Fund selection - October 2015

Each month in PWM, nine top European asset allocators reveal how they would spend €100,000 in a fund supermarket for a fairly conservative client with a balanced strategy

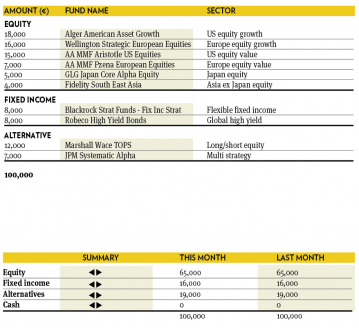

Julien Mechler

Chief investment officer, AA advisors. Based in: Paris, France

“Despite the tumultuous events hitting markets over the past weeks, macroeconomic developments and company fundamentals remain supportive for risky assets. In particular, the US and European economies should continue to improve, while commodities and emerging markets may have stabilised. Regarding our positioning, although it is clear that risks have increased, we keep our portfolio unchanged, meaning overweight in developed market equities. Within our equity positions, we keep a bias toward growth, waiting for more visibility on monetary policy before switching toward value.”

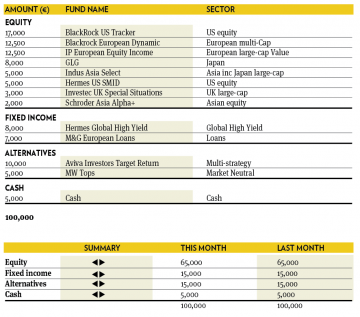

Thomas Wells

Fund manager, multi-assets, CFA, Aviva Investors. Based in: London, UK

“If you can keep your head when all about you are losing theirs…Yours is the Earth and everything that’s in it.’ –Rudyard Kipling. Despite September proving to be another volatile, painful month, now is the time to be patient and assess rather than react and panic. Economic fundamentals remain good in the US and while growth is slowing globally this does not predicate a global recession. Valuations looked toppy in April, but now appear more attractive. We fully redeemed out of Libor Plus and re-allocate the capital to Hermes Global High Yield which is offering investors more attractive risk adjusted returns.”

Gary Potter and Rob Burdett

Co-heads of multi-management, F&C Investments. Based in: London, UK

“Concerns over global growth and a confusing message from the Fed meant more volatility. The Fed said they were monitoring developments abroad as well as at home, leaving investors confused as to when their criteria for raising rates will be met. Emerging markets continued to feel the pressure through falling currencies. Japanese equities saw the worst performance of the major markets, down 4.98 per cent; the US performed the best and was down 0.98 per cent. Bond funds were the best performers in the selection – F&C Macro Global Bond was down 0.87 per cent. The worst came from Odey Odyssey, down 7.99 per cent. We expect heightened market volatility to continue.”

Silvia Tenconi

Hedge Funds & Manager Selection, Eurizon Capital. Based in: Milan, Italy

“September was another ugly month for the portfolio, the only positive performer being Exane Archimedes. Jupiter European Growth only lost 70 basis points while European equities shed in excess of 400. JPMorgan US STEEP, Vanguard and Templeton Mutual European were disappointing. We are taking profit on the winners and topping up laggards: reducing Robeco US Opportunities and adding to JPMorgan US STEEP, reducing Jupiter European Growth and adding to JPMorgan Europe Equity Plus and Blackrock European Equity. We still prefer equities, high yield and alternatives to government bonds and cash.”

Sebastien Bonnet

Head of Financial Engineering, FundQuest, BNP Paribas Group. Based in: Paris, France

“September was another difficult month for equity markets in general. The situation in China and the expectations about the policy of the Fed have contributed to the general uncertainty. Since the middle of August, signs of a global de-synchronisation among the various developed and emerging economies have multiplied. Low commodities prices are heavily impacting large economies such as Brazil and Russia, while the lack of visibility on the Chinese government’s decisions is raising concerns and risk aversion for the investors. In that context, we are keeping the emphasis onto strategies with a low net exposure and specific beta selection.”

Peter Haynes

Investment Director, SGPB Hambros. Based in: London, UK

“Equity markets ended the month in negative territory as further weakness in commodity markets and uncertainty over the Chinese economy weighed on investor sentiment. The Fed’s decision to not raise interest rates, despite reasonably strong domestic economic data, created further confusion and raised questions about the credibility of central banks generally. It was encouraging to see the position in Blackrock European Absolute Alpha increase in value by just under 1 per cent despite the Stoxx Euro index falling by -4.5 per cent. Given the current volatility, we have retained the current high cash position.”

Bernard Aybran

CIO Multi-management, Invesco. Based in: Paris, France

“The balanced portfolio was tweaked toward more fixed income over the course of September. Within fixed income, credit risk has been lowered and the proceeds were invested in pure government bonds. On the equity side, Asian investments have been lowered some more. This was solely the outcome of an asset allocation decision as one key feature has to be mentioned: actively managed funds are performing well this year. In the European equity markets, the number of funds beating the index is particularly high, which comes as a major difference compared to many previous years.”

Toby Vaughan

Head of Fund Management, Global Multi Asset Solutions Santander. Based in: London, UK

“We retain a balanced strategy across the portfolio with controlled equity allocations to manage volatility, continuing to ensure that non-equity allocations are not overly dependent upon fixed income – hence the material weightings in absolute return focused strategies and 5 per cent in cash. We make one switch from JPM US Value to the AXA US enhanced index fund, to take a more risk controlled approach within the US and avoid some of the more material sector biases within value strategies at the moment. We reduced high yield exposure by a couple of per cent, using it to increase absolute return exposure further.”

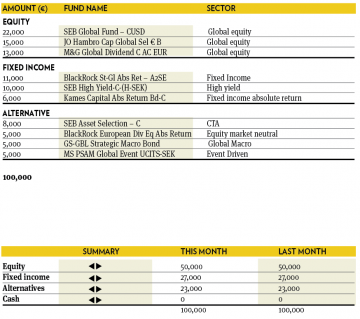

Peter Branner

Global CIO, SEB Asset Management. Based in: Stockholm, Sweden

“The turbulent markets in September hit JO Hambro who had a really bad day at the end of the month which erased the full relative returns of the year. The underperformance was related to their healthcare holdings that were hit by both a potential pricing regulation and worsening credit conditions. Their historical pattern shows large moves on both the up and downside but the recent event is a bit out of their historical pattern which raises concerns around portfolio construction. We reduced the JO Hambro position in favour of SEB Global Fund, where portfolio construction is one of the core qualities for their long-term successful track-record.”