The 2022 CBI Index: Key findings - Caribbean nations retain top spot

The CBI Index’s Key Findings present an evaluation of each country, both overall and within the parameters of the nine pillars. Sponsored by CS Global Partners

The CBI Index is intended as a practical tool, both for those who wish to compare citizenship by investment (CBI) programmes as a whole and for those who wish to compare specific aspects of each programme. These aspects are reflected by the CBI Index’s nine pillars: Freedom of Movement, Standard of Living, Minimum Investment Outlay, Mandatory Travel or Residence, Citizenship Timeline, Ease of Processing, Due Diligence, Family and Certainty of Product.

Pillar 1: Freedom of Movement

Austria and Malta, both Schengen and EU member states, retain the top score of 10. As members of the EU, Austria and Malta offer citizens the right to live and work in all EU member states, as well as the greatest global mobility.

The five Caribbean nations of Antigua and Barbuda, Dominica, Grenada, St Kitts and Nevis and St Lucia scored seven, with St Kitts and Nevis having visa-free/visa-on-arrival access to the highest number of countries (156). St Lucia and St Kitts and Nevis have access to 15 of the 20 key business hubs assessed in the 2022 CBI Index, while Dominica, Grenada and Antigua and Barbuda closely follow with access to 14. All the Caribbean jurisdictions are members of the Caricom Single Market and Economy, which comprises 15 member states and facilitates the right to work for certain categories of workers.

Further reading

A guide to global citizenship: The 2022 CBI Index

Sourced from research commissioned by CS Global Partners

Montenegro, which is seeking to become an EU member state by 2025, follows with a score of five, then Turkey and Vanuatu on three, Cambodia on two, and Egypt and Jordan round up the rankings with a score of one respectively. Citizens of Montenegro have access to 123 countries and 13 business hubs. This is followed by Turkey which, while having access to 110 countries, only has access to four business hubs.

Also on three, Vanuatu has suffered the greatest drop in global mobility following the EU’s suspension of visa-free access to the Schengen region for citizens of Vanuatu with a passport issued after May 25 2015. It now only enables visa-free/visa-on-arrival access to 98 countries and only four business hubs, compared with 2021 when its holders enjoyed access to 133 and 13 respectively.

With its membership of the ASEAN Economic Community, Cambodia follows with a score of two and allows visa-free/visa-on-arrival access to 53 countries and one business hub — Singapore.

Egypt and Jordan again share the bottom place with access to 52 countries and a single business hub.

Pillar 2: Standard of Living

Austria retains the top spot with a score of nine, with Malta closely following on eight. Austria edges out Malta due to its higher gross national income (GNI). Both countries have seen significant declines in gross domestic product (GDP) growth over 2021, compared to other CBI nations, with Egypt having the highest increase of 3.6 per cent, closely followed by Turkey. Malta retains the highest life expectancy at 82.5, followed by Austria at 81.5.

Turkey is in third place with a score of seven, due to its high expected years of schooling (16.6) and GDP growth, but receives low scores for relative safety and freedom.

Grenada, Montenegro, Antigua and Barbuda, and St Lucia share fourth place with a score of six. These countries all have similar freedom, GDP growth and GNI scores, but vary with respect to life expectancy, expected years of schooling and relative safety. Grenada retains the top position for expected years of schooling with an average of 16.9.

Fifth position is shared again by Egypt, Jordan, St Kitts and Nevis, Dominica and Vanuatu with a final score of five. Of this group, Dominica has the highest life expectancy at 78.2 and a perfect freedom score. All jurisdictions in this grouping have relatively low average expected years of schooling, with St Kitts and Nevis having the highest average of 13.8, while Jordan, Egypt, and Vanuatu all have perfect scores for relative safety.

Due to the variable economic impacts of Covid-19, there are vast differences in GDP growth between CBI nations. Here, Egypt and St Lucia take the highest and lowest spots respectively at 3.6 per cent and –20.4 per cent.

Having attained the lowest scores in life expectancy, years of schooling, GNI and freedom, Cambodia remains at the bottom of the rankings in 2022 with a score of four.

Pillar 3: Minimum Investment Outlay

There have not been many significant changes in the minimum investment outlays since the 2021 CBI Index, which is reflected in no change in the order of the final scores. The only jurisdiction with a decrease in their final score since last year is Turkey, dropping from eight to seven, based on its recent increase in the minimum investment outlay from US$250,000 to US$400,000. St Kitts and Nevis ended its limited time offer of US$150,000 for a family of four at the end of December 2021, but, as the scores are based on minimum investments for a single applicant, it did not affect its score.

The Caribbean jurisdictions of Dominica and St Lucia maintain the top spot with a perfect score of 10 due to their minimum investment outlay of US$100,000.

These are closely followed in second place by the other three Caribbean jurisdictions of St Kitts and Nevis, Antigua and Barbuda, and Grenada as well as Vanuatu, all with scores of nine with minimum contributions of between US$130,000 and US$150,000.

As with the 2021 CBI Index, Cambodia and Egypt follow with a score of eight and a minimum investment contribution of approximately US$250,000.

Following Turkey, Montenegro maintains its score of six from the 2021 edition, requiring just under US$490,000 as a minimum investment.

Jordan and Malta maintain scores of four with a minimum investment of US$750,000 and €705,000 respectively.

As the most expensive option with a minimum investment of €3m, Austria takes the final spot with a single point.

Pillar 4: Mandatory Travel or Residence

There are no changes from the 2021 CBI Index to scores under the Mandatory Travel or Residence Pillar. The top place with perfect 10 scores are retained by the Caribbean jurisdictions of Dominica, Grenada, St Kitts and Nevis, St Lucia and Jordan, who have no travel or residency requirements from CBI applicants.

Austria, Cambodia, Montenegro, Turkey and Vanuatu follow with a score of eight. These countries require an applicant to make a single trip to their new country of citizenship, often for obtaining a National ID card or to swear an oath of allegiance.

Antigua and Barbuda maintains its score of six as it both requires applicants to spend a minimum of five days in the country every five years and to travel to the country (or one of its embassies) to swear the oath of allegiance. It should be noted that the minimum presence requirements remain suspended temporarily until 31 August 2022 due to the Covid-19 pandemic.

Malta retains its place at the bottom of the rankings with its score of two. This is due to the 12–36-month minimum residency requirement (depending on the investment outlay) before acquiring citizenship. Applicants must also take two subsequent trips to provide biometric information for their residence card and to take the oath of allegiance.

Pillar 5: Citizenship Timeline

St Kitts and Nevis still holds the top position with a perfect score of 10 for the Citizenship Timeline Pillar, due to the Accelerated Application Process where, for an additional fee, an applicant can obtain their citizenship within a maximum of 60 days instead of the standard processing time of approximately three months.

Offering a decision within three months are the Caribbean jurisdictions of Dominica and St Lucia, with a score of nine in the Citizenship Timeline Pillar and placing them in second position. This ranking is shared by Vanuatu, Montenegro and Jordan, whose average processing time of three months also scores nine points.

Turkey and Cambodia maintain a score of eight and are joined by Egypt, which has gained two points since the 2021 CBI Index, with all three jurisdictions offering an average processing time of between three and six months.

Antigua and Barbuda retains its score of six due to its average estimated processing time of between six and seven months.

This is followed by Grenada, whose score has dropped from nine to five this year, due to feedback that their application processing is presently taking between six and 12 months.

Malta maintains its score of three due to its best-case scenario minimum timeline for obtaining citizenship of 13 months. Austria rounds out the list with a score of two with a timeframe of 12–36 months.

Pillar 6: Ease of Processing

The five Caribbean jurisdictions of Antigua and Barbuda, Dominica, Grenada, St Kitts and Nevis, and St Lucia retain a perfect score of 10 for the Ease of Processing Pillar for the sixth year in a row. They are joined by Malta and Egypt (which increased their scores from nine to 10), as all of these jurisdictions make the process of obtaining citizenship as easy and straightforward as possible by having official government websites and dedicated units, as well as doing away with burdensome application requirements such as interviews, language, culture or history tests, proof of minimum business experience and evidence of the purchase of tangible or intangible assets.

Jordan, Turkey and Vanuatu (whose scores have dropped from 10) score seven for the Ease of Processing Pillar. These countries achieve lower scores due to the absence of an official government website for their CBI Programme or a dedicated CBI Unit.

Montenegro has a score of six as it requires an applicant to demonstrate investment in tangible or intangible assets and lacks a dedicated CBI Unit and an official government website (which is still inaccessible as of June 2022).

Austria and Cambodia again round out the bottom rankings with scores of four. Austria’s score is due to the requirement to demonstrate a minimum level of business experience, and Cambodia’s score is weighed down due to the language requirement and history and culture test. Additionally, neither of these jurisdictions has an official government website or a dedicated CBI Unit.

Pillar 7: Due Diligence

As with previous years, Dominica, Grenada, Malta and St Kitts and Nevis retain perfect scores for the Due Diligence Pillar, due to their stringent and comprehensive requirements. These four countries all require the provision of either fingerprints or a biometric passport, have robust external due diligence procedures (including on-the-ground checks and/or assistance from international law enforcement agencies, demand police certificates from both an applicant’s country of residence as well as their country of citizenship, expressly ban or require enhanced due diligence on applicants of certain nationalities and require comprehensive supporting information in respect of an applicant’s source of funds).

St Lucia, Antigua and Barbuda, and Montenegro follow closely with a score of nine. More stringent checks on applicants’ source of funds for St Lucia and Montenegro would see these jurisdictions attain a perfect score alongside the other Caribbean jurisdictions and Malta, while Antigua and Barbuda could improve by tightening its police certificate requirements.

Egypt follows on seven points. It requires the submission of fingerprints, clean police certificates from both an applicant’s country of residence and citizenship, and corroborated evidence of employment or business ownership, but only conducts internal due diligence checks through government agencies instead of engaging an external agency. There are also no nationalities explicitly banned from applying for the programme. The country could improve by placing more rigorous demands on the information collected to establish the source of the applicant’s funds.

Vanuatu has dropped two points from seven to five since the 2021 CBI Index for its Due Diligence Pillar score, as the island nation has yet to make documented changes to enhance its due diligence in relation to working with external agents. Additionally, Vanuatu does not yet require the provision of fingerprints or issue biometric passports, and the programme has room to enhance the stringency of its source of funds checks.

Austria and Cambodia follow on four points, as although both countries issue biometric passports, they do not conduct on-the-ground due diligence checks and both countries could have more stringent police certificate requirements. Austria does not exclude any nationalities, while Cambodia’s due diligence comprises only banking know-your-customer checks. The supporting evidence required to establish an applicant’s source of funds is also unclear.

Turkey scores three, one point above Jordan on two, due to it collecting fingerprints and issuing a biometric passport, but nevertheless requires improvement in all other aspects of their due diligence standards.

Pillar 8: Family

There have been no changes to the scores in the Family Pillar since the 2021 CBI Index, with all family eligibility criteria broadly unchanged across all the programmes.

Antigua and Barbuda, Dominica, Grenada and St Kitts and Nevis retain perfect scores for their family friendliness as, in addition to a main applicant, they allow the applicant’s spouse, children under 18 and over 18 in certain circumstances, siblings, parents and grandparents of both the main applicant or their spouse to be included in an application.

St Lucia retains its score of nine along with Malta due to not permitting grandparents to be included in the application, with the latter falling short of a perfect score due to its exclusion of the main applicant’s siblings.

Vanuatu maintains its score of seven as children over 18 must have a high level of dependency to be included in the application. Additionally, only the main applicant’s parents can be included, with grandparents and siblings remaining excluded as of 2022.

Montenegro follows on six as, while it allows a spouse, children under 18 and children over 18 to be included with few restrictions (provided they are tied to the main applicant), and siblings, parents and grandparents cannot be included in an application.

Egypt and Turkey share a score of five. While Turkey allows a spouse to obtain citizenship at the same time as the main applicant, children over 18 can only be included if they have a medical condition that makes them dependant. Conversely, Egypt allows children over 18 to be included with few restrictions, but a spouse only receives their citizenship a year after the main applicant.

Austria and Jordan remain on four, with stringent dependency requirements for eligibility of certain family members to be included in an application.

Cambodia scores the lowest with two as it only allows the applicant’s spouse and children under 18 to be included in an application.

Pillar 9: Certainty of Product

Dominica is met this year by St Kitts and Nevis in attaining a perfect score for the Certainty of Product Pillar, due to the programme’s longevity, popularity, renown, stability and adaptability. While not reflected in the overall scores, St Kitts and Nevis trails slightly behind in its reputation due to the lack of clarity around its multiple investment options, in comparison to the clear and transparent two-track investment routes offered by the Dominican programme.

While this year all CBI programmes have faced challenges to their stability as a result of the increased regulatory scrutiny of the EU and US, as well as the conflict between Russia and Ukraine, the Caribbean programmes in particular adapted quickly to protect the stability and integrity of their programmes, as also seen previously in response to Covid-19.

This is clearly demonstrated by the five Caribbean jurisdictions, along with Malta, swiftly implementing suspensions on applications from Russian, Belarusian nationals (and in one instance, Antigua and Barbuda suspending a Ukrainian national) due to political instability and the difficulties of conducting on-the-ground vetting checks to maintain the integrity and high due diligence standards of their programmes.

St Lucia and Antigua and Barbuda follow on eight and seven points respectively, due to their popularity with consistently high application volumes, stability with no caps on the number of applications or specific calls to end their programmes, and adaptability both in respect of changes to keep the programmes function during Covid-19 and their swift response to the Russian invasion. St Lucia fares slightly better on the reputation score due to the ongoing Choksi controversy the Antigua and Barbuda programme has faced.

Grenada follows on six, down one point from the CBI 2021 Index. This reflects the programme’s lower number of application approvals in comparison to some other Caribbean programmes and its medium overall reputation.

Turkey follows on five and scoring highly on its popularity and renown, due to its ever-increasing volume of applications. Despite this, Turkey is receiving significant calls for the closing of the programme by its government and in the media, and this reality is reflected in its low stability, reputation and adaptability scores. It is also notable that Turkey did not implement any bans on applications by Russian or Belarusian nationals.

Though Malta, Jordan, Austria, Cambodia and Egypt all follow on four points, there is significant variability in how these pillar scores are attained across these different jurisdictions. Malta’s score, for example, is due to its current ‘MEIN’ (Maltese Exceptional Investor Naturalisation) offering still being in its infancy. It also imposes a cap on the number of applicants and continues to face significant calls for closure from the EU Parliament. Nevertheless, due to its significant benefits, it scores highly in respect of its reputation and adaptability.

As Jordan’s programme is still comparatively new, it retains a lower score for longevity and also loses points for stability due to the cap of issuing of 500 passports annually.

Austria’s score has dropped from five to four, as, while not explicitly targeted in the EU Parliament’s criticisms, will be directly affected by any legislative changes implemented on CBI programmes in EU Member states.

Cambodia’s programme retains its score of four due to no significant changes in its popularity, stability, reputation or adaptability as it is still a relatively unknown programme despite having been in existence since 2013.

Egypt’s programme, last year’s newcomer, continues to gain in popularity and reputation since its inception in 2020, which is reflected in its increased score from two to four.

The most notable change in scores is from Vanuatu, which has dropped from a score of seven to two in this year’s CBI Index. The country has faced significant criticism internationally with regards to the stringency of its programme and most recently has lost one of its key benefits — Schengen access — which was withdrawn by the EU due to its concerns over the programme’s failures to make satisfactory improvements to its security measures. Accordingly, these factors together have adversely impacted the programme’s popularity and reputation.

Finally, Montenegro takes last place with a score of two, largely due to the confirmation that it will be closing its CBI Programme at the end of 2022.

Final Scores: The Highest-Ranking Programmes

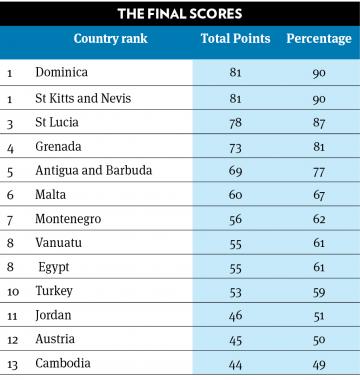

For the second year running, St Kitts and Nevis joins Dominica in 2022 in equal first place overall as the highest ranked programmes in the CBI Index, with both scoring 81 points.

Furthermore, it is Dominica’s sixth consecutive year sitting atop the overall rankings, and it once again maintains a perfect score of 10 in six of the nine pillars under assessment.

Dominica’s consistency is a combination of an affordable minimum investment outlay, thorough and comprehensive due diligence, a streamlined application process, as well as its reputation for investing into the real economy of Dominica through ambitious, sustainable development projects facilitated by CBI funds.

As the only programme with an accelerated application process ensuring a decision within 60 days, St Kitts and Nevis retains its title of having the fastest overall processing time of all jurisdictions, with a perfect score of 10 for the Citizenship Timeline Pillar. In addition, St Kitts and Nevis received perfect scores for minimum travel requirements, ease of processing, due diligence, family and certainty of product, but falls behind Dominica due to its higher minimum investment outlay.

As the newest Caribbean programme, St Lucia is now in its sixth year and jumps from fourth to third overall in this year’s CBI Index, ahead of Grenada’s score of 78. This increase in the overall score relates to improvements in due diligence — in particular the introduction of biometric passports and increased popularity and adaptability, while remaining competitive with a minimum investment outlay in line with Dominica of US$100,000 for a single applicant. A further tightening of its due diligence requirements and/or the inclusion of grandparents as eligible dependants could see it become a serious competitor for the top spot in the 2023 CBI Index.

Grenada slips down to fourth in the overall rankings this year with a score of 73 points. Although the programme maintains a competitive minimum investment outlay of US$150,000, stringent due diligence, generous family friendliness, and minimal travel requirements, Grenada is facing significant processing delays according to key industry contacts, and this is reflected in a drop in its ease of processing score.

Rounding out the top five is Antigua and Barbuda with its score of 69 retained from last year and again resulting in the Caribbean programmes occupying the top five overall spots in the CBI Index. Antigua and Barbuda’s lower score in comparison to the other Caribbean programmes is a result of its five-day residency requirement every five years, as well as its comparatively longer processing time of between six and seven months. A reconsideration of the residence requirement and/or shortening processing times could yield improved scores for this programme going forward.

Malta jumps up to sixth place this year with an overall score of 60. While still in its infancy, Malta’s MEIN offering is very popular, as the only remaining well-known CBI programme of any EU member state, and it achieves high scores in both freedom of movement and standard of living. However, as a result of its EU status, it continues to face significant criticisms and calls to close the programme from the EU Parliament, therefore also making it the programme most under threat which adversely affects its overall certainty of product score. This is despite Malta’s stringent due diligence regime, which mirrors the requirements of the Caribbean CBI programmes, and its swift reaction to the banning of Russian and Belarusian applications. Where Malta scores less highly is for its minimum investment outlay, which is currently priced at €705,000 (more than double all of the Caribbean programmes), its residency requirements and its citizenship timeline.

Montenegro follows in seventh place with an overall score of 56. It scores highly for its short citizenship timeline and comprehensive due diligence requirements, but its higher minimum investment outlay and lack of a dedicated unit to facilitate the processing of applications limits its popularity, and it is due to be terminated at the end of 2022.

Vanuatu drops to eighth place in 2022, putting it level with Egypt with an overall score of 55. Despite its low minimum investment outlay and short citizenship timeline — both for which it received a score of nine — its low freedom of movement benefits in comparison to other programmes as well as a lack of progress in the arena of due diligence despite repeated warnings (something that ultimately resulted in the loss of its visa-free access to the Schengen Area this year) has adversely affected its reputation and popularity, as reflected by the reduction in its certainty of product score. Vanuatu has until February 2023 to address the EU’s concerns before it reassesses the ban.

Relative newcomer to the CBI industry, Egypt, received a perfect score of 10 this year for ease of processing as a result of its government website finally going online as well as having a dedicated CBI Unit. It also scored relatively highly for its minimum investment outlay, which is lower than the two other programmes in the wider Middle East and North African (MENA) region, Turkey and Jordan; mandatory travel requirements; and citizenship timeline. With the best score among the wider MENA programmes for due diligence and an increased certainty of product score due to significant increases in applications, Egypt achieved a significant jump of six points in its overall score in only its second year of inclusion in the CBI Index. Ensuring that the main applicant’s spouse is granted citizenship at the same time could be one area of improvement for Egypt’s programme.

Behind Egypt on 53 points and in 10th place overall is Turkey. Turkey’s programme continues to be popular due to its greater freedom of movement to key business hubs and higher standard of living compared to other programmes in the wider MENA region. However, Turkey recently increased its minimum investment outlay from US$250,000 to US$400,000, reducing its score in this pillar from eight to seven. Here, an area for improvement would be to the programme’s due diligence requirements, as this would go some way to quell the local criticism of citizenship by investment and calls to end the programme.

In 11th place with a score of 46 is Jordan. Jordan’s programme remains relatively unknown and requires the highest minimum investment outlay of the three wider MENA programmes. It unfortunately does not score well in the freedom of movement and standard of living pillars and is the lowest scoring programme for due diligence. Enhanced checks on source of funds and the engagement of an external agent would be suitable options for improvement.

Austria and Cambodia round out the index in 12th and 13th place with scores of 45 and 44 respectively. Despite its perfect score for freedom of movement and having a very high standard of living, Austria’s score is weighed down due to having the highest minimum investment outlay of all CBI programmes, a long citizenship timeline and a lack of transparent mechanisms to ensure the ease of processing applications. In addition, its due diligence standards fall short in comparison to a number of other programmes, and, due to the EU Parliament criticisms, the programme is under threat on the basis of its EU member status.

Cambodia also remains a relatively unknown programme, with low scores for freedom of movements and standard of living. It is the only programme that requires a language and culture and history test, and receives the lowest score in the family pillar. Its due diligence standards and ease of processing are also areas that require improvement.