Fund selection - October 2018

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Head of Multi-Assets, ABN AMRO Investment Solutions. Based in: Paris, France

“The global economy is humming along, supported largely by the US, while Europe and emerging markets are lagging. The US has seen GDP growth of 4.2 per cent in Q2, supported by fiscal stimulus and tax reductions. This positive scenario has, in turn, fed company earnings growth and fuelled US stockmarket highs. Even if Europe is lacking similar positive impulses, we believe the big picture remains for steady global growth to continue well into 2019. In this environment, we continue to prefer stocks over bonds and keep our portfolio unchanged.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“Notwithstanding the best efforts of Italian politics to upset markets on the last trading day of the month, September was positive for the portfolio. We saw a rebound in risk assets outside the US with particularly strong performance from our Japanese equity managers. We add to Artemis Income, our UK equity manager, from cash on the back of some recent style and asset class weakness. Despite a 10 per cent depreciation in sterling versus the dollar since April, UK equities have lagged other developed markets. We would expect this to reverse.”

Gary Potter and Rob Burdett

Co-heads of multi-manager, BMO Global Asset Management. Based in: London, UK

“Investors sentiment remained subdued in September as politics continued to dominate headlines, though economic data remained supportive as did central bank actions and statements. Markets made positive ground on the whole with Japan leading the pack – the Schroder ISF Japanese Opportunities was the best performer. BGF Asian Growth Leaders was the worst as Asia suffered with a resolution to the trade discussions between China and the US remaining elusive. This fund has been sold in the model, replaced by the CC Asia Focus fund.”

Silvia Tenconi

Multimanager Investments & Unit Linked, Eurizon Capital SGR. Based in: Milan, Italy

“In September, the performance of the portfolio was marginally positive. Top contributors were M&G Global Dividend, Comgest Emerging Markets Equity and Eastspring Japan Dynamic Fund. The biggest detractors were Jupiter European Growth and Investec Asia Pacific Equity. We still think equities are the best allocation this year, and keep our exposure. We are tempted to increase exposure to emerging assets, given their low valuation, we are still cautious on this asset class. We made no changes to the portfolio during the month.”

Jean-Marie Piriou

Head of quantitative analysis, FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“After its recent rebound, we decided to take profits on H2O Multibonds and to reshuffle the fixed income bucket in the portfolio. Emerging market debt currently offers good potential returns. Thus, we introduce the Barings Emerging Markets Local Debt Fund. We also take the opportunity to diversify our allocation by investing in US senior loans and extend high yield investments to other regions.”

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown Fund Managers. Based in: Bristol, UK

“Ongoing negativity surrounding our industry coupled with turbulent politics and economics mean it’s amazing any private client invests at all. Yet I started my PWM portfolio in August 2016 and while a couple of funds have suffered small loses, by far the majority have delivered positive and sometimes fantastic returns. Lindsell Train has achieved more than 50 per cent, while Marlborough Micro, Findlay Park, Man GLG Japan and JO Hambro delivered between 25 and 50 per cent. The market often catches out the pessimist and certainly has in the last two years.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

A number of changes have been made. A global macro fund has been redeemed as its process has been unable to navigate the rising rates environment. Second, a balanced pan-European fund has been replaced by its globally diversified equivalent, as higher interest rates in the US are now way more attractive and justify an extra layer of currency exposure. Overall, the year is proving quite challenging for multi asset funds as all non-US assets are mostly having a difficult time. In the equity space, many actively managed funds are outperforming this year.”

Paul Hookway

Senior Fund Analyst, Kleinwort Hambros. Based in: London, UK

Value versus growth in the US was the big debate in September. Should we capitulate and switch Robeco US Premium Equities into a ‘growth’ fund or switch Janus Henderson Global Technology into a new ‘value’ fund. There’s plenty of research to support adding more value, though it is mostly backward looking. It doesn’t take into account disruptive innovation driven by technology adoption. This was not present in previous cycles. Value may be cheap for a reason, with limited chance of recovery.We maintain our current allocation, but the debate will continue.”

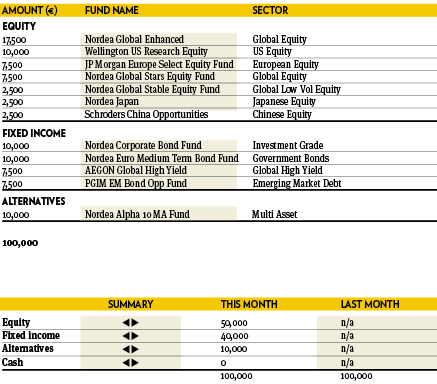

Lea Vaisalo

Chief Portfolio Manager, Nordea investments. Based in: Copenhagen, Denmark

“Robust global growth, underpinning solid earnings growth and prospects for higher yields, favours an equity overweight. Within equities, we recommend an overweight in China and underweight in Europe despite recent volatility. For fixed income, with little value to be had overall, we keep an underweight versus equities. Within the different bond segments, we presently find nothing that stands out on a relative basis and stick to the neutral call across the bond classes. We seek to balance our factor tilts by allocating to multi-asset style premia within alternatives.”