JO Hambro takes it to the limit

Source: Standard & Poor’s, www.funds-sp.com

Small fund gets noticed by big players thanks to a limited number

of stocks. Roxane McMeeken reports.

A small London funds house is beginning to attract the attention of Europe’s large investment players. JO Hambro Capital Management is becoming a regular in the group of favourite fund managers picked by PWM’s expert panel each month.

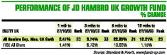

Credit Suisse has consistently selected the JO Hambro UK Growth Fund for the past three months, no doubt based on the fund’s impressive performance figures. According to ratings agency Standard and Poor’s, the fund returned 12.21 per cent over the past 12 months.

This compares to the considerably more meagre 1.15 returned by its benchmark, the FTSE All Share Index, during the same period.

Strict secret

The fund’s manager, Mark Costar, reveals that the secret of his technique is to keep the fund strictly limited to between 50 and 60 stocks. “We have a very rigorous stock selection process. So when we find a stock we want it to be a big enough holding in the portfolio to make a real difference,” he explains.

At the same time, Mr Costar seeks to have enough stocks in the fund to ensure that all his eggs are not in the same basket.

Risk is further controlled by investing in companies with market capitalisations ranging from large through to small. The emphasis is currently on the heavier end. “At the moment 75 per cent of the portfolio is in large caps because historically we have found this to be a fertile hunting ground,” says Mr Costar.

This marks a shift from the more evenly balanced allocation, which characterised the fund from its inception a year ago. Recent moves include the sale of shares in the mid-cap firm Taylor Nelson and the increasing of holdings in blue chips GlaxoSmithKline, British Aerospace and Amvescap.

Companies are chosen for the fund using a bottom-up approach, rather than a top-down, macro-economics-driven strategy. “We use what I call a ‘clean piece of paper’ approach,” says Mr Costar. “We look forwards. I don’t care where the share price has come from or how it got there. I only care about where it’s going.”

He adds that he is “ruthless at cutting losers – we are very unemotional about dropping stocks.”

Mr Costar looks for companies with classic “growth” characteristics. They should be well run and capable of generating growth at all times in the economic cycle.

When assessing a potential investment, merely understanding the company’s business model is not enough, argues Mr Costar. He places special emphasis on cash, which he says is a “strong verifier of earnings”.

“You can manufacture or distort earnings through accounting procedures, but you can’t distort cash.”

But while it’s important to buy into a strong business, he says that the share price is critical. “You don’t make your money by buying a good company, but rather by buying it at a good price.”

Mr Costar is loath to use external research, despite the fact that he works with only one other fund manager, Alex Savvides. This is unusual in bottom-up managers because their investment style demands that they investigate the stocks they buy in great detail. It is even less common in a small fund management firm, which has necessarily has fewer resources.

Nothing to hide

Nonetheless, Mr Costar insists, “we don’t plug into the oxygen supply of the big brokers.” Instead, JO Hambro sees a lot of private companies. Because these firms are not for sale on the stock market they have nothing to hide from the investment community and therefore prove excellent sources of market information, according to Mr Costar.

Once he has the background, the next step is to visit potential portfolio companies intensively. “We see between seven and 10 firms a week,” he says. “We tend to see them outside of their results cycle. Within the cycle everyone else is seeing them. If we go at the same time we won’t get any information that anyone else doesn’t have, so we’ll have no competitive advantage.”

Fund facts

- Launch: 6 November 2001

- Size (at 30 August 2003): Ł123.5m

- Denomination: sterling

- Minimum: Ł1000 – retail; Ł100,000 – institutional

- Domicile: Dublin

- Fund rating: Forsyth AA rating

- Initial charge: up to 5 per cent

- Management fee: 1.25 per cent pa

- Performance fee: 15 per cent on excess if fund outperforms benchmark by 1 per cent