Fatca regulations threaten Hong Kong’s reputation

Hong Kong has experienced huge growth as an international wealth centre in recent years but by signing up to Fatca regulations it could be in for a bumpier ride

The rise of Hong Kong as an offshore wealth centre will leave Switzerland looking over its shoulder. However, with incoming Foreign Account Tax Compliance Act (Fatca) regulations set to shake up the market, this rise may be at risk.

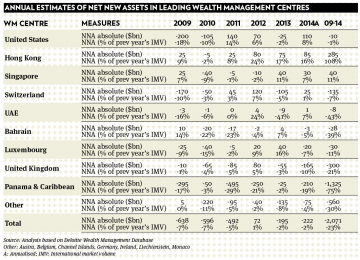

According to the recent Deloitte Wealth Management Centre Ranking Report 2015, Hong Kong experienced significant growth in net new assets. From 2009 to 2014, Hong Kong received $290bn (€267bn) in capital from new clients, a growth of 108 per cent when measured against 2008 (see table). In comparison, the only other international wealth centre attracting new assets in the same period was Singapore, with net new asset growth of $40bn.

According to the report, Hong Kong has now risen to become the fifth largest offshore centre in the world with international market volume at $600bn. Switzerland is still the clear market leader, managing and administering $2tn of assets at the end of 2014.

However, net new assets from clients have fallen in Switzerland by $135bn, indicating the banking hub may be losing its competitive edge. Recent tax scandals, currency devaluations and political pressures from Fatca rulings have had an impact on its reputation. Wealth Insight has even predicted that investments being moved out of Switzerland will significantly increase from $754bn in 2014, to $1.2tn in 2019.

With the Swiss market coming under pressure, Hong Kong has had further opportunities to establish itself as a dominant offshore wealth centre by attracting the client assets migrating from Europe.

The World Wealth Report 2014 from Capgemini and RBC Wealth Management stated Asia-Pacific was the fastest growing region in the world, with HNW investable assets having an annualised global growth rate of 9.8 per cent. China, one of the major contributors to this growth, had a HNW population growth rate of 17.8 per cent.

With an attractive reputation as an entrypoint into the Chinese market, and strong trade links with the mainland and Northeast Asia, Hong Kong certainly has the appeal and foundations in place to entice new clients to invest their assets in the region.

However, in November 2014 the Hong Kong government signed an agreement with the US for its financial institutions to be compliant with Fatca regulations. Recent political disruptions regarding its relationship with China have already caused some discomfort to Hong Kong’s reputation. However, if Hong Kong suffers the damage Switzerland has at the hands of Fatca, then investors may look elsewhere.

With close neighbour Singapore already replacing Mauritius as the leading source of foreign direct investment into India and a financial ethos of openness, transparency and business integrity, Hong Kong will need to be careful its reputation remains intact. Otherwise, like Switzerland it may need to start looking over its shoulder.

Rory Pennington is an analyst at wealth management think-tank Scorpio Partnership