Flavel puts investment at core of Coutts’ growth plan

Peter Flavel, Coutts

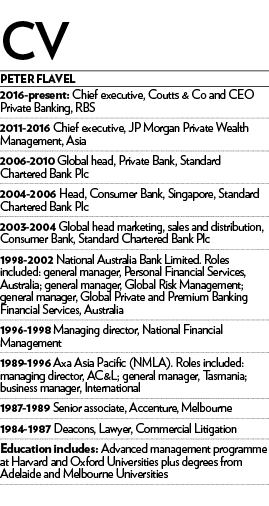

With Coutts now firmly concentrating on its core UK market, the challenge for chief executive Peter Flavel is getting its existing clients to do more with the bank

Glancing out of his office window on the Strand in London’s West End, looking out onto the square next to St Martin-in-the-Fields church, Coutts’ recently installed Australian chief executive Peter Flavel feels a pang of nostalgia.

Global Private Banking Awards

In the Global Private Banking Awards 2016, Coutts won the awards for:

- Best Private Bank in the UK

- Best Initiative of the Year in Client-facing Technology

- Best Private Bank for Philanthropy Services

He points excitedly to the group of elderly Chinese early morning risers, performing their ritual tai chi exercise regime. “We could almost be in Hong Kong,” he remarks wistfully, before the sight of a red London bus draws him firmly back to the Anglo-Saxon reality, and the post-Brexit referendum storm he has flown into.

Now that Coutts has sold both its Asian and Swiss operations, it is these domestic diversions and their consequences which are keeping his clients awake at night. “When I talk with clients, some of them are worried about Brexit,” admits Mr Flavel, who clocked up many years working for retail financial institutions Axa and National Australia Bank in Melbourne, before catching the private banking bug in Singapore.

“But there are more that see opportunities presented by looking at other regions around the world. I am very much in the second camp.”

Investment opportunities are clearly present for these clients in Asia, the Americas and the Commonwealth, he says. “I see many clients who have that positive outlook. But there are significant challenges to negotiate.”

Like the UK, Coutts has also been reducing its international exposure, while trying to keep itself open to opportunities for investment in foreign markets, to boost client returns.

“The past is the past,” comments Mr Flavel, gently but firmly, when it is suggested to him that bands of loyal Coutts clients in the Far East felt let down when their accounts were sold on to Swiss bank UBP. Following the end of its foreign adventures, after parent group RBS decided to downsize, Coutts is now “laser-focused” on its core business, says Mr Flavel. “This means delivering exceptional private banking, lending and investments, centred on the UK and clients with a strong linkage to the UK.”

The latter target group includes Americans with complex financial affairs, including business ownership demands and children’s educational needs, working in the UK and clients from emerging markets who do business in London and prefer to bank in the UK.

But the core segment of wealthy individuals that Coutts hopes to expand its business from are very much UK resident, comprising its traditional “heritage” clientele of land-owning lords and earls, high-flying executives in the UK’s “top 20” professional firms, a growing coterie of entrepreneurs spread across the country’s regions plus younger actors, entertainers and celebrity sports people seeking the stability of investing with the same bank which handles the financial affairs of the royal family.

“You’d be surprised at how many younger clients we have,” he says. “Coutts is an aspirational brand. A significant proportion of young entrepreneurs are drawn by the heritage of the brand and wish to book and invest with us.”

The short-haul flights of old from Singapore to Indonesia, Thailand and Malaysia have been replaced by frequent train journeys to the UK regions, with regular client meetings in Edinburgh, Birmingham and Portsmouth.

One of Mr Flavel’s key objectives in these meetings is to convince clients to both invest with and borrow from Coutts, with just a quarter of the £60bn ($73bn) currently held by the bank actually put to work in long-term investments for clients.

“We have a large deposit base, so there is a huge opportunity for our clients to participate more in investing in multi-asset strategies, particularly in the low interest rate environment,” says Mr Flavel. “Clients need to understand there is a huge opportunity cost to keeping money in deposits, especially when they take into account inflation. People are starting to understand the benefits of a more diversified investment portfolio.”

Clients typically see Coutts as a luxury brand, providing concierge services as well as banking, expert at obtaining tickets for sold-out events and flying people back from foreign trips when they are taken ill.

“It’s somewhat of a surprise to people when they learn that our main investment solutions are first quartile and are very strong compared to our competitors and peers over one, three and five years.”

The bank has done a lot of work in simplifying the investment proposition, overseen by chief investment officer Alan Higgins, not afraid to make brave calls on markets, supervising nearly 200 staff.

One key reform instigated by Mr Flavel is to unify and standardise the investment view across all client segments and regions, so that relationship managers no longer have so much leeway in deciding the content of portfolios. If Coutts’ investment experts have decided this is the best allocation, suggests Mr Flavel, why not take advantage of this and maximise returns?

“We want asset allocation and securities selection from our central group of people to be delivered in a consistent way, so clients can share the same ideas whether they are in Edinburgh or London,” he says.

Previously, he believes, Coutts may have neglected to channel clients into investments, concentrating on providing them with exclusive banking services. “Private banking to me is wealth management, and that means looking after the transactions of clients, their savings, their investments and their full balance sheet,” says Mr Flavel. “That’s what Coutts brings: a whole-of-family view.”

The most significant resource for Coutts, he believes, is the existing client base, rather than any new leads. “Many of our clients can do more things with us,” he suggests.

For investment clients, this might include looking at their lending needs. Reductions across all of Coutts’ residential mortgage rates, as much as 80 basis points for the five-year fixed rate, now down to 2.19 per cent, could provide an incentive for this, he believes.

Key to increasing these opportunities is greater co-operation with other group brands, such as retail and commercial banking franchise NatWest. Ten per cent of new clients recruited to the Coutts franchise during 2016 have been from NatWest group referrals.

“NatWest is the largest commercial bank in England and Wales,” says Mr Flavel. “We are going back to the way Coutts worked with NatWest 20 to 30 years ago. Many people in this office remember how well that relationship worked in the past.”

His own past career, with memories of huge deals that the commercial and private banking arms of Standard Chartered would co-operate on, is also fuelling this vision.

I have seen first hand the power that a strong relationship between a private bank and commercial bank can have in engaging sophisticated entrepreneurs

“I have seen first hand the power that a strong relationship between a private bank and commercial bank can have in engaging sophisticated entrepreneurs,” recalls Mr Flavel, who instructed his teams to contact every single investment client of the bank on the day following the UK’s Brexit referendum.

While clients will long be living with the uncertainty of a new relationship between the UK government and its neigbours, Mr Flavel is delighted to report that Coutts’ traditions will remain intact. This interview took place just hours after the bank’s holding company confirmed its purchase of the lease to the building at 440 Strand, where it has been headquartered since 1902.

Much had been made previously about the future of the exotic Koi carp, which swirled around the pool at the centre of the bank’s atrium, party to many clandestine conversations between wealthy clients and bankers. Mr Flavel nods slowly and gestures amiably towards the fish: “Those carp are here to stay.”