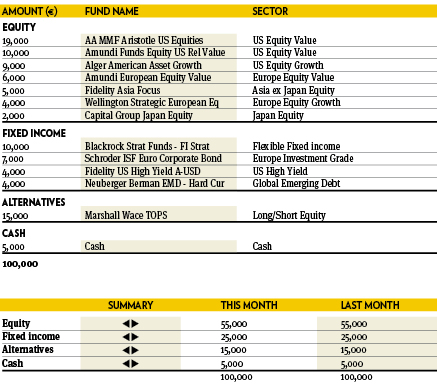

Fund selection - September 2018

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“This summer, political developments have stirred markets. Investors, however, regained their focus on the steady economic fundamentals. We now see our expectations confirmed in the new incoming economic data, as they are more encouraging. The newest Taiwanese and Korean export order data, for example, were very strong in July and the German IFO Business Climate Index jumped in August, compensating five months of decline. In the US, the composite Purchasing Managers’ Index continues to point towards solid growth. With this backdrop, we keep our allocation in favour of equities. In the Asian equity component we replace BlackRock Asian Growth Leaders with Fidelity Asia Focus, a bottom-up quality oriented strategy managed by a talented portfolio manager.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“Having reduced exposure to risk assets at the end of July, the portfolio remains in defensive, wait and see mode. Whereas value opportunities are certainly beginning to present themselves in equity regions outside the US, the macro picture remains too uncertain. Until the trade rhetoric between the US and China has played itself out, we remain comfortable sitting on the sidelines with high levels of cash.”

Gary Potter and Rob Burdett

Co-heads of multi-manager, BMO Global Asset Management. Based in: London, UK

“August saw mixed returns from markets. Sentiment was fragile, particularly around emerging markets which fell into ‘bear market’ territory, down 20 per cent from the market peak back in January. Concerns continued to centre around Argentina, already subject to an IMF bailout, while Turkey faces several issues. The knock-on effect of this, combined with continuing trade war rhetoric, depressed most markets in euro terms, with the exception of the US. The conditions suited Artemis US Extended Alpha, rising 4.62 per cent but were less favourable to any emerging market and even Asian funds. We have been anticipating some increased volatility for some time now and believe the portfolio is sufficiently balanced to weather this period and so have made no changes this month.”

Silvia Tenconi

Multimanager Investments & Unit Linked, Eurizon Capital SGR. Based in: Milan, Italy

“In August, the performance of the portfolio was marginally positive. Top contributors were Vanguard US Opportunities, Wellington US Research and Jupiter European Growth. The biggest detractors were the emerging markets funds, Comgest and Fidelity FAST. The recently added Investec Asia Pacific Equity, invested in China, was also a big detractor. Our exposures to the US dollar and Japanese yen added value, while the position in Carmignac Portfolio Securité detracted. We still think equities are the best allocation this year, and keep our exposure there. We made no changes to the portfolio during the month.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“Since the beginning of this year, disconcerting political events triggered erratic shifts on financial markets. We are still expecting a global positive trend, and our conviction is supported by a robust macro and microeconomic environment induced by accommodative monetary policies. However, clear divergences appear between regions. The US seems to benefit from its economic expansion and also emerges as a winner from the context of trade tensions. Meanwhile, US markets could be resilient in the event of a market turndown, driven by a flight to quality effect. Thus, we have decided to slightly reinforce the portfolio’s equity portion, mainly through US equities.”

Paul Hookway

Senior Fund Analyst, Kleinwort Hambros. Based in: London, UK

“Following on from the major changes in July we didn’t alter the portfolio in August, maintaining our neutral positioning. We focused instead on our US equity exposure implementation. In particular our holding of Janus Henderson Global Technology, which has added significant value since addition.Facebook’s significant fall at the end of July caused us to consider reducing this and use the proceeds to increase our exposure to value US Equity. A bias towards growth has been beneficial, but at some stage value will come to the fore again. We need to do this before it happens as we expect it will be too late after the event.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“Over the month of August, the balanced portfolio has had the proportion of alternatives increased at the expense of the fixed income. This is mainly due to a top down view that, as they drifted down, European equity markets offered better value so that an alternative portfolio allowing equity investment could help seize this renewed opportunity. Still, all alternative strategies suffered over the month of August as most asset classes but US stocks experienced negative performances. The European, equity market remains a fertile ground for stock pickers despite an overall very disappointing year for the broad indices.”

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers, Based in: Bristol, UK

“I spotted a 20p coin on my desk that was minted in 1995, the same year I joined Hargreaves Lansdown. It got me wondering how much buying power this plucky coin had suffered over the years. Based on our inflation calculator it has almost halved in value. You still get 20p’s worth of stuff, it is just you get less stuff than you would have got back in the day. Over the same period the FTSE World Index TR would have grown that same 20p into £1.28p. Here’s to all those perma-bulls.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“The Lazard Global Listed Infrastructure fund seeks defensive, low-volatility returns from a preferred list of stocks. It is a concentrated valuation driven portfolio of selected stocks conducted from company specific characteristics like, regulated or contractual price mechanism, monopolistic market structure, low demand volatility and inflation protection. Not surprisingly, the fund has struggled versus a growth led global equity market so far this year. However it injects various diversification benefits to the portfolio and will most likely serve the portfolio well when market tumbles, therefore we keep the position intact.”