Financial world in flux following EU poll upset

Christian Edelmann, Oliver Wyman

While banks fear that access to EU talent may be restricted in the post-Brexit landscape, some wealthy clients have already sensed a buying opportunity amid the uncertainty

Financial institutions in the UK, and City of London in particular, have been in ‘wait and see’ mode since the referendum vote to leave the European Union.

“All of our clients are running through different scenarios,” says Christian Edelmann, global head of wealth and asset management practices at consultancy Oliver Wyman.

But what clearly emerges is the importance of interdependency between sell-side investment banks and buy-side private banks, insurance companies and asset managers, providing flows to profitable trading and capital markets businesses. “It’s an ecosystem you need in order to operate out of London or any other financial centre,” says Mr Edelmann.

“The extent to which a UK wealth manager should worry depends on their share of non-UK clients served out of the country,” he says.

With the distinct possibility that the UK might lose passporting rights for financial services, domestic banks may need to go down the same route as Swiss banks, and build onshore presence in the EU, for example by opening a subsidiary, to continue to serve existing EU clients and solicit new cross-border business.

Bureaucracy and the cost of having to go through a regulatory approval process may lead some banks to review their business model, whether this is an investment worth making.

UK private banks serving European clients might even decide to focus on domestic clients only, possibly also looking to attract Asian money, speculates Mr Edelmann.

Grusome admin

A dozen wealth managers and private banks including BNP Paribas, Deutsche Bank, Northern Trust, Pictet, and UBS declined to speak to PWM on the possible impact of Brexit, only stating it is “just too early to say”, and “they do not see clients leaving the UK”.

“Until the post Brexit landscape is known, I expect banks to refrain from making drastic decisions affecting UK operations, because it is not economically efficient to simply vacate expensive London office space and leave it empty, especially as the bank in question would need to rent expensive office space in another European city,” says James Quarmby, head of private wealth at law firm Stephenson Harwood.

“Also, moving people is difficult and expensive, you need to pay relocation expenses and the admin is gruesome.”

Further reading

The Great Debate: Is an exodus from London to Paris on the cards?

Camilla Stowell, head of private office and international at Coutts, states that passporting rights “will influence” the bank’s business model but it is “too early” for any plans on any possible subsidiary in the EU. EEA passporting is relevant to only a sub-sector of the bank’s international client base, mainly biased towards the US, Middle East, Asia, and Africa. International clients are all served from Coutts’ offshore centre and platform in Jersey – a non EEA passported jurisdiction.

Skilled workers

One of the key issues UK firms face is access to skilled European workers. Should there be no free movement of people post Brexit, employers would be limited to UK workers, or require a sponsor licence to employ someone even within the EEA.

“What a lot of people have forgotten, because it has been so easy to recruit in the UK, is that it is extremely time consuming and expensive to sponsor a worker through a work visa,” says Mr Quarmby. Limiting EU immigration was at the centre of the ‘Leave’ political campaign. “Access to skilled workers post-Brexit is going to be a real issue.”

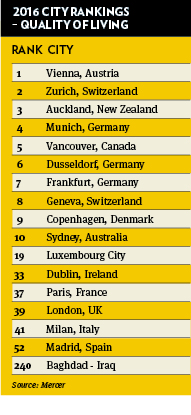

What makes London thrive is its massive pool of talent, from all over the world, including substantial parts from the EU, says Michael Maslinski, partner at international multi-family office Stonehage Fleming. “If it lost that, it would lose something significant.”

$1.3tn

The UK offshore financial industry accounts for $1.3tn out of the total $10tn private wealth booked in offshore centres, according to the Boston Consulting Group’s Global Wealth 2016 report. Switzerland remains the largest destination for offshore wealth, holding nearly one-quarter of all offshore assets globally

Despite Brexit, wealth management players remain surprisingly upbeat about London’s future as an attractive place for wealthy families.

“High net worth private clients come to the UK because of the language, schools, culture, and lifestyle, not because we are in the EU,” states Stephenson Harwood’s Mr Quarmby. “I do not expect a reduction of wealthy people coming.”

The majority of wealthy are from outside the EU, and those from within would be able to use the UK Tier 1 investor visa route or, if employed, are likely to be in ‘high scoring’ professions.

Also, the UK tax regime for wealthy foreigners is still “second to none”, states Mr Quarmby, despite uncertainty about the UK ‘non-domiciled taxation regime’, which has contributed to attract international wealth, but next year will change and could negatively affect a significant segment of the ultra wealthy.

What is not known is how many people are simply not even considering the UK anymore because of Brexit. "We only get to hear about aborted transactions". For example, a family office based in London Mayfair, LJ Partnership was going to acquire Virtus Trust in Guernsey, but pulled out after the referendum.

Taking quite a contrarian view, Point72 Asset Management, a family office that manages millionaire investor Steve Cohen’s $11bn fortune and the personal money of some of its employees, has doubled the size of its workforce to 25, looking to expand its footprint in London further, as part of its global footprint. “The availability of the best talent, infrastructure, access to corporates and the role of London within the wider global equity markets are not going to be impacted significantly by Brexit,” says Will Tovey, head of London at the firm.

In the aftermath of the referendum, clients were in shock but the speed of formation of the new government and positive impression made by prime minister Theresa May helped to bring stability, reports Stonehage Fleming’s Mr Maslinski. “A lot of our clients have their interests quite readily entrenched with the UK and are not going to make big decisions to part company or reduce their commitment to the UK, until things become clear.”

What clients have realised, with the rise of terrorism and political instability, is that the UK is a safe place, with one of the best legal systems in the world, and represents a haven for money and investments, says Mr Maslinski.

Indeed, the slump in price of prime properties in London coupled with devaluation of sterling may offer a buying opportunity. This is particularly true for ultra wealthy families who invest for the very long term.

Clients’ key concerns today are to ensure they are diversified in their activities, flexible, and not carrying too much currency risk, given many have global cash flow requirements, physical assets and lifestyle requirements in the UK, explains Coutts’ Ms Stowell.

“We expect currency volatility to continue, and our view is that Brexit will just elongate the low interest rate environment for longer than we perhaps anticipated earlier on in the year.”

However, it is undeniable that Brexit has brought much uncertainty and disappointment to EU nationals living in the UK, states Chris Edward, UK country manager at Lombard International Assurance, a global firm headquartered in Luxembourg, providing wealth planning and succession solutions to HNW families.

“Despite bringing positive contribution to the economy, European clients living in the UK feel British people no longer want them, and they are not welcome,” he says.

This uncertainty is affecting investment decisions.

“I know personally of a number of family offices and asset managers in Switzerland who were going to set up in London so they would be also able to passport into the EU, but have decided not go ahead, says Mr Edward. “Everything is on hold and entrepreneurs are delaying big investment decisions.”