Getting to grips with new business models

The end of secrecy-led services led private banks to put portfolio management at the heart of business models. But a new generation of clients is demanding a much broader range of services from their wealth managers

Faced with demands from a new generation of wealthy entrepreneurs – combined with a regulatory onslaught and a wave of technological disruptions – private banks are once more being forced to re-examine their business models and product offers.

The ‘one bank’ policy, which intertwines investment banking and private wealth management, sometimes augmenting them with expert portfolio management units, has failed to make an impact as a unique business model, believe both banks and consultants.

The mere sporadic success which this misguided business strategy has achieved will precipitate its eventual decline, believes Ray Soudah, CEO of Zurich-based strategic consultancy MilleniumAssociates. The broad palate of products, which the private banking behemoths offer, is largely irrelevant to most wealthy global private clients, he claims.

Having witnessed a massive consolidation in private banking during the last five years – including the disappearance of Merrill Lynch as a wealth management force, the absorption of smaller domestic franchises into operations overseen by cross-border giants, and the swallowing up of Asian operations by Swiss specialists and Asian regional players – Mr Soudah is convinced the one bank model of Swiss banking is about to fold.

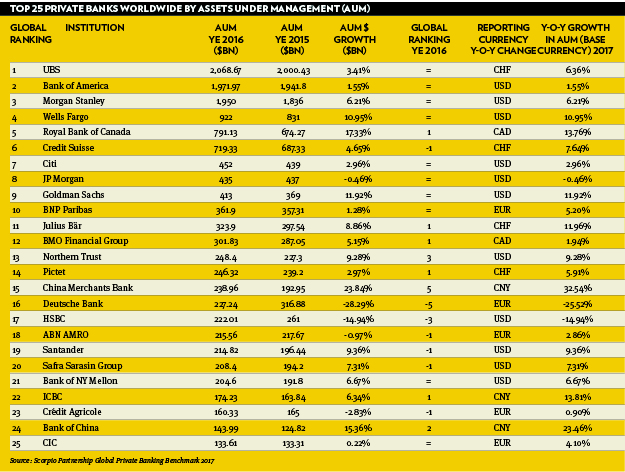

His thinking is that the dominance of the major integrated players over the wealthy private client space has nearly run its course. At least two of the top five global banks are under threat, he believes, and cannot survive in their current fragile form, poised to either merge with one another or take over their smaller competitors (see table at bottom).

Because operating costs – particularly relationship manager salaries – are growing so fast and banks are spending billions developing fintech solutions, business strategies are no longer determined by the revenues they generate. The cost of services and strategies is now the key variable in the business model, says Mr Soudah.

Life in the old dog yet

But this does not mean it is time to sound the death-knell for traditional, Swiss-style high-touch private banking. It is its symbiosis with investment banking that is being called into question. The core contributor to revenue remains asset management-linked fees, says Seb Dovey, co-founder of wealth think-tank Scorpio Partnership.

More than 10 years ago, many private banks, especially the Swiss ones, were saying they needed a wholesale change to their approach, putting portfolio management rather than secrecy-led tax structuring at the centre of their offers. UBS was one of the most vocal of this group.

Most have made this transition successfully, believes Mr Dovey. They have achieved this by selling more products, but disguising these, because even the word “product” carries a distinctly “negative odour”.

The success of this model has emanated from an ability to express the fee schedule to customers in relation to broader, holistic services, where goal planning and wealth structuring are included alongside asset management, says Mr Dovey.

But this has proved something of a smokescreen. The banks have concentrated on managing portfolios, and paid lip service to other client needs. Whichever goals and structures are discussed and determined with relationship managers, a set of specific revenue-generating financial ‘instruments’ is always conjured up to support client objectives.

“Fundamentally, if growing revenue is directly linked to an increase in the assets managed, then there will be a need to sell more of these asset management capabilities,” adds Mr Dovey.

Changing needs

While this steady growth of assets managed by the industry, according to Scorpio’s decade-long tracking of these data points, suggests private banks have made a reasonable job of their core task, the needs of clients are now gradually changing. The younger, entrepreneurial class, in particular, is more demanding of and receptive to a broader range of services on offer from the banks.

Although this should never be delivered to the detriment of core asset management skills, it is becoming evident that younger clients are looking for new ideas. While private banking made its first transition away from secrecy to management of assets relatively successfully, the next shake-up will redefine the industry’s direction and requires even more of a mindset change.

The new ideas include networking with fellow investors, offering more access to ideas and investment concepts linked to social responsibility and environmental issues.

This trend, highlighted by Mr Dovey, is clearly being picked up by banks, both the giants whom Mr Soudah says cannot survive in their current guise, and the boutique players who are making a name for themselves by managing assets instead of providing investment banking services.

The equation is not a simple one. But the key change is that the new breed of clients are entrepreneurs, requiring a much broader palate of services, while the older business segment, selling up their assets, are more interested in portfolio management.

Wider service

These “softer issues” have become just as important as actually managing wealth and are still rising up the wish-list for younger entrepreneurial clients, admits Joe Stadler, head of ultra high net worth business at UBS Wealth Management.

“There was a traditional way of covering clients and now there is a new way of covering clients,” suggests Mr Stadler. “As you go up the wealth scale, the bigger families are much more complex to run.”

If you focus only on investment management, you can miss two thirds of the broader piece

That traditional route of tackling wealth management – taking the bankable chunk of assets and using it to try and generate performance – was once at the centre of the business, but is now just one of several elements used for servicing what UBS calls “Big Money”.

Because 70 per cent of these super-rich customers at UBS are entrepreneurs, only a minor segment of their total wealth is in bankable assets. Focusing on just a small piece of the picture means clients will not give their full attention to the private bank in question, believes Mr Stadler.

To broaden this attention span, private banks need to focus much more on clients’ business interests and this means having an investment bank on call. UBS claims this can help clients raise money to improve the capacity of their enterprises and then facilitate a sale or merger of the firm when the time is right.

This remains a key belief of banks like UBS and Credit Suisse, which propagate this ‘one bank’ system. Other key elements highlighted by Mr Stadler are succession planning – managing the risk of transition from one generation to the next in order to stop “the family falling apart” – and “passion” investments including wine, classic cars, works of art and philanthropic ventures.

“If you focus only on investment management, you can miss two thirds of the broader piece,” claims Mr Stadler.

One stop shop

Swiss rival Credit Suisse has staked its entire future on a closer collaboration between investment and private banking.

“There are very few of our entrepreneurial clients who don’t do investment banking business with us,” claims Francesco De Ferrari, head of private banking for Asia Pacific at Credit Suisse, estimating that up to 70 per cent of the upper client segment, with more than SFr50m ($52m) to invest, make use of these corporate facilities.

The core client base at Credit Suisse now consists of “asset rich, cash poor entrepreneurs with corporate, institutional-style needs,” confirms Philippe Theytaz, head of strategy at Credit Suisse’s private banking division, tasked with improving collaboration with the investment bank through a new “one stop shop” solutions unit.

“This is the next generation of private banking and an evolution of what the ‘one bank’ strategy used to be,” says Mr Theytaz, describing the system of a lead private banker or wealth manager always available to clients, with an investment banker to support them. “We did this as we felt we were missing some opportunities,” he says, particularly on the lending side.

But despite the increased faith of these major institutions in this integrated service, some voices are criticising these old school models, including Mr Soudah of MilleniumAssociates.

“Most private banks need not and cannot afford a sustainable and global M&A service offering for their clients,” says Mr Soudah.

“To do so on a global basis, across all industry segments is onerous, even though an increasing number of private banks are coming to realise that while client demand is there, it is insufficient in revenue terms for any individual private bank to justify the costs associated.”

Additionally, he says, most clients are increasingly seeking independent advisory services, rather than deploying the services of bankers linked to just one financial group.

MilleniumAssociates aims to capitalise on what it sees as this changing industry dynamic to promote its own M&A advice and execution service. More recently, it has extended this to target the clients of private banks. According to the company’s brochure, “the service enables banks to offer their clients guidance through even the most complex mergers, acquisitions or disposals of companies as well as supporting any IPO or bond/capital market needs.”

If this service takes off as strongly as Mr Soudah hopes, then this will prove a direct threat to the integrated model. If banks such as Credit Suisse now run their investment banks purely to support the more lucrative wealth management business – a far cry from the ‘Masters of the Universe’ era when investment bankers ruled the roost – then their proposition could look increasingly fragile if they fail to convert private clients to buyers of their institutional services.

A new approach

A bifurcation of the sphere is now occurring, with another, strong “pure play” segment, particularly the so-called “Geneva connection” of UBP, Pictet, Banque Syz and Mirabaud focusing increasingly on portfolio management. But these banks are also re-inventing themselves, with private equity emerging as the latest asset management specialisation,

There is an understanding among this coterie that private banking must enter a new era, moving away from black boxes and derivatives to embrace investment strategies which their clients can relate to.

“People are tired of virtual finance, its irresponsibility and lack of emotion, which they now link to the dark side of globalisation,” believes Lionel Aeschlimann, managing partner and head of asset management at Mirabaud & Cie.

“There is a fatigue with these elements. What we think about are real family-owned businesses involving entrepreneurs. When people hear about this new approach, they are very relieved.”

The Geneva private banking community was hit by a tidal wave of redemptions post-2008 when the Madoff fraud combined with a post-crisis distrust in illiquid hedge funds. These twin forces almost destroyed the business models of many in this close-knit financial village.

Now the banks are going back to their roots, talking about tradition, but avoiding any mention of opaque instruments or financial engineering. This is a huge sea-change to the derivatives and hedge funds-embracing mentality of 10 to 15 years ago.

“People want financial returns and our mission is to deliver the best possible risk-adjusted return,” says Mr Aeschlimann.

“With seven generations of partners, we have lived through many crises. It’s in our DNA, but we need to be fast enough, as we don’t know where the next crisis will come from. We know managing money is not a game, it is a matter of responsibility. That’s why we are choosing solid companies, manufacturing special products resistant to crises.”

Such a philosophy can offer protection for clients, preserving and diversifying their wealth, believe these bankers.

“I don’t think you can really be a private bank without a very strong investment backbone,” says Michel Longhini, CEO of private banking at Union Bancaire Privée. “Some commercial and retail banks, who did not have this tradition have decided to exit this business. Those who are still here have kept this emphasis on investment and innovation.”

Relationships and service are not enough for clients, if a bank cannot effectively manage their family’s assets, believes Mr Longhini.

Deeper partnerships

This expertise should not however preclude private banks entering deeper partnerships with asset managers, believes Pascal Blanqué, global CIO at fast-expanding French funds house Amundi. This is despite a belief shared by many wealth managers that this expertise should be developed internally.

“The big private banks I know are all running partnerships and they are asking asset managers for more services,” says Mr Blanqué. “Providing investment strategy is just one aspect, but you also need to provide training of private bankers on the ground.”

Investment houses have an important role to play in this sphere, advising relationship managers on asset allocation, risk profiles and latest portfolio management techniques, believes Mr Blanqué.

Whether between different groups or clients themselves, this more collaborative environment is definitely part of the redrawn private banking landscape.

What was once seen as a series of distribution funnels for internally-crafted investment banking and asset management products is now, through client, regulatory and market pressures, a much more open environment.

Private banks have long ago breached the barrier of trying to stop their top clients talking to each other. Instead, the most forward-looking encourage this dialogue and facilitate networking opportunities.

BNP Paribas Wealth Management does this through its Leaders Connection app, connecting those clients with more than €100m ($117m) of financial wealth to each other. But the role of the private bankers in this process will also be key to the discipline’s mentality reset. Although the industry is transforming, it will remain people-oriented for the longer term, says Vincent Lecomte, co-CEO of BNP Paribas Wealth Management. “The relationship manager’s role will be critical. Through the RM, we can mobilise all the bank’s resources.”

Like the Swiss giants, BNP Paribas wants to bring in credit, advisory and structuring teams from investment banking to back up private clients in their day-to-day life and business.

The danger with this approach is that private clients once more become a distribution target, ripe to be offloaded with latest, flavour-of-the month investment banking strategies. Both UBS and BNP Paribas have previously stated they have ditched this product-pushing strategy.

Mr Lecomte at the French bank re-affirms that the client must now come first in any transformation, if this dynamic industry is not to lose its course once more. “Our main goal,” he says, “is to re-invent the customer experience.”