Sub-advisory evolves to meet distributors’ rising demands

Ryan Blute, Pimco

Respondents to PWM’s 14th annual sub-advisory research survey point to increased regulation and the promise of tailored solutions to meet clients’ needs as driving growth in the sector

Last year marked the countdown to MiFID II, the most ambitious regulatory shake-up of Europe’s financial sector in a decade. The level of readiness of the different financial institutions and the medium to long-term impact of the new rules on the industry, were among the most talked-about topics across the region’s financial hubs.

The transformational effect of MiFID II was felt long before the January 3, 2018, implementation deadline. As one private bank put it last autumn, change was coming “whether we are ready or not”.

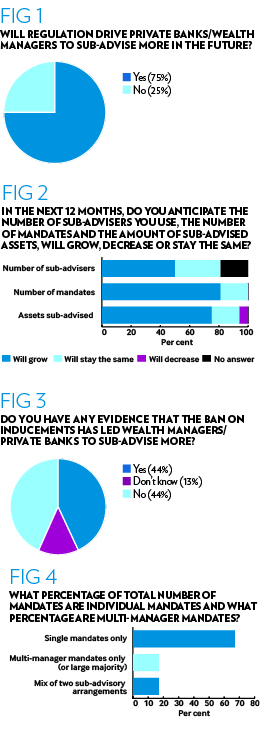

Regulation, be it MiFID or other local regulatory measures, was mentioned as one of the key drivers for the growth in the uptake of sub-advisory arrangements among Europe’s distributors, according to the latest edition of PWM’s annual sub-advisory research. Three quarters of distributors taking part in the survey believe regulation will drive more private banks, wealth managers and other distributors to go down the sub-advisory route (Fig 1).

Now in its 14th edition, the study gathers information from twenty top European distributors – including private banks, wealth managers, fiduciary managers and investment managers – with combined client assets of around €1.5tn ($1.9tn), of which €390bn (26 per cent) are sub-advised to external managers. The research also analyses responses from a handful of large sub-advisers with total assets under management of more than €8.5tn, of which 4 per cent are managed on a segregated basis.

The large majority of respondents to our survey are confident the sector will get bigger this year. More than 75 per cent of distributors say they expect sub-advised assets to increase, with 81 per cent also predicting a rise in the number of mandates. However, just half of the distributors in our sample think the number of sub-advisers being used will increase (Fig 2).

Unsurprisingly, sub-advisers responding to the survey were even more optimistic about the outlook for the sector, with all of them saying they expect to see growth both in assets and number of mandates.

“There are multiple pressures in the wealth management industry which are influencing the direction of distributors towards sub-advisory models,” says Michaela Collet, head of retail partnership and solutions at BlackRock’s Emea retail client business.

“Regulation lies at the heart of this, but we also see fee and margin pressures, demographic shifts and digitalisation as additional forces which are driving distributors to re-consider how they deliver their investment proposition to their clients.”

Interestingly, most sub-advisers interviewed say the ban on inducements has already resulted in more wealth managers choosing to sub-advise, but just 44 per cent of distributors share that view (Fig 3).

Pressure for meeting regulatory requirements is also forcing distributors to rethink their business models and redefine their roles to focus on core competencies.

“On the whole, firms have already worked out how they are responding to regulatory requirements and, in many cases, this has actually led to a fairly fundamental review of which parts of the value chain their clients value the most,” says Tim Banks, principal at Mercer in London.

“Certainly, we think that this would lead to more outsourcing. That, in tandem with the continuing focus on outcome-based investment, means there will be an even greater role for sub-advisory going forward.”

Responses to the survey indicate that enhancing client offering is the main driver pushing distributors to enter into sub-advisory arrangements, followed by the possibility of developing investment solutions specifically tailored to clients’ needs, and enjoying more transparency than that offered by off-the-shelf funds.

Institutional DNA

Another factor influencing the uptake of sub-advisory is the need for private banks and wealth managers to access institutional investment solutions and economies of scale.

“Running sub-advised portfolios is completely different to running a mutual fund. You need to have institutional DNA to be able to service and manage these portfolios,” says Ryan Blute, head of Pimco’s global wealth management business.

He explains that the firm’s experience in managing segregated mandates for more than 40 years puts them in a good position when it comes to undertake the very complex task of managing a sub-advisory account.

“For example, you have to negotiate agreements with counterparties for derivatives, you have to design custom guidelines for the portfolio – there are a lot of operational and behind-the-scenes aspects involved.”

Some distributors offering model or discretionary portfolios, might continue to use off-the-shelf mutual funds as building blocks to invest in very clean-cut, well-defined segments of the market,” he adds. “But when it comes to sub-advisory portfolios, what we are seeing, at least in Europe, is that they hire us, or one of our competitors, to deliver broader, total portfolio solutions, that are adapted to their investment goals, risk appetite and so on.”

Room for all?

The distributors interviewed agreed the selection of a sub-adviser is much more complex than simply picking an investment product. The relationship requires co-operation on many levels so issues related to brand recognition, operational integrity and support are valued by all participants.

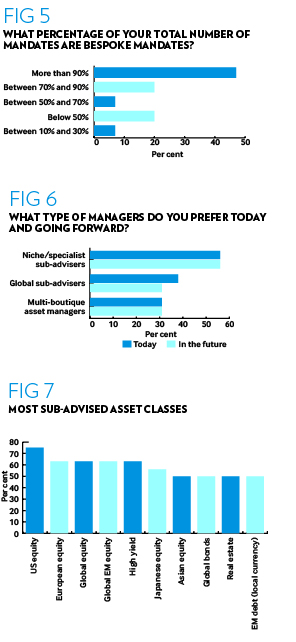

When it comes to different types of sub-advisory arrangements, distributors are showing a clear preference for single-manager mandates, with two thirds of respondents choosing this option over a multi-manager solution (fig 4). Nearly half of respondents also indicate that more than 90 per cent of their mandates are bespoke (Fig 5).

10 most used sub-advisers

- Aberdeen Asset Management

- BlackRock

-

Franklin Templeton/Invesco/Schroders/

Wellington - Neuberger/Axa IM/JP Morgan/Threadneedle/T Rowe Price

Specialist or niche investment managers are favoured by more than half of distributors, although global and multi-boutique players are also widely used depending on the nature of the mandate (Fig 6).

Size, it transpires, does not come up as one of main selection criteria, with most distributors focusing their attention on the ‘four Ps’ of investment manager selection – people, process, product and performance.

As such, long-term consistent fund performance, investment style and the quality of the management team, were picked as the main considerations when selecting a sub-advisory partner.

“We are choosing a team and it doesn’t really matter if that team is part of a large organisation or if it is part of a small boutique,” says Stéphane Monier, chief investment officer, at Lombard Odier Private Bank in Geneva.

“What matters is the quality of the team, their people and process, and that they stick to what they are good at, avoiding style drifts.”

He concedes that when picking a smaller boutique, his team might need to spend more time doing due diligence, to make sure their business model is sustainable.

The Swiss private bank’s sub-advised funds are organised across two separate Luxembourg SICAV platforms – one called PrivilEdge (Ucits), the other Gateway (SIF).

Participants picked personnel changes, bad performance, capacity constraints and changes to the business model or investment style as the top reasons driving distributors to replace their sub-advisers.

Issues related to capacity play a very important part when selecting and monitoring a manager, believes Cord Hinrichs, head of asset allocation at Corestone Investment Managers in Zug.

10 best sub-advisers

- BlackRock

- Invesco

- JP Morgan/Threadneedle

- Franklin Templeton

- T Rowe Price/Axa/Aberdeen

- Schroders/Wellington

“Capacity is a big topic when searching for managers in general, before we even invest with them, and then it’s obviously a big part of the monitoring process,” he explains.

“Capacity, or neglecting capacity constraints, might push the managers into areas or market segments where they don’t have an edge, or maybe we already have another manager that fulfils that part of the portfolio.”

Bigger pie, fewer forks

As the sub-advisory market grows, so does competition among providers. Participants currently use more than 450 sub-advisers, from global players managing large mandates, to very small, niche investment firms. However, a quick look at the results shows that the most used sub-advisers, and those most highly-rated by distributors, are well-known, large investment management firms.

The most used sub-adviser by our sample of distributors is Aberdeen Asset Management, followed by BlackRock. A shared third position was taken by Franklin Templeton, Invesco, Schroders and Wellington Management International. BlackRock was also the most highly-rated sub-adviser followed by Invesco, with JP Morgan and Threadneedle in a joint third place.

US, European and global equities are the asset classes most sub-advised by respondents (Fig 7) but many highlight a rise in alternative assets and emerging market investments. Although a large majority (65 per cent) of respondents say traditional asset classes such as equities and fixed income are more suitable for sub-advisory, the same proportion believe alternative asset classes have stronger growth potential (Fig 8).

Lombard Odier’s Mr Monier explains that allocation decisions are made from strategic or tactical points of view. He compares the bank’s strategic allocation to an oil tanker that needs to be shifted slowly, little by little.

“As a European private bank, we will always have a large exposure to European and Swiss equities but, from a tactical point of view, we will also do searches for managers across other segments and regions.”

At Mercer, Mr Banks thinks that for many wealth managers equities were starting to look fully valued, resulting in an “increasing focus on alternative asset classes, such as funds of hedge funds and direct private markets”.

Optimistic outlook

Both distributors and sub-advisers share optimism about the future growth of the sector but acknowledge it is developing at different speeds across the continent.

“Across Europe, the adoption of sub-advised models is moving at different speeds,” comments Ms Collet at BlackRock. “We believe that less established markets, such as France and Germany, will start to evolve as distributors evaluate their response to MiFID II. Early adopters include private banks and insurance companies in the UK, Italy and Switzerland, but increasingly we are also seeing IFA networks and wealth managers considering this approach as they build scale.”

Lombard Odier is optimistic about its sub-advisory business. “We have developed our private client base and they trust us, and that has allowed us to grow quite significantly,” says Mr Monier. “We are now making it available to some external asset managers.”

Rise of the robots

It is very difficult, if not impossible, to write about any growing investment sector without mentioning how technology and automation are changing the rules of the game.

Participants in our research predict most of the future growth in sub-advisory arrangements will come from traditional private banks and wealth managers (Fig 9). But, as some point out, the rise of robo-advisers and its impact on wealth management should not be dismissed.

Top 5 drivers to sub-advise

- Enhanced offering to clients

- Funds specifically tailored to client’s needs

- Higher transparency than off-the-shelf funds

- Search for higher alpha

- Bringing innovative solutions

On the retail side, there is definitely growing demand from younger customers for using more technology and cutting out the middle man, believes Cord Hinrichs, head of asset allocation at Corestone Investment Managers. The disruption, he says, is already happening.

“Most of the robo-advisory right now is passive – you tell them what your risk profile is, and they come up with a passive solution. But the next step would be goal-based investment, looking at what it is that the customer actually wants, in terms of financing a house or tuition for the kids when they got to college,” he explains.

This would result in more customised sub-advised investment solutions, combining passive and active, that could allow retail clients to access a whole spectrum of institutional investment products. “There is still that gap when it comes to robo-advising but [the sector] is growing, slowly. In the longer term, robo-advisers are here to stay as intermediaries.”