Fund selection - November 2015

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Julien Mechler

Chief investment officer, AA advisors. Based in: Paris, France

“After a turbulent summer, it appears to be back to normal in equity markets. Inflows have also returned, as recession fears faded. We continue to believe in a scenario calling for moderate economic growth in the medium term. In terms of monetary policy, the ECB and Federal Reserve are continuing to head in different directions. The ECB signals it is adding more stimulus, while the US policymakers are giving hints that the hiking cycle could start sooner than expected. In this context we maintain the overweight in equities with a bias towards growth, waiting for more visibility on monetary policy before switching toward value."

Thomas Wells

Fund manager, multi-assets, CFA, Aviva Investors. Based in: London, UK

“Our decision to not underweight risk assets in September proved very fortuitous with the equity markets’ rally in October recovering nearly all ground lost over the summer. We did, however, take the opportunity to close out one of our most profitable trades – an underweight in emerging markets – by trimming an overweight to Japan. While recognising there are structural issues within some areas of emerging markets, in our view the level of pessimism is overdone, and with valuations and FX both at interesting levels we have made an investment in the BlackRock EMD local currency fund. Although we remain optimistic on the Japanese equity market, we are cognisant on the scale of its outperformance performance over the last two years and hence are happy to book profit here."

Gary Potter and Rob Burdett

Co-heads of multi-management, F&C Investments. Based in: London, UK

“Markets rebounded significantly in October from the falls of the previous month as risk appetites returned thanks to a stabilisation in Chinese economic data and generally dovish rhetoric from the world’s central banks. Comments from ECB President Mario Draghi suggesting further stimulus may come in December caused the euro to weaken, which in turn compounded already strong runs from asset markets. Japan led main market bourses higher with a 12 per cent gain in euro terms – the Morant Wright Japan fund matched the returns of its underlying market as the best performer of the selection. Conversely the UK market was the worst, but still a respectable performer gaining 8 per cent. With bonds gaining modest ground relative to equities the fixed funds in the selection fared worst, but still made positive ground. We have replaced the Normura Japan Strategic Value fund with Schroder ISF Japan Opportunities. With the predicted volatility materialising we remain cautiously optimistic as we move closer to year end.”

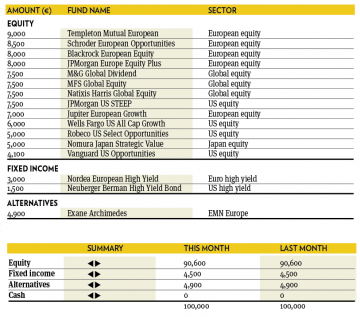

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“In October, equity markets came back up with a vengeance and our portfolio followed suit. The only fund that posted negative results was Exane Archimedes, while global equity funds like Natixis Harris Global Equity and M&G Global Dividend recorded performances in excess of 10 per cent (in euro terms). Vanguard US Opportunities, following a little setback caused by the prolonged turbulence in the biotech industry, is slowly regaining the ground it lost in September. We kept the portfolio unchanged during the month: we still prefer equities, high yield and alternatives to government bonds and cash.”

Sebastien Bonnet

Head of Financial Engineering, FundQuest, BNP Paribas Group. Based in: Paris, France

“Since the end of the summer, the main sources of market concerns have been the slowdown of the Chinese economy and the uncertainty surrounding the normalisation of the Federal Reserve’s monetary policy. The Chinese market is at more of an inflection point than previously in our view, but has definitely not yet reached a breakout situation. The expected rate hike in September was delayed as a result of the global and US economic slowdowns, which appear unlikely to change, given the poor outlook for growth. In that context, we still believe the allocation is favourably positioned to comfortably adapt to these changes.”

Marie-Alix de Grully

Portfolio Manager, SGPB Hambros. Based in: London, UK

“October saw a strong increase in optimism with markets rebounding strongly from their September lows. Several central banks, including the ECB and the People’s Bank of China, reiterated their message for supportive monetary policy, boosting confidence. In Europe, we saw good data implying a strengthening economic environment. There was a sharp turnaround in sentiment for materials and mining stocks: they were among the strongest performers after having lagged in the previous months following concerns around the slowdown in Chinese growth and the continued fall in commodity prices. Within the portfolio, we have been unhedging our position in the Japanese equity fund GLG Japan Core Alpha as we now think any further yen weakness is limited. We have also been using cash to increase our equity exposure, investing in the Henderson Global Technology fund as prospects for technology remain favourable.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“The balanced portfolio kept the overall asset allocation unchanged. Several changes have been made in both the fixed income and the equity side. In fixed income, a financial debt holding has been reduced as the investment team of the fund has changed of late. In the equity holdings, an extra investment has been added, focusing on high dividend real estate stocks listed in Europe. Lastly, after the serious drawdown experienced during the previous quarter, the investments in emerging Asia have been increased a tad. However, Europe remains by far the major region of investment.”

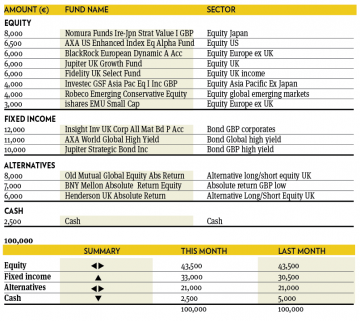

Toby Vaughan

Head of Fund Management, Global Multi Asset Solutions Santander. Based in: London, UK

“The combination of a more supportive policy environment (in China and potentially Europe), continued resilience of economic data, and renewed risk appetite from oversold levels all mean we are happy to maintain our allocations to risk assets, albeit within a highly diversified strategy. Equity weightings remain at just more than 40 per cent and we moved some of the allocation from cash into high yield due to the attractive valuations in that area following the widening of spreads over the summer. We have limited changes to specific managers and we continue to maintain the material position in absolute return focused strategies due to the lower expected returns from sovereign bonds.”

Peter Branner

Global CIO, SEB Asset Management. Based in: Stockholm, Sweden

“Over the last couple of months we have been looking for a replacement for our event-driven hedge fund position where our current holding, Morgan Stanley PAM Global Event, has had a high correlation to event indices which can be accessed through passive instruments. We have searched for a manager with more focus on pre-announcements opportunities and have found Pictet Agora. The strategy is focused on potential future events and other triggers, which are expected to release significant shareholder value in short periods of time, while at the same time maintaining a very low correlation to the equity market. The portfolio manager Elif Actug has proven to have a high ability to identify such opportunities and with her long proven experience we expect that to continue. We therefore add Pictet Agora to the portfolio and sell Morgan Stanley PSAM Global Event.”