Fund selection - April 2015

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Julien Mechler

Chief investment officer, AA advisors. Based in: Paris, France

“Following the recent upward movement , the equity markets could be seen as showing high valuations and therefore potentially expensive. Nevertheless, the environment with low volatility and low inflation remains positive in the coming months, and also on the macro side the perspectives of recovery remain supportive. In particular European quantitative easing and the weakness of the euro, together with low oil prices, will represent tailwinds for the recovery. So we keep our allocation unchanged with an overweight of equity versus bonds.”

Thomas Wells

Senior Multi Manager Fund Analyst, CFA, Aviva Investors. Based in: London, UK

“February saw a strong reversal in both US and UK rates which has continued into early March. We have not changed our stance and continue to run a low duration fixed income book. It is pleasing to see that this position is now bearing fruit. That said, with the US 10yr hitting 2.25 per cent it is beginning to look interesting. In terms of the wider portfolio, we have made no changes this month. Our managers are performing in line with expectations and our asset allocation reflects our cautiously optimistic outlook. Sometimes the most difficult decision when managing a portfolio is to do nothing – this is such a time.”

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“Performance in February was solid once again, thanks to our equity and US dollar exposure. High yield’s contribution was positive both in the European and US markets. Our Equity Market Neutral fund was broadly flat for the month. At the end of February we decided to increase our exposure to European equities, reducing our US equity funds at the margin. We trimmed JPM US Steep and added to Schroder European Opportunities. We eliminated our hedging to the yen, investing in the Nomura Japan Strategic Value fund in local currency.”

Gary Potter and Rob Burdett

Co-heads of multi-management, F&C Investments. Based in: London, UK

“Japan was the stand out performer last month with domestic pension funds increasing their equity allocations, giving the market a boost, though Europe followed closely as did the UK despite the forthcoming general election. The best performing fund of the selection was the Verrazzano Advantage European fund, recovering from some recent poor performance. While just making a positive return, the F&C High Income Bond fund trailed the selection. Markets have come a long way in the first two months of the year, and while we remain cautiously optimistic we remain cognisant of the potential for volatility in the coming months.”

Sebastien Bonnet

Head of Financial Engineering, FundQuest, BNP Paribas Group. Based in: Paris, France

“Given the current debate around the Greek bailout settlement, we are favouring equity risk in our core allocation. We have a fundamentally positive view on equities driven by our global economic view, relatively loose monetary policy and ample global liquidity. We are positive on emerging Asian equities as they should benefit from low commodity prices. There may be downward pressure on bond yields from the upcoming asset purchases by the ECB, but improving growth and inflation should limit any downward pressure on yields. In that respect, our preference goes to European investment grade corporate bonds.”

Peter Haynes

Investment Director, SGPB Hambros. Based in: London, UK

“European equities outperformed the US for the second consecutive month in February. US market sentiment continues to focus on the timing and velocity of monetary policy tightening whereas the renaissance of European equity markets has been driven by gradually improving trends in the eurozone, a weaker euro and the impending bond purchase programme by the ECB. We reduced our allocation to US equities following a sustained period of outperformance, adding the sterling-hedged JO Hambros Continental Europe fund as we expect the QE programme to support equities but maintain pressure on the currency.”

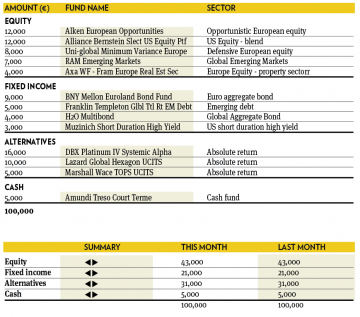

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“During February, the broad asset allocation remained unchanged. We added to the European equity holdings, through an actively managed fund, invested on both the British and continental large cap stocks, at the expense of the smaller companies that were previously in the portfolio. The massive flows of capital heading for European financial markets are inflating all asset classes on both the equity and fixed income spaces. Meanwhile, in order to profit from an ongoing euro depreciation, the FX exposure is kept at meaningful levels, mainly versus the US dollar.”

Toby Vaughan

Head of Fund Management, Global Multi Asset Solutions Santander. Based in: London, UK

“Given the combination of genuine improvement in European economic data, as well as the supportive ECB action and improving signs of political co-operation, we continue to like European equities and have increased our exposure (at the expense of high yield). The mixed macroeconomic signals in the emerging world, together with their sensitivity to any pick up in US interest rate expectations mean we retain our low allocation, though this is something we will reassess over the coming months. Our allocation to absolute return at the expense of lower allocations to sovereign bonds and cash remains.”

Peter Branner

Global CIO, SEB Asset Management. Based in: Stockholm, Sweden

“In a period of uncertainty where equity markets are heading, market neutral strategies can be a valuable element in a portfolio. Currently we hold BlackRock St-Eu Div E AR-A2S, a fund only focused on the European market. To get a more balanced exposure we exchange this for the global version of the same strategy, BlackRock Global Long/Short Equity Fund. This strategy is a new Ucits vehicle run by the same experienced team as the European fund. The clear advantage of the global product is that it has a much wider geographical scope providing a better balance and diversification in the portfolio.”