Wealth managers take small steps towards smart beta

The use of ETFs following smart beta strategies is clearly on the rise, but a number of wealth managers remain sceptical as to just how suitable they are for private client portfolios

The relentless growth of exchange traded funds (ETFs) continues. By the end of January 2017, assets invested in ETFs and ETPs (exchange traded products) listed globally reached a new record high of $3.69tn according to ETFGI, the independent research firm.

At the forefront of innovation and growth in this sector are the “smart beta” strategies, which promise to exploit the inefficiencies displayed by index-based ETFs and improve returns. Although the research surrounding smart beta, or factor, investing has been around for several decades, it is only fairly recently that these strategies have started to be packaged up in ETF wrappers and therefore made more accessible to investors.

ETF providers have been relentlessly promoting these strategies for a number of years now and investors are starting to take notice. ETFGI reports assets invested in smart beta equity ETFs/ETPs were just $3bn short of the $500bn barrier ($497bn) at the end of November 2016.

Last year saw a big change in how investors are using smart beta ETFs, claims Bryon Lake, head of Invesco PowerShares Emea. “They understand the tools now and have dialled in on how they can be used. It is as if in 2015 they were starting off at med school but by 2016 they had graduated and were already doing surgery.”

Adoption by region

- The US, Canada and Australia have the highest rates of smart beta adoption, with more than 10 per cent of total ETF assets utilising smart beta strategies, as of December 2016

- Europe has a total smart beta adoption rate of 7 per cent, with Latin America at 5 per cent and both Africa and Asia at 2 per cent

Source: First Bridge Data

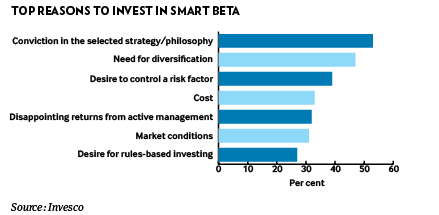

A combination of factors made this possible, he believes, pointing to a recent study carried out by Invesco, which indicated investors have a high level of confidence that smart beta strategies will do what they promise. In addition, respondents to the survey pointed to low yields, market volatility, assets becoming more correlated and finding value as their biggest challenges, while the smart beta strategies proving the most popular are those which target these needs.

Move towards value

The first half of 2016 was very much a risk-off environment, reports Manuela Sperandeo, head of iShares Emea specialist sales, and investors therefore gravitated towards defensive factors, such as minimum volatility.

But things began to change after the Brexit referendum, with flows back into more traditional market-cap exposures. “And then, as investors got more constructive on risk they started turning their attention towards more risk-on factors. Value was the big theme going into Q4 and into January 2017.”

There is certainly increased interest in smart beta strategies, agrees Ms Sperandeo. Although the research around factor investing has been around for a while, it is the access that has been transformed.

“ETF technology enables investors to have very immediate, cost-effective and transparent access to these strategies. And there are now enough products with a live track record. They now have the ability to demonstrate how these strategies work in real life and in different market environments.”

The big asset managers were earliest adopters of smart beta products, but there is now growing interest from wealth managers and most other types of investors, reports Chris Mellor, product specialist at ETF provider Source. “The same thing happened with ETFs more generally, so I’d expect the trend towards smart beta to continue.”

The ongoing disappointment around actively managed funds is a big reason for the switch to smart beta, and ETFs more broadly, he believes. “If you are tired of paying high costs, especially if you’re not being compensated by better performance, then ETFs are going to be quite attractive.”

Although equities is the largest asset class targeted by smart beta strategies, Mr Mellor describes how there is also demand for fixed income strategies that use criteria other than just size. He gives the example of weighting emerging market bonds based on GDP, which gives exposure to higher growth countries such as India and China.

Nizam Hamid, head of ETF Strategy at WisdomTree Europe also reports “a big change” in the way private banks and wealth managers are approaching smart beta. “They are starting to recognise how they should look at positioning smart beta solutions in their portfolios,” he explains, with many now understanding how smart beta strategies can be used as core parts of portfolios.

Investors are looking at these as a sort of middle ground between pure market cap and active management, he believes. A lot of active managers define themselves in a certain way via their style, but performance has been challenging for many of them.

“So we are seeing investors look at the styles of managers they have traditionally used and then ask if there is a more systematic product they can put in portfolios that can replace that active manager.”

ETF providers have put a huge amount of effort into educating investors as to how to use ETFs, and as to the different types of strategies available. Indeed, it is essential that investors look at the strategies first, insists Mr Hamid.

“The fact that a certain strategy is available as an ETF is secondary - an ETF after all is just a wrapper. What is critical is knowing and understanding what your exposure or style tilt is.”

Although smart beta is on the up, the adoption of these strategies is not universal. ETFs are becoming an increasingly popular asset class for private banks and wealth managers in Asia, but the use of smart beta strategies is still relatively new and take-up is modest, says David Quah, head of ETFs at Mirae Asset Global Investments in Hong Kong. He does believe this will change, as knowledge of these products continues to grow, pointing to high dividend and low volatility ETFs as potential sweet spots.

Wealth managers wary

ETF providers may claim that wealth managers are turning to smart beta like never before, but plenty are biding their time before committing substantial client assets to these products.

Some have no interest at all. “We don’t use ETFs, smart or otherwise, as it is our desire to add value through stock selection,” says Paul Sedgwick, head of investments at boutique family office Frank Investments.

Smart beta ETFs are active management by another name, as they involve some form of asset allocation away from the index they track, he believes. “I’m not sure the unsophisticated investor would fully appreciate the risks.”

Others are starting to dip their toes in the water, albeit cautiously.

“If a client comes to us and says they are interested in smart beta, then we can have that conversation,” says Sue-Wei Wong director and investment specialist, managed investments at Citi Private Bank, but notes there has been only limited client demand. For Citi, smart beta remains more of a tactical allocation within portfolios.

Over the course of the last year, from the end of 2015 through 2016, Citi was looking to gradually de-risk portfolios, and within certain portfolios looked at products such as minimum volatility ETFs within developed, liquid markets. “However, these would be a relatively small part of an overall portfolio, and would work as a complement to other managers we also held for diversification purposes.”

A lack of track record is one of the main reasons we are seeing a reluctance for wealth managers to use smart beta strategies

The availability of ETFs and smart beta is growing hugely, admits Ms Wong. “But none are the same. Otherwise there wouldn’t be so many different ones.”

This makes track record vital, but a common complaint from investors is that, with so many of these strategies being quite new, many have less than a five-year track record.

“This would be one of the main reasons we are seeing a reluctance for wealth managers to use them,” says Mr Wong. “They haven’t gone through a period of extreme stress for you to see how they will perform.”

Due diligence is therefore absolutely crucial, but individual retail investors simply do not have the capacity to complete that.

“It has to be taken up by wealth managers, which is a chicken and egg situation. It needs to be driven by the clients and we need that track record for that to happen.”

Investec Wealth and Investment is “selective” when it comes to smart beta, says Adrian Todd, fund selection specialist at the firm, with the strategies “not heavily used” in client portfolios.

“There have been a lot of new products hitting the market in recent years and while we have seen an improvement in the robustness of the strategies in general, there are still many which we view as being relatively un-tested, expensive, or more use from a tactical rather than long-term perspective within portfolios.”

Single factor strategies are too dependent on market timing and can go through extended periods of underperformance, he believes. Investec is more comfortable with dividend-focused equity ETFs as it finds them more intuitive and believes they can help provide exposure to high-quality, yielding companies in a cost-efficient way.

However there are different approaches to income-orientated equity strategies, he warns. “So understanding the difference between products which may seem similar by name but where the underlying indices are materially different is important.”

Investec would look to avoid strategies which are more dependent on near-term market views, so any smart beta ETFs it does hold tend to be strategies it is comfortable holding long-term. “We look for the strategies to be transparent, to make sense intuitively and for the relative performance profile to be explainable, rather than just because it may have happened to perform well historically,” says Mr Todd, adding a reasonable track record would be three or more years.

Another way in

On the other hand, Coutts is very comfortable with the idea of smart beta investing, but does not believe ETFs are the best way to implement these investment theories.

There is a clear distinction between two types of vehicles to access the smart beta, or factor investing, space, says Minesh Gajjar, director of fund research at Coutts. “One is via ETFs, the other is by going down the route of funds. By that I mean smart beta funds that are actively managed. They are not as simplistic as smart beta ETFs and don’t face the same drawbacks.”

Citi uses smart beta ETFs, but “very sparingly” and does not see that allocation going up. However smart beta funds are something that it does use in portfolios. Although they are not yet as a core allocation across portfolios, Mr Gajjar does expect their use to increase and to become more of a core allocation.

Any good investment manager will have a philosophy around how they want to manage money and have certain biases they believe in, he explains. Coutts, for example, likes to see itself as having a bias towards value, and in addition quality.

“So we can either go out to market and try and find pure active managers that give us those biases, or we can look towards smart beta products, which are quantitatively created, disciplined and if it is research which we thoroughly understand, it allows us to put that exposure into portfolios that tallies with our own philosophy.”

VIEW FROM MORNINGSTAR: A modest, but growing, slice of the European ETF pie

A solid body of evidence shows that most actively managed funds struggle to beat traditional market benchmarks over the long term, mostly due to the higher fees they charge. With that in mind, it is no surprise passive funds have grown in popularity.

Interestingly, as investors are becoming more comfortable with the basic concept of passive investing, they are willing to go beyond plain vanilla market exposures and into the realm of strategic beta.

Strategic beta, or smart beta, funds are linked to indices that seek to exploit one or more factors, such as value, growth, size, volatility and income, against market-cap weighted benchmarks.

In the context of the European exchange traded fund market, strategic beta funds represent just 8 per cent of total AUM, but their share is growing. At the end of 2016, strategic-beta ETFs totalled more than €43bn AuM ($46bn), up from €31bn a year earlier.

iShares remains the largest money gatherer, retaining 42 per cent of strategic beta share, with its minimum-volatility, dividend-oriented and property-yield suites representing seven of the 10 largest strategic beta ETFs in Europe (see table).

In terms of net inflows, strategic beta ETFs attracted more than €9bn last year, representing 20 per cent of the total money flowing into ETFs.

In a world of rock bottom interest rates, it is not hard to understand why the bulk of assets (41 per cent) continue to be placed in income-seeking strategies. Five of the 10 largest strategic-beta ETFs in Europe follow a dividend-oriented benchmark, including the SPDR S&P US Dividend Aristocrats and the SPDR S&P Euro Dividend Aristocrats ETFs, which are both positively rated by Morningstar analysts.

It is important to note that factors have cycles. They can experience long stretches of underperformance and outperformance relative to other factors, as well as the broader market. As expected, timing these factors is just as difficult as timing the market.

Considering this, investors are probably better off by combining a few single-factor ETFs or investing in a multi-factor ETF instead.

Monika Dutt, fund analyst, Morningstar