Is smart beta really such a clever idea?

Manuela Sperandeo, iShares

Smart beta is taking off, with assets flowing into products following these strategies and ever-more providers entering the arena. But should private investors steer clear?

The surge of inflows into exchange traded funds (ETFs) shows no sign of abating, with many wealth managers seeing these products as key building blocks in client portfolios. At the forefront of innovation and growth in this sector are the “smart beta” strategies, which promise to exploit the inefficiencies displayed by index-based ETFs and improve returns.

According to Morningstar, globally there were 950 “strategic-beta” – their term for smart beta – exchange traded products (ETPs), with collective assets under management of approximately $478bn, as of December 31, 2015. Market share has been increasing across the globe, although these strategies have made greater inroads in the larger, more mature markets than smaller, less developed ones.

As the flow of assets into the sector picks up speed, the numbers of firms offering these strategies is also growing fast. According to BlackRock, the number of smart beta providers globally has grown from 54 at the end of 2012 to 92 in December 2015.

“This is clear evidence of increasing interest, both from established providers as well as new niche players who see smart beta as a way to enter the ETF market,” says Manuela Sperandeo, Emea head of specialist sales at iShares, BlackRock’s ETF business.

“When people use smart beta they are looking for an outcome,” says Bryon Lake, head of Invesco Powershares Emea, the fourth largest ETF provider globally with more than $100bn in assets under management. Investors may be searching for yield, or for diversification, or perhaps to lower the overall risk within their portfolio and smart beta ETFs are tools to help them achieve a specific outcome.

“If these strategies are delivering the outcomes people are looking for, then they realise there is value in them. I think that investors are taking on smart beta because of the investment proposition rather than the low fees.”

Research carried out by Invesco suggests use of smart beta will triple over the next three years. The average smart beta user has around 7 per cent of their portfolio in these products today, but indications are this will rise to around 20 per cent. The wealth segment seems to be warming to the concept most, believes Mr Lake, adding that retail investors can also see the benefits.

“But we are just getting started. If you think about how big the rest of the fund industry, is this smart beta thing is really just getting going.”

Why all the interest? “Quite simply because everyone along the value chain, from the adviser to the investment manager to the product provider, is under increasing pressure to deliver value added strategies for investors,” says Hector McNeil, co-CEO of ETF provider WisdomTree Europe.

In 2016, he expects the focus in Europe to move away from ETF pricing to a debate on the performance of ETFs, as has been the case in the US, and expects the growth and success of smart beta to continue.

So smart beta may be growing, but is it suitable for private investors or best left to institutions? In February, Rob Arnott, chairman of Research Affiliates, an asset management business specialising in smart beta, warned how these strategies could go “horribly wrong” due to rising valuations and the impact these are having on the space. The very popularity of these vehicles could lead to a crash, he argued. Is it worth steering clear altogether?

“High net worth and retail investors may certainly be interested in investing in smart beta strategies but first they need an understanding of their risk/return profile,” believes Denis Panel, CEO of THEAM, an affiliate of BNP Paribas Investment Partners. One of the great benefits of ETFs in general has been their transparency and easy-to-understand nature, and while smart beta is a relatively sophisticated concept, it is important that care is taken to improve the clarity and client-comprehension of such strategies.

“All investors want to follow and easily understand the product and its performance, hence the importance of education and transparency. Asset managers and distributors have to work to simplify their language and explain the real added value,” says Mr Panel, adding that providers should try to keep things simple and educate customers through events, tools and services.

Educating investors is a key area where a wealth manager can add value for their clients by passing on this knowledge, says Christopher Mellor, equity product manager at Source, the ETF provider. “We believe smart beta has a place in anyone’s portfolio, but the investor needs to understand it. There has been a tendency to lump all smart beta products into one bucket, but the truth is that the term smart beta captures a wide array of different investment strategies.”

Retail investors – including high net worth individuals – need to know what a particular smart beta product is aiming to do, and whether that objective meets their own investment needs, he says.

“The good news is that one of the key characteristics of smart beta funds is that they offer a systematic or indexed approach to investing, which means they should have clear rules and clear objectives, making this process easier to accomplish.”

The debate should be shifting as to how best these strategies are put to use, believes Mr Mellor. The smart beta universe is immense, with a very wide range of objectives. Source separates this universe into two distinct categories: strategies and tools. Strategies include any smart beta funds aiming to outperform a traditional market-cap weighted benchmark index. These tend to replace core holdings and may therefore be considered suitable holdings for the long term.

“Tools, on the other hand, would be any smart beta fund that aims to isolate and capture a specific segment of an index,” he explains. These may outperform the broader market in certain market conditions, but not all, and are probably more useful as short-term tactical holdings.

Twenty20’s Top three Predictions for ETFs in 2016

2016 will be the year ETFs finally take a bite out of active management

Financial advisers in the UK have been slow to adopt ETFs, but this is changing and expect a number of platforms to increase their offerings

Growth in ETFs with an SRI theme

ETFs will never cure all of the ills of the investment world, says Allan Lane, managing partner at Twenty20 Investments, but are a convenient investment wrapper which almost always offers a better version of similar strategies that were previously available. “Fees are lower, transparency is higher, and with some exceptions they have performed well in a market crisis. And so it is with smart beta products.”

For many years these strategies were the preserve of the wealthy, he claims, but they are now available to anyone at an affordable rate. Of course there is no guarantee these types of systematic funds will ever outperform again, he admits, but that is also the case with plain vanilla beta exposures.

“What can be said with certainty is that compared to the vast array of duff investment products heaped on the end investor over the last fifty years, these products don’t even come close.”

Smart beta indices can fit into private banking business models as they offer an answer to some limitations of existing market cap-weighted indexes, says Philip Philippides, head of UK ETF and index fund sales at Amundi. Returns can be enhanced by investing at a more granular level, for example in a low volatility index during times of market turmoil or in a momentum index strategy during a period of recovery.

“For investors who feel current risks are higher and markets more volatile, larger cap or quality factor indices could be a helpful allocation tool, as well as lower volatility products. It is also possible to invest in multi-factor products, which adjust factor exposures systematically to account for different cycles, freeing investors from the investment timing decision.”

But not everyone is convinced enough to get involved. The attractions of smart beta remain clear, says Andrew Summers, head of collectives at Investec Wealth & Investment, but his firm has yet to use these products despite believing there is strong empirical evidence supporting their benefits.

“Many smart beta products are still priced at a premium to more vanilla ETFs, which is hard to justify,” he explains. “It also enables us to continue to employ excellent active managers for an only modestly higher fee and benefit from the experience and value add we believe such managers provide.”

The paradox of off-the-shelf smart beta products is that if you’re smart enough yourself to understand what’s going on, you probably don’t need them, and if you aren’t, you shouldn’t use them

Private banks’ usage of ETFs, both smart beta and traditional vehicles, varies widely, says Daniel Pytlik, fund analyst at Julius Baer in Zurich.

“The paradox of off-the-shelf smart beta products is that if you’re smart enough yourself to understand what’s going on, you probably don’t need them, and if you aren’t, you shouldn’t use them.”

He warns that clients of those bankers who only use “homemade” products are missing out, claiming that at Julius Baer, a team of analysts search for most attractive net returns across the product universe.

Academic roots

Although smart beta, or alternative beta, has been around for at least five years, the investment ideas themselves have been around much longer.

“Alternative betas all have their roots in academic papers from the seventies and eighties,” says Andrew Clare, professor of asset management at Cass Business School in London.

“A lot of the time the ideas for new products come from marketing departments of investment managers rather than fund managers or deep research. But most of these ideas do come from academics, who had no intention of setting up a fund based on them or for any kind of financial gain.”

The smart beta concept may be nothing new, but the way these strategies are being packaged up in ETFs and made widely available to all kinds of investors certainly is. But would this have been possible without recent advances?

“The rise of technology has been a driving force behind the development of smart beta strategies,” says Ms Sperandeo at iShares. Higher quality data, its wide availability and improved processing power have provided the means to measure and capture systematic drivers of returns previously only available to institutional investors, she explains.

Improved technology has certainly helped in the construction of these products, but it also has a major role to play on the distribution side. “Firstly, technology allows a wider dissemination of information on these strategies, thus accelerating the education process and increasing awareness,” says Ms Sperandeo.

“Secondly, as the availability of ETFs on distribution platforms increases, these strategies will become more accessible and potentially find a place as core strategic holdings.”

Scrabble index

Cass Business School in London constructed an index using a rules-based approach modeled on the board game Scrabble. Using a dataset of a selection of US equities quoted on exchanges between 1964 and 2014, Cass made allocations according to each stock’s ticker symbol, allocating according to the points a company’s symbol would be worth in Scrabble. For example Apple (AAPL) scored six while Exxon Mobil (XOM) scored 12.

Allocations to stocks were based on those scores, rather than market cap and it turns out the Cass Scrabble Index would have substantially outperformed market cap. “We did this to illustrate that you can create an index from anything,” says Dr Nick Motson, a member of the faculty of finance at Cass. “This has no academic grounding and there is no reason why it should work, but it does.”

Anyone can produce an index, but people developing smart beta strategies are loading theirs in ways that will tend to outperform market cap. “They aren’t just throwing darts at a board,” he says.

The bulk of smart beta performance comes from value stocks, explains Dr Motson. “In some way the methodology is identifying value. Market cap can tend to buy more of the stocks that are over-valued and less stocks that are under-valued. Market cap tends to be overweight growth stocks and underweight value. They are extremely heavily weighted in very large stocks.”

VIEW FROM MORNINGSTAR: Expect fees to fall further

Strategic beta ETPs, often referred to as ‘smart beta’, continued to make inroads in Europe last year, with investors pouring more money into these products which seek to either improve return or alter risk relative to more traditional market benchmarks. Over the course of 2015, strategic beta ETP assets swelled by a third to €32.4bn ($37bn).

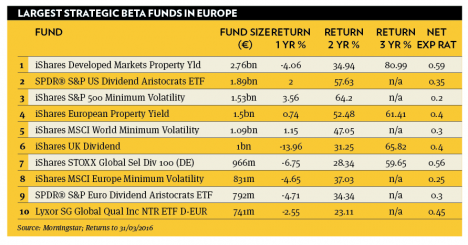

Again in 2015, dividend-focused ETFs were among the top-sellers, and unsurprisingly so, given the prevailing low rate environment. Six of the 10 largest strategic beta ETFs in Europe follow a strategy that screens and/or weights constituents based on dividend metrics. Two of the top 10 strategic beta funds are property ETFs, the largest of which is the iShares Developed Markets Property Yield ETF (IWDP) from BlackRock. The fund offers exposure only to companies with a forecast dividend yield of at least 2 per cent.

State Street’s SPDR is one of only two providers to challenge iShares’ dominance of the top 10 list, with two entries from the popular S&P Dividend Aristocrats range. In addition to screening, these funds also weigh holdings based on annual dividend yield.

Elsewhere, increased investor focus on risk in the face of continued global economic uncertainty has helped minimum volatility strategies to gather assets. The largest of these funds, the iShares S&P 500 Minimum Volatility (MVUS), outpaced its plain-vanilla counterpart, the iShares Core S&P 500 ETF, by more than 5 per cent over 2015.

The growth in asset flows into European strategic-beta ETPs has seen competition between providers intensify and fees fall, especially on products offering access to the more common factor exposures, such as value, momentum and quality. Over the past five years, the average TER of European strategic beta ETFs has dropped from 0.43 per cent to 0.39 per cent.

Already, we have begun to see providers respond to these developments by concocting evermore innovative and complex strategies, for which a premium can be charged. As the European strategic beta ETP market continues to evolve, we can expect further downward pressure on fees for more vanilla strategic beta equity exposures and look forward to further innovation in the form of multi-factor offerings and in particular, expansion into the relatively under-explored fixed-income market.

Jeffrey Schumacher, senior manager research analyst, Morningstar