Fund selection - November 2016

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“The effect on the overall economy of the earnings recession observed in the energy and materials sectors is now behind us, as oil and commodities have rebounded substantially. Stocks are now offering appealing medium-term returns at a time when risk has increased in bond markets and cash is yielding only marginal returns. These considerations lead us to increase our equity allocation mainly at the expense of fixed income. Within equity we increase the exposure to value managers in both the US and Europe, on the back of the improving economic environment and the increasing expectations of stronger growth in both regions. At the same time we trim the allocation to alternative investments while concentrating the positions in our strongest conviction represented by Marshall Wace.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“October saw a long-awaited steepening of yield curves as markets began to price in higher inflation expectations globally. Despite this, we believe returns within developed rates continue to be asymmetrically skewed to the downside. Our portfolio has been relatively insulated from this rates sell-off, given our fixed income exposure remains relatively short duration (global high yield) or emerging market related. We made no portfolio changes, but remain ready to add risk should markets present any buying opportunities.”

Gary Potter and Rob Burdett

Co-heads of multi-management, BMO Global Asset Management. Based in: London, UK

“Markets made positive ground over the month in the main, despite a surge of concern regarding inflation and continued uncertainty on the political outlook. Bond markets repriced at the prospect of future central bank responses to rising prices though opinion in the market remained mixed on the future path of both. Sterling suffered falls as Q1 was announced as the likely trigger for Article 50. Japan was the strongest of the major equity markets with the Schroder ISF Japanese Opportunities compounding the returns of its base market as the best performer of the selection. Conversely the UK market fell the most thanks in the main to the currency falls early in the month. The Odey Absolute return was the worst performer of the selection. With the US election early in November we expect volatility to continue from here.”

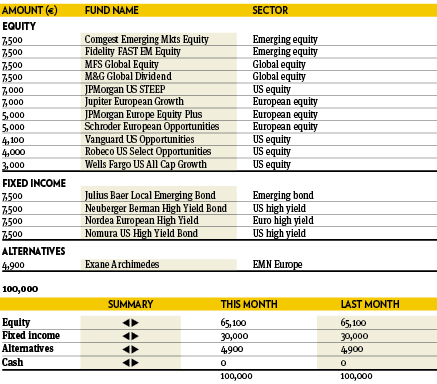

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“The portfolio ended the month marginally up. Positive contributions came from Nomura US High Yield Bond, Comgest Emerging Markets Equity, Neuberger Berman High Yield Bond and Julius Baer Local Emerging Bond. Detractors were Jupiter European Growth, Vanguard US Opportunities and Wells Fargo US All Cap Growth. Albeit cognisant of the risks arising from a possible unexpected outcome from the US elections, we are also confident in our managers and current asset allocation, and prefer to stand short-term volatility rather than closing risks at this time. We made no changes to the portfolio and continue to prefer equities and credit to government bonds.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“Guided by investor concerns over higher interest rates, major equity markets continued to struggle, moving sideways more than demonstrating a strong trend. Japanese equities were the only exception supported partly by the weakening yen. Bond markets were dominated by tensions with regards to the inevitable interest rate hike by the Fed and the future of the asset purchases programme by the BCE. In an investment climate marked by uncertainties over the course of monetary policy, bond yields and political developments, we have left our prudential asset allocation unchanged.”

Peter Haynes

Investment Director, SGPB Hambros. Based in: London, UK

“Sterling continued to be under pressure in October ending the month at a new low of 1.22 versus the US dollar. The weakness in sterling since the vote to leave the European Union has lead to fears of higher inflation given the UK’s dependence on imported goods. Against this background, bond yields rose quite sharply during the month with the yield on the 10 year benchmark gilt rising to 1.24 per cent from 0.75 per cent at the end of September. Within the portfolio, the GLG Japan Core Alpha was the best performing equity fund helped by yen weakness versus the US dollar during the month.”

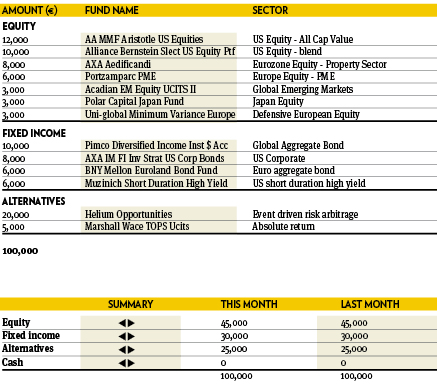

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“The balanced portfolio has been reshaped meaningfully during October as, despite a tame volatility on the overall indices, major moves have been recorded on the market behaviour. First, diversifying assets have been increased on the equity side, at the expense of European stocks: gold mines and emerging markets. Second, as corporate high yield spreads increased, albeit mildly, their weight has been increased at the expense of a global macro portfolio that has been losing money over different market configurations. The bottom line is the portfolio is ending the year with a more diversified profile than before.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“IPM Systematic Macro is a diversified, market neutral hedge fund. What characterises this fund is that it does not rely on directional positioning, instead it assesses the relative attractiveness and exploits the discrepancy in fundamentals by taking long and short positions. All investment ideas, once introduced to the model, are still active. What varies over time is size and direction, i.e. longs or shorts. We believe this demonstrates robustness and a consistent investment process aiming to deliver. The fund comes with a substantial amount of risk, still low correlation to other funds, benefiting the alternative part overall. We take a position of 4 per cent, financed from the other hedge funds.”