Fund Selection - September 2014

Each month in PWM, 9 top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Julien Mechler

Chief investment officer, AA Advisors. Based in: Paris, France

“The US economy may continue to grow at a stronger pace, as is suggested by the improvements of main macro indicators, such as employment statistics, real estate markets or activity surveys. In Europe growth remains weak but is improving and inflation remains subdued. Emerging markets as a whole are finally showing improved fundamentals. Equity valuations are not cheap anymore in absolute terms, with the exception of emerging market equities, but lower bond yields are supportive for relative valuations. With risks abating, the drivers behind the overweight allocation to equities continue to strengthen, so our positions are unchanged.”

Peter Fitzgerald

Head of Multi-Assets, Aviva Investors. Based in: London, UK

“While we continue to see more value in equities than fixed income, we have been trimming our equity exposure at the margin and increasing the cash weighting. This is against a background of a six year bull market in equities and ongoing geopolitical turbulence. This manifested itself primarily in European equities and we reduced exposure to BlackRock’s European Dynamic fund. Europe, in particular, was selected as PMIs appear to be stalling and France and Italy are flirting with recession. This fund has a perennially higher beta than the market and is exhibiting pronounced growth characteristics.”

Management selection team

Eurizon Capital. Based in: Milan, Italy

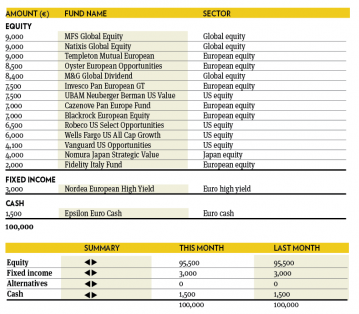

“In June and July the portfolio lost 23 bsps in absolute terms, lagging its benchmark by 1.17 per cent. The worst negative contribution came from our European equity exposure, while US and Japanese funds added to performance. Best contributors were Nomura Japanese Strategic Value, Wells Fargo US All Cap and Vanguard US Opportunities. Worst were Templeton Mutual European and BlackRock European Equities. We retain our positive outlook for equities versus bonds and a preference for credit over government issuers, therefore we did not make any changes to the portfolio during the month.”

Gary Potter and Rob Burdett

Co-heads of multi-management, F&C Investments. Based in: London, UK

“Strong company results and positive global growth numbers helped markets to progress, though geopolitical events overhung general sentiment. The failing of Portugal’s third largest bank Banco Espirito Santo again called into question the European recovery, though this was taken by the market as an isolated incident, for now. Markets made steady progress with only Europe losing ground. The Blackrock Continental European Flexible fund compounded the falls of the base market as the worst performer, with JPM Emerging Opportunities the best. We remain cautiously optimistic but are ever cognisant of a pickup in volatility from here.”

Sebastien Bonnet

Head of Financial Engineering, FundQuest, BNP Paribas Group. Based in: Paris, France

“Geopolitical events have dramatically impacted the equity markets and increased short-term volatility. Monetary policies and global liquidity remains supportive, however we remain neutral on global equities. With generally low default rates and decent company balance sheets, European high yield corporate bonds are still providing a positive carry. Government bond yields look set to go higher. We believe that inflation discounted by linkers remains too low. We are neutral on convertible bonds, commodities and cash. The monetary stimulus in the eurozone should at last weaken the euro.”

James de Bunsen

Multi-asset fund manager, Henderson Global Investors. Based in: London

“The Henderson Value Trust is a new addition and provides exposure to some less liquid asset classes, such as private equity, infrastructure, distressed debt and hedge funds. It currently trades at around a 15 per cent discount to net asset value, partly due to its exposure to out of favour areas such as resources and emerging markets and partly due to a somewhat troubled history prior to Henderson winning the trust mandate. (Some of the underlying assets are also priced below NAV so there is a double-discount story.) Meanwhile, it was pleasing to see that our decision to cut our high yield exposure in June appears well timed.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“The balanced portfolio kept the broad balance unchanged between the major asset classes, which means a somewhat cautious position on the equity markets. Similar to the previous months, the diversification of the equity holdings has been increased some more, by adding to the emerging holdings out of Europe. While the fixed income funds in the portfolio behaved as expected, finding value in the area has been challenging for quite a while now and many of them now emphasise capital protection over performance. In this context, with no obvious cheap asset class, the portfolio remains cautiously positioned.”

Toby Vaughan

Head of Fund Management, Global Multi Asset Solutions Santander. Based in: London, UK

“We remain well diversified across equity, fixed interest and absolute return allocations. The 43 per cent in equity reflects a constructive outlook for markets, and an overweight against a hypothetical neutral weighting. The fundamental environment supports equities with improving economic and earnings growth, a lack of inflationary pressures in the developed world, and expectation of highly accommodative monetary policy for some time. This helps bond markets, but valuations are so stretched the upside return is limited. This is why we allocate to flexible strategies in bond markets and have a material allocation to absolute return strategies.”

Peter Branner

Global CIO, SEB Asset Management. Based in: Stockholm, Sweden

“In the alternative space, our BlackRock fund has had a challenging period as there have been quick sector rotations and changing outlooks on the European equity market. Despite the market neutral nature, we know that short term intra-market turbulence can be challenging for the strategy. Performance bottomed in May and since then the fund has recovered a majority of the previous losses. Over the same period, MS PSAM Global Event has been stable and provided diversification. As our expectations to the strategy has been confirmed and our conviction has strengthened, we reallocate the risk in our alternatives portfolio slightly from BlackRock to MS PSAM.”