Fund selection - September 2016

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

Giovanni Becchere

Senior Portfolio Manager - Multimanagement & Solution, AA Advisors. Based in: Paris, France

“The number of positive dynamics in emerging markets has been increasing. Commodity prices are stabilising, emerging markets currencies have strengthened and the outlook for commodity-exporting countries is gradually improving. Structural reforms are also on the rise. At the same time, developed markets have been negatively affected by slower than expected growth, political uncertainty in Europe and the potential consequences of the Brexit vote. In this context we increase our exposure to emerging Asia at the expense of developed markets. At the same time we replace Fidelity South East Asia with the high conviction and flexible BlackRock Asian Growth Leaders.”

Thomas Wells

Fund Manager, Multi-assets Aviva Investors. Based in: London, UK

“One of the greatest challenges as a fund manager is to do nothing. Having de-risked the portfolio in April and subsequently seen a post-Brexit rally, there is a temptation to chase it and add risk. This would be a mistake. Whether it is rates, credit or equities, markets are expensive and there is no clear improvement in fundamentals; the only support for asset prices is a continuation of Central Bank intervention. As difficult as it may seem, now is the time for taking stock and waiting for more compelling opportunities. Hence in August we made no portfolio changes.”

Gary Potter and Rob Burdett

Co-heads of multi-management, BMO Global Asset Management. Based in: London, UK

“In a quiet month markets ground higher with Asia leading the pack, though the Majedie UK Focus fund was the best performer of the selection. Conversely, North America, while making mild positive returns, was the worst performer though the CF Odey Odyssey fund was the laggard of the selection. Currencies were unexciting without central bank rhetoric to stir up sentiment. The one area of volatility was the oil price which gained 20 per cent from low levels in the month amid talks of production cuts. As we move into the final months of the year markets will likely increase their focus on the forthcoming US election in November, with France and Germany also going to the polls in 2017. After a quiet period, we expect volatility to pick up from here.”

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“The portfolio posted positive results in August, taking advantage of the receding risk aversion. Main contributors were the high yield funds, both the US and the European ones (Neuberger, Nomura and Nordea). The global equity funds were a positive too, with M&G Global Dividend outperforming its benchmark for the month.The biggest detractors were JPM Highbridge US STEEP, also due to its high allocation to utilities, and the emerging markets equity funds, Comgest and Fidelity FAST, strongly underperforming their benchmark. We made no changes to the portfolio and continue to prefer equities and credit to government bonds.”

Fundquest Advisor Management Selection Team

FundQuest Advisor, BNP Paribas Group. Based in: Paris, France

“Financial Markets were in a status quo since the post-Brexit rebound, but remained tense following the crude oil price drop (under $40 at the beginning of August) and expectations of a Federal Reserve rate hike. In this environment, keeping some equity risk in the portfolio can help benefit from arising opportunities and diversification gains – MSCI EM overperformed by 2.3 per cent in August.”

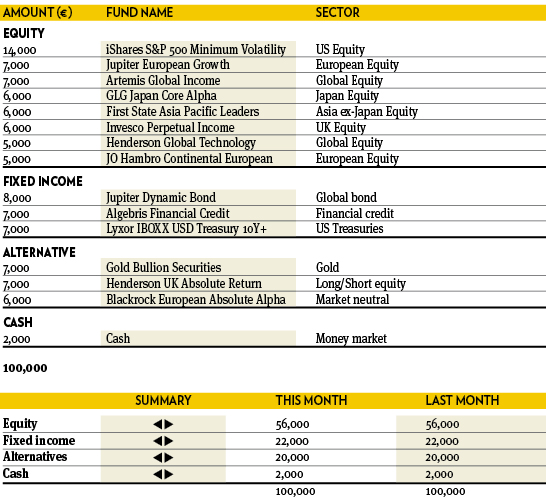

Peter Haynes

Investment Director, SGPB Hambros. Based in: London, UK

“The UK decision to leave the European Union continued to dominate financial markets as investors considered the longer-term implications of the weakness in sterling and future monetary policy. Bond markets continued their upward trajectory as the likelihood of any interest rate rises have now been pushed firmly into the distance. Equity markets were generally higher, continuing the post-Brexit rally at the end of June with emerging markets and Japan leading the way. At the sector level, US large cap technology companies performed strongly and as such, Henderson Global Technology was the strongest performer during the month.”

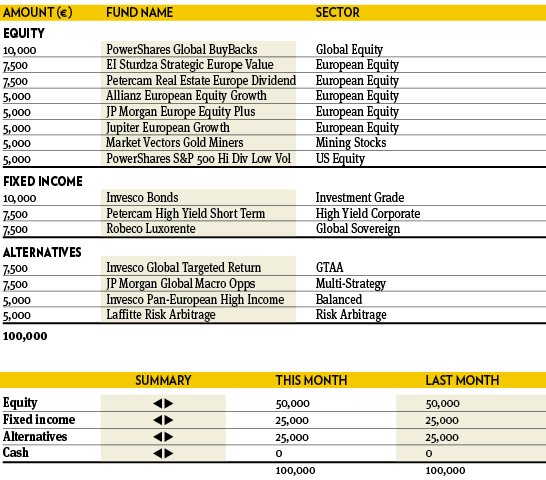

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“The balanced portfolio kept an unchanged asset allocation in August. We did trim the high performing high dividend US stocks and added to gold miners and European stocks, which continue to be hit by outflows. The alternative investments are behaving very differently from one fund to the other, the most beta-exposed outperforming the others, with a much higher volatility. The pure arbitrage funds have been struggling to perform over the year and remain a drag on the overall performance of the portfolio, when compared to stocks and bonds.”

Lee Gardhouse

Chief Investment Officer, Hargreaves Lansdown fund managers . Based in: Bristol, UK

“For our portfolio, what hurt immediately following the referendum vote is what has been helping most since. Sterling has shown some strength and small and mid-sized UK equities have been the best area of the market. Our structural bias to managers selecting shares in this area has been beneficial to performance with JO Hambro UK Equity Income and Marlborough UK Micro-Cap Growth leading the charge. GLG Japan Core Alpha is also worthy of mention this month as it delivered an 8 per cent return against an index that fell marginally. We have backed this manager since 2007, and while you have to accept periods of strong out and underperformance the long term results have been exceptional.”

Peter Branner

Global CIO, SEB Asset management. Based in: Stockholm, Sweden

“The Pictet Total Return – Agora Fund is an event-driven market neutral hedge fund. The three man investment team utilises a catalyst-driven approach to the European market, leading to a high conviction portfolio of investment strategies. Each strategy is hedged individually to extract alpha by isolating idiosyncratic risk. The track record is strong and more than a decade long. The market has been macro-driven overall this year and as the Pictet team is very much focused on bottom-up fundamentals we are satisfied with the result even though it has not been as strong as usual. We trust the team’s ability to deliver uncorrelated returns for us as soon as the market turns in favour and we stay with the position.”