The 2019 CBI Index: Key findings - Caribbean remains on top

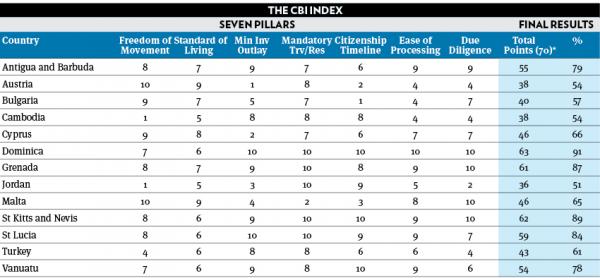

The CBI Index’s key findings present an evaluation of each country both overall and within the parameters of the seven pillars

The CBI Index is intended as a practical tool both for those who wish to compare citizenship by investment programmes as a whole and for those who, instead, value certain aspects of a programme more than others. These elements are reflected by the seven pillars of the CBI Index: freedom of movement, standard of living, minimum investment outlay, mandatory travel or residence, citizenship timeline, ease of processing, and due diligence.

Pillar 1: Freedom of Movement

European nations continue to offer the highest number of countries and territories to which citizens can travel visa-free or with a visa-on-arrival, as well as free travel to the highest number of business centres. Austria and Malta scored 10 each, with Bulgaria and Cyprus just behind at nine. This distinction is primarily due to Austria and Malta being part of the Schengen Area, and thereby benefitting from a comprehensive common visa policy and a reciprocity mechanism for countries with visa exemptions. Neither Bulgaria nor Cyprus, for example, can offer visa-free travel to the United States, a primary business hub.

Further reading

The next highest-scoring group is formed by the Caribbean states, with Antigua and Barbuda, Grenada, St Kitts and Nevis, and St Lucia each awarded eight points. This follows a significant push on the part of their Foreign Ministries, and in particular that of St Kitts and Nevis, to expand simplified travel offerings for citizens.

Citizens of St Kitts and Nevis and St Lucia have access to 15 out of 20 business hubs selected for the 2019 CBI Index, while citizens of Antigua and Barbuda, Dominica, and Grenada can access 14. In total, Dominica has slightly fewer destinations in its list than its Caribbean counterparts, bringing its score to seven – the same score achieved by Vanuatu. For both these countries however, the trend seems to be one of increasing visa-free and visa-on-arrival destinations.

There was no significant shift in the scores received by Turkey, four, or Cambodia and Jordan, both of which received minimum scores. Jordanians can only access one CBI Index business centre, while Turkish citizens can travel freely to five.

Pillar 2: Standard of Living

As in 2018, Austria and Malta both received top scores in this pillar. Their high life expectancy, safety levels, and ability to uphold basic freedoms propelled them to first place, as did their scores in expected years of schooling and economic stability. Austria performed better with respect to gross national income per capita, but Malta fared better with respect to GDP growth.

Cambodia was the only country to get the top score for its rate of GDP growth, as its economy continues to grow at above seven per cent per annum. Overall however, Cambodia failed to achieve high scores with respect to national distribution of wealth, citizens’ liberties, and educational prospects.

First place in expected years of schooling is occupied by Grenada, where the average man or woman is educated for 16.9 years. The high standard of primary and secondary education in the country is achieving greater recognition from the international community, as is Grenada’s medical and veterinary school: St George’s University. With a robust history of education and a multitude of schooling centres, Austria, Bulgaria, and Malta followed closely.

The effects of Hurricane Maria, which at the time caused losses of 226 per cent of the country’s GDP, still impact Dominica’s economy today, something that is reflected by a subdued gross national income. However, its lush vegetation and investment in clean energy positions it as the best Caribbean nation for life expectancy, coming in behind Austria and Europe’s Mediterranean nations, and scoring the same as Turkey.

Overall, Antigua and Barbuda joined Grenada to rank top of the Caribbean nations, rising due to its increasingly developed business infrastructure and growing property market. Turkey’s score fell by one, largely down to low economic growth and citizens’ freedom. Bulgaria too experienced a slight worsening, dropping from eight points to seven primarily because of faltering GDP growth. The lowest scores went to Cambodia and Jordan, despite these countries scoring highly for safety.

Pillar 3: Minimum Investment Outlay

In offering citizenship to successful applicants in exchange for a $100,000 contribution, both Dominica and St Lucia attained a perfect score. Antigua and Barbuda also proffers an investment option of $100,000, but continues to apply a significant government fee of $25,000, meaning that, in reality, Dominica and St Lucia provide the most affordable citizenship options.

Having first sought to follow the pattern set by the more expensive European programmes, Turkey has now cut its minimum investment threshold by 75 per cent to $250,000. This significant volte-face, and the many applications that were recorded by the Turkish Government in its aftermath, may be an indication of what minimum investment outlay – i.e. one in the low hundreds of thousands of dollars rather than the millions – is more likely to balance a nation’s investment needs with the spending capability of prospective applicants.

For the 2019 edition, the CBI Index assessed the Vanuatu Development Support Programme (DSP) rather than the Vanuatu Contribution Programme (VCP). This is because the DSP was converted into a full citizenship programme (rather than an honorary citizenship programme) in order to attract investment from a broader market. At $130,000, the DSP is slightly less expensive than the Grenada and St Kitts and Nevis programmes, which offer citizenship to single applicants donating $150,000.

At the same time, Cyprus bucked this trend and increased its investment requirements in May 2019 by introducing two additional €75,000 donations either in socioeconomic initiatives supporting the building of affordable homes, or to the Research and Innovation Foundation.

Although Malta’s nominal minimum investment amount did not change from 2018 to 2019, the present strength of the US dollar against the euro meant it scored higher this year than it did in the 2018 CBI Index. Austria, Bulgaria, and Cambodia did not vary their investment requirements and were accorded the same scores as in 2018 – currency exchange rates having had little impact. Jordan also maintained its $1m minimum investment outlay.

Pillar 4: Mandatory Travel or Residence

Five countries dominate this pillar: Dominica, Grenada, Jordan, St Kitts and Nevis, and St Lucia. Applicants to these programmes do not need to travel to or reside in the country before, after, or during the citizenship process. In the Caribbean, this is justified by the use of enhanced due diligence procedures, which include in-situ travelling by third party firms to the applicant’s country of residence or birth. This does not imply, however, that jurisdictions discourage their economic citizens from visiting for pleasure or to connect with their new home.

Austria, Cambodia, Turkey, and Vanuatu each received a score of eight due to their one-time travel requirements. Turkey requires applicants to visit the nation to provide biometrics to obtain a residence card. Vanuatu mandates a one-visit trip to attend an oath signing ceremony. Currently, applicants have some flexibility over where they can travel to, as the ceremony can be held in Dubai, Hong Kong, or Singapore. Vanuatu is also currently considering London as an additional oath-signing destination – something prospective applicants will be monitoring over the coming year.

Antigua and Barbuda and Bulgaria were awarded commendable scores, with Antigua and Barbuda losing some points for its five-day residence requirement but not for its oath of allegiance travel requirement, as, in practice, applicants complete the oath at the same time as they fulfil the residence requirement.

Malta, however, lagged with this pillar’s lowest score due to its significant residence and travel requirements. Two separate trips must be made to the country (to provide biometrics and take the oath of allegiance), and applicants must spend a minimum of 12 months on the island before they can receive citizenship.

Although Cyprus may seem to present a heavy residence burden by requiring applicants to hold a resident permit for at least six months, there is no physical presence requirement attached to the permit. Applicants must, however, visit the nation twice, once to provide biometrics and once to take the oath of faith.

Pillar 5: Citizenship Timeline

Jumping significantly from its 2018 score, St Kitts and Nevis joined Dominica and Vanuatu as one of the fastest citizenship by investment programmes in the world, scoring full marks and leaving behind the delays caused by the sudden influx of applicants to its Hurricane Relief Fund.

Processing times in Dominica and Vanuatu are typically under two months; St Kitts and Nevis, whilst periodically reaching three months, offers an accelerated route for applicants who pay a premium. St Kitts and Nevis remains the only citizenship by investment nation to provide such an option to its applicants. In Dominica and St Kitts and Nevis, faster processing times reflect both decades-long experience in the industry and the multitude of mandated due diligence firms that provide additional processing resources. Vanuatu’s speed should be monitored in the coming year as the DSP is expected to attract more applicants, likely resulting in slower processing if current quality controls are to remain at the same level.

Jordan and St Lucia placed second with nine points. With its relatively new programme, Jordan may experience longer processing times going forward if demand from investors increases.

Grenada climbed by two points to eight – the result of increased focus on processing following significant waiting times last year. Cambodia also increased its score from seven to eight, while Antigua and Barbuda and Cyprus each scored six.

Since the 2018 CBI Index, Turkey’s ranking has slipped due to mounting applications numbers and, consequently, speed being far less of a guarantee. Despite this, it is considerably faster than Malta (which takes around 13 months), Austria (two years), and Bulgaria (three to five years, depending on the investment option chosen by the investor). These three countries are the slowest citizenship by investment programmes.

Pillar 6: Ease of Processing

As has been the case since the launch of the CBI Index in 2017, the Caribbean programmes achieve high scores across the board under this pillar, reflecting their straightforward and highly streamlined processing systems. The region has long led the way in collaboration and information-sharing, which has enabled the programmes to apply similar processing models and offer greater transparency.

This is generally due to longevity and countries’ willingness to refine their programmes. However, not all programmes offer the same stability to applicants. In St Lucia, for example, it is unclear which – and when – real estate options will be made available for investment.

Vanuatu also ranked highly, having no interview, business experience, language, or culture and history requirements. The improvements to the DSP and the guarantee of full citizenship are positive steps towards improving processing and certainty, yet, in June 2019, four economic citizens had their citizenship revoked. The precise reasons behind the revocation, and the due process procedures that were applied, are still unclear.

Europe’s programmes attained a range of scores. Each of them, except for Austria, requires applicants to invest in tangible assets, such as real estate, or intangible assets, such as government bonds. These investments demand time and extensive documentation. Jordan and Turkey also require proof of complex investments. For example, in Jordan, an applicant can choose between investing in small and medium-sized enterprises, treasury bonds, securities in an active investment portfolio, or a project creating at least 20 jobs, or depositing funds in a non-interest-bearing account at the Central Bank of Jordan.

In the past year, Bulgaria, Cyprus, and Malta all received criticism from intergovernmental European bodies, which cast some doubt on the continuance of their programmes. Indeed, Bulgaria announced it would end its Immigrant Investor Programme, although this was not followed in practice. It also suffered from allegations of wrongdoing by government employees and the potential withdrawal of passports from economic citizens.

Turkey rose by one place to a respectable six points as it improved engagement with applicants, a development reflected in the approximately fivefold increase of firms marketing the country’s programme. Cambodia and Austria are last due to the lack of readily available information on their programmes, as well as more exacting requirements, such as a language test and history and culture test in Cambodia, and an interview in Austria.

Pillar 7: Due Diligence

Dominica, Grenada, Malta, and St Kitts and Nevis all attained full marks. For Dominica, Malta, and St Kitts and Nevis, this has been a consistent result since the inception of the CBI Index in 2017. Greater diligence in authenticating source of funds ensured that Grenada also joined the top rank this year, rising from a score of eight in 2018. Despite a small drop from last year, Antigua and Barbuda also scored highly by virtue of its strict requirements for documentary evidence and employment of independent due diligence providers.

Next closest were Bulgaria, Cyprus, and St Lucia. St Lucia gained two extra points chiefly as a result of new measures to exclude applications from certain jurisdictions which could not be adequately vetted and posed a risk to national security. Bulgaria tightened its requirements for criminal records, now demanding them from an applicant’s country of origin and of permanent residence. However, it also eliminated its list of restricted nationalities.

Turkey decreased in ranking due to it not implementing due diligence restrictions on certain nationalities. It came joint fifth with Austria and Cambodia, whose scores remained unchanged. Despite both Austria and Cambodia requiring biometrics – a standard feature of their passports – they each lose points due to their requirements for evidence of source of funds and police records. Cambodia, for example, asks for a letter certifying that the applicant has a clear criminal history, but does not request original police certificates from specific jurisdictions. Neither Austria nor Cambodia employ independent due diligence firms to perform checks on applicants.

Last is Jordan, which, albeit having rejected a significant percentage of applications, applies a due diligence model with fewer safeguards than those of Caribbean and European jurisdictions. If Jordan were to invest in more stringent screening of applicants and their financial sources, this could be a key step in strengthening its programme’s reputation and raising its ranking in the CBI Index.

Final Scores: The Highest Ranking Programmes

Overall, the central industry trends of transparency, experience, and enhanced security saw the Caribbean nations carry their success from past years into 2019, outperforming their peers in five out of seven pillars.

Dominica emerged once more as the country with the world’s best citizenship by investment programme, combining extensive due diligence with efficiency, speed, affordability, and reliability. Dominica also set the record for the highest percentage score ever achieved on the CBI Index: 91 per cent.

St Kitts and Nevis maintained its upward trajectory regarding visa-free and visa-on arrival offerings and continued to demonstrate its commitment to enhanced due diligence. It also improved its citizenship timeline following clearance of the applications submitted during the temporary Hurricane Relief Fund option. Despite major improvements, the country could benefit from providing applicants with greater certainty as to investments of choice.

Grenada also increased emphasis on programme due diligence, but benefited most from its improved citizenship timeline after the significant slowdown noted in 2018. St Lucia surpassed Antigua and Barbuda for the first time, the southern island improving its scores under freedom of movement, citizenship timeline, and due diligence.

The best performing programme outside of the Caribbean was Vanuatu’s DSP, allowing the country to remain in sixth place. The DSP, analysed by the CBI Index for the first time in lieu of the VCP, brought greater clarity and certainty to investors, yet there remain issues with the nation’s due diligence processes and with the certainty provided to successful applicants, particularly after certain notable incidents of deportation. As Vanuatu focuses on making the oath process easier for applicants, it will be interesting to observe how this affects investor interest over the coming year.

For investors looking towards Europe, Malta is now joint first choice with Cyprus in terms of overall scores when these are rounded to the nearest integer, but comes just below with respect to their percentage scores. Cyprus performed well in the majority of pillars, and remains the fastest economic citizenship option in the region with one of the simplest residency and travel requirements. Malta’s extensive travel offerings, high standard of living, well-established processes, and robust due diligence, meant it scored more highly on these pillars than any other European programme with the exception of Austria, which also stood out for freedom of movement and standard of living. As compared to other countries, however, Malta remains the jurisdiction with the most taxing residency and travel obligations, and has one of the longest timeframes in which to obtain citizenship.

The better scorer of the two Middle Eastern players in the CBI Index, Turkey overtook Bulgaria to place ninth, owing to its faster, more economic, and more straightforward programme. A key area of improvement was minimum investment outlay, as the nation dropped its minimum investment to $250,000. To further improve its score, Turkey would do well to invest in greater due diligence and developing visa-free and visa-on-arrival agreements with international partners, as well as raise the standard of living of its citizens. Bulgarian economic citizens, on the other hand, can enjoy a good quality of life and widespread visa-free access, but should expect to wait at least three years and fulfil burdensome requirements.

Joint 11th worldwide with Cambodia, Austria offers a high standard of living and global mobility, but presents a lengthy timeline and low due diligence. In contrast to its European neighbours, Austria’s residency and travel requirements are more attractive, yet applicants continue to encounter a considerable lack of clarity and reliability around processing. Equally, Cambodia must do more to improve its processes and due diligence, yet it also faces broader challenges: average quality of life is low and its citizens are limited in their ability to travel. Both these issues are shared with Jordan.

This left last place to Jordan, whose scores for due diligence and living conditions fell. Whilst Jordan has established one of the CBI Index’s faster programmes and has no mandatory travel or residence requirements, investment outlays are high and there is a paucity of publicly available information concerning its systems. Providing more reliable information to help inform investors could considerably raise its profile. Given that Jordan, like Turkey, is still in the early stages of developing and refining its offering, amendments are likely to materialise in the future.