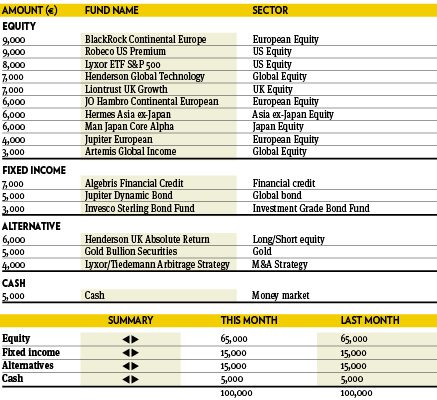

Paul Hookway

Senior Fund Analyst, Kleinwort Hambros. Based in: London, UK

“The Bank of England, as expected, raised rates by 0.25 per cent, though markets appear to have anticipated a more hawkish stance as gilt yields marginally fell in response. In contrast, the Fed made no change with insufficient data to justify a rise. Equity markets have been strong, in particular Asia and Japan, though valuations are getting stretched. Henderson Global Technology benefited from strong earnings growth in the sector. We still see pockets of value in Europe equity markets, where we increased our exposure adding a new holding of Jupiter European, reducing Artemis Global income to finance it.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“Over the month of October, both the equity and the fixed income parts of the balanced portfolio have been moved. On the equity side, the pro-cyclical tilt of the portfolio has been increased by switching the long-held real estate investment into a global portfolio of energy-related stocks. As opposed to the sector as a whole, the actively-managed real estate fund in portfolio did add good value to the portfolio over the first three quarters of the year. On the fixed income side, an investment grade global bond fund has been increased at the expense of a high yield fund.”

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers, Based in: Bristol, UK

“Bullishness is always eventually followed by bearishness as the metaphorical beer goggles melt away and what was considered a beautiful market with unending potential turns out to be little more than just another equity market. It feels to me that the US is currently considered to be an Amazonian beauty while the UK market is no better that a plain Jayne, the girl next door. In 2012, Japan was all but given up on, Europe was left it in the cold in 2013 and the Asia and emerging market growth story seemed all but forgot in 2015. It’s all too easy to get wrapped up in the moment but don’t forget your history.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“Artisan Global Value determines the intrinsic value of a business and invests at a significant discount. The fund solely invests in value companies with high or improving returns on capital in combination with strong financials and therefore has predictable future cash flows. Given this value oriented investment style and the fact that the fund only lags slightly from benchmark year-to-date, in a market that has indubitable favoured quality growth companies, we are fine with the position. We kept this relatively high weight to this position as we predict low alpha correlation to the other equity funds due to a different investment style.”