Fund selection - January 2016

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

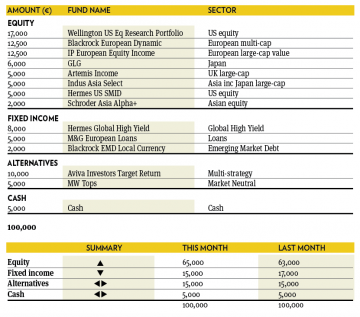

Giovanni Becchere

Senior portfolio manager - Multi management & Solution, AA advisors. Based in: Paris, France

“Equity markets have suffered in the first week of 2016, triggered by troubles in China and with disappointing industrial data that generated volatility. Even if in the short term developed markets remain vulnerable, we don’t expect the turmoil to have a durable or material impact on medium-term global growth prospects. We expect this episode of volatility to abate, based on the continuing economic recovery underway in the US and Europe, which is relatively immune to the risks linked to China’s economy. So, after having reduced the equity exposure in the last quarter of 2015, for the time being we remain on hold with no changes in both asset allocation and fund selection.”

Thomas Wells

Fund manager, multi-assets, CFA, Aviva Investors. Based in: London, UK

“In December we made one fund switch; redeeming out of Investec UK special situations, a distinctive value manager, and replacing them with Artemis Income, a more core proposition. As is our custom, we also used the market sell-off on the back of disappointment surrounding ECB president Mario Draghi to add equity risk, funded through a reduction in M&G European Loans. We still retain a sizeable position in this fund, however, we are conscious of market liquidity within space. Finally, as promised we will continue to be a selective liquidity provider adding risk as and when the market presents value opportunities.”

Gary Potter and Rob Burdett

Co-heads of multi-management, F&C Investments. Based in: London, UK

“The backdrop of the first increase in interest rates from the Federal Reserve since June 2006 and disappointment at the lack of additional monetary stimulus from the ECB compounded traditional December volatility, with markets swinging significantly in the month. The euro was a natural casualty of the news, falling significantly against most major currencies and in euro terms equities lost ground as a result. The Odey Odyssey fund was the worst performer of the selection falling 7.2 per cent, with the F&C Macro Global Bond fund the best but still losing 0.9 per cent. As we enter a new year we remain cognisant of the potential for muted economic growth to dampen market sentiment, with eyes ever focused on central bank activity, but we remain cautiously optimistic on the outlook over the year.”

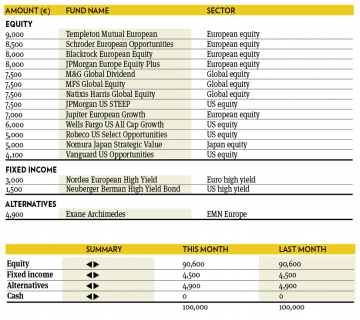

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“In December, the portfolio suffered a 4 per cent loss, closing the year with an absolute performance of 10.74 per cent. The best contributors for the month were Exane Archimedes and Nordea European High Yield. The worst performers were M&G Global Dividend, Natixis Harris Global Value and MFS Global Equities. We expect equity markets to be choppy in 2016, while we see value rising in high yield and emerging assets. We will rotate our positioning to take advantage of changing trends in due course. We kept the portfolio unchanged during the month: we still prefer equities, high yield and alternatives to government bonds and cash.”

Sebastien Bonnet

Head of Financial Engineering, FundQuest, BNP Paribas Group. Based in: Paris, France

“Equity markets were underperforming at the end of the year, with the MSCI AC World index posting a monthly fall of 1.9 per cent and emerging markets (MSCI Emerging) dropping 2.5 per cent, with both indices expressed in dollars. However, we keep a substantial amount of risk in the portfolio. In general we believe in a low growth and low inflation environment for 2016, which should favour US and European high yield bonds.”

Peter Haynes

Investment director, SGPB Hambros. Based in: London, UK

“December saw the first rate rise in the US since 2004. This move – so long delayed – was followed by a rally as equity markets realised that the pattern of unexciting growth in the developed world was unlikely to be threatened by the prospect of modest and slow increases in rates. 2016 looks likely to be another year of reasonable growth and low inflation in the developed world. Normally, this is a reasonable backdrop for profits and therefore equity investors. This relatively benign picture will be disturbed from time to time with uncertainty about the pace of growth in China, friction in the Middle East, stress in the energy part of the high yield bond market, the British referendum, and the potential for disruption in the oil price being some of a number of potentially destabilising factors. Within the portfolio, we switched the Fidelity Moneybuilder into a long dated US Treasury ETF as a hedge against further sterling weakness.”

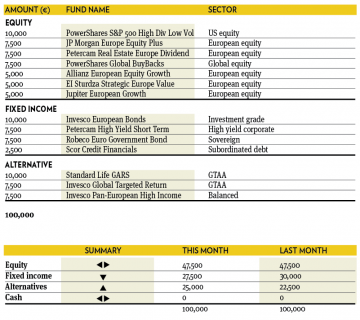

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“The balanced portfolio had changes on both the asset allocation and the fund selection over December. On the latter, an extra actively managed fund has been added in the European equity space, allowing us to diversify the investments some more in an area where the differences between stocks are very important. In US equity, the exposure has been changed from a high growth bias to a defensive, low volatility stance. In addition, the remaining Asian equity has been sold. Finally, on the fixed income side, duration has been reduced and the proceeds added to the alternative funds.”

Toby Vaughan

Head of Fund Management, Global Multi Asset Solutions Santander. Based in: London, UK

“Despite recent volatility we are not looking to reduce our risk asset exposure as while the risks from the emerging world, China and commodities are clear, the developed market economic cycle remains intact and some of our tactical indicators are approaching oversold territory. We have made some changes within the target model within equities to ensure our favoured markets (Europe and Japan) are allocated to sufficiently. Equity returns are likely to be moderate in aggregate, but we believe these two markets have more return potential given a superior earnings outlook, accommodative policy environment and more favourable valuations.”

Peter Branner

Global CIO, SEB Asset Management. Based in: Stockholm, Sweden

“Finding attractive fixed income investments is difficult in the current low rate environment. In search for yield the more flexible strategies tend to move into credits and sometimes also into currencies and convertibles. This makes good pure bond investments a scarce resource but Robeco Lux-O-Rente is one of them. The philosophy of the fund is that price data from related markets have a certain prediction power on bond returns. The investment process follows a rather simple quantitative model using factors such as inflation, monetary policy and trend. The fund invests only in government bonds in Japan, the US and Germany. With inception in 2006, the fund has a long track record and has shown stability in performance. We diversify the fixed income part of our portfolio by adding Robeco Lux-O-Rente and finance this by reducing the allocation in the Black Rock Absolute Return Bond fund.”