Fund selection - June 2017

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

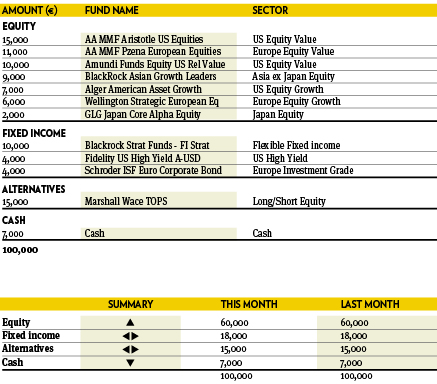

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“The positive momentum in the global economy should continue, as Europe and emerging markets take over from the US as the engines of growth. Despite a possible slowdown in China, the global recovery has become self-sustaining. In this environment, supported by low interest rates and expectations for double-digit earnings growth, we maintain our overweight in equities with a regional preference for Europe and emerging markets. We prefer value-oriented strategies as in the mid-long term they will benefit the most from the economic recovery.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“Markets continue to grind higher with the S&P and Nasdaq reaching record levels. Interestingly, we have seen a significant style shift within markets. Immediately post-Trump the reflation trade resulted in value sectors such as banks outperforming with defensives lagging and duration selling off. This has now reversed. Japanese banks, for example, having been 20 per cent ahead of the market are now flat to the Topix. This reversal, while negatively impacting GLG Japan, helped Baillie Gifford and demonstrates the benefit of style blending managers.”

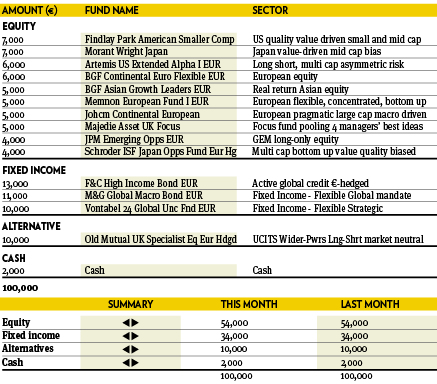

Gary Potter and Rob Burdett

Co-heads of multi-management, BMO Global Asset Management. Based in: London, UK

“The victory of Emmanuel Macron and subsequent sense of relief was most notable in currency markets as the euro strengthened against major currencies. Economic data supported the move with a generally positive tone as did corporate Q1 results, though political tensions remain at the fore of investors’ minds. The euro-hedged Schroder ISF Japan Opportunities fund was the best performer. The CF Odey Absolute Return fund has been replaced by the Old Mutual UK Specialist Equity Eur Hedged fund in the model.”

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“The portfolio ended May roughly flat. The main contributors were Fidelity FAST Emerging Markets, Jupiter European Growth, Fidelity European Dynamic Growth and Comgest Emerging Markets Equity. Main detractors were JPM Highbridge US STEEP, Robeco US Select Opportunities, M&G Global Dividend and Nomura US High Yield. For the second month in a row, it was our exposure to the US dollar that detracted most, while the returns of pretty much all the funds were positive in local currency. We made no changes to the portfolio.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“The recent dip in equities was modest; markets have recovered in emerging countries and the US despite this context of political turmoil. We have decided to slightly reshuffle our US equity exposure by increasing growth bias (through Morgan Stanley US Growth fund) and by reinforcing the global technology thematic.”

Peter Haynes

Investment Director, Kleinwort Hambros. Based in: London, UK

“Yet again, politics dominated the headlines during May, nowhere more so than in the UK. When the snap general election was announced in May, sterling reacted positively and opinion polls predicted the Conservatives would substantially increase their majority. Towards the end of the month, polling data suggested the result could be much closer and sterling depreciated sharply against the dollar. None of this prevented equity markets grinding higher and ironically, the UK FTSE 100 was the best performing developed market.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“The broad asset allocation has been kept unchanged though changes have been made within both the equity and fixed income allocations. Profits have been taken in the European stockmarkets and reinvested in Asian and US markets. The credit and high yield exposures have been marginally increased as duration had paid off quite well. The underlying investments mostly achieved their objectives though our US high dividend stocks ETF has been struggling for a while as a handful of high growth, mostly IT, stocks are leading the market by a wide margin.”

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers, Based in: Bristol, UK

“There are still plenty of reasons being touted as to why investors should be afraid, but instead they are pushing the buy button. We have seen strong performance recently from the European bloc and the unloved UK market is making good headway. Equity analysts got behind the curve and are having to upgrade company earnings expectations. My colleague, Mark Dampier, often says people underestimate their home market. I agree, especially given the quality of managers that can be backed across Europe. There has been no change to weights or asset allocation.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“JO Hambro Global Select is managed by Christopher Lees and Nudgem Richyal. Contrary to most mangers, the fund is comprised of a concentrated number of thoroughly selected holdings analysed from a top-down perspective. The fund has struggled year-to-date due to the macro-driven sell off in commodities., but they are positive on this sector. The fund is growth-seeking which is mainly expressed through recovery growth in the material sector and structural growth represented by the technology sector. The equity part of the portfolio is well diversified. We keep our positions.”